Chapter 10

advertisement

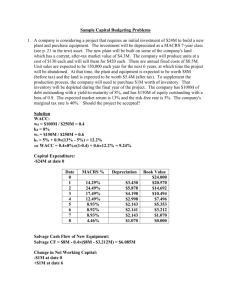

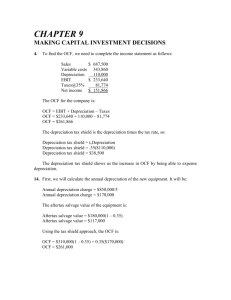

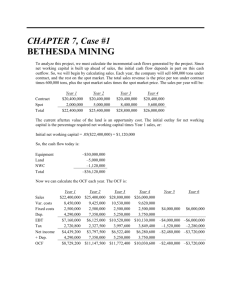

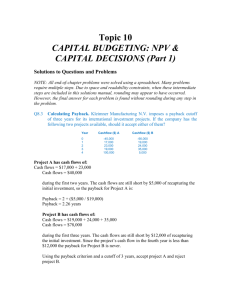

Chapter 10 Questions and Problems 1. Relevant Cash Flows Precious Metals Ltd. is looking at setting up a new manufacturing plant in South Africa to produce gold bracelets. The company bought some land six years ago for 5 million rand in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net 5.4 million rand. The company wants to build its new manufacturing plant on this land; the plant will cost 10.4 million rand to build, and the site requires 850,000 rand worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project? Why? • ZAR 5,400,000 + 10,400,000 + 850,000 = ZAR 16,650,000 • 2. Relevant Cash Flows • Winnebagel Corp. currently sells 30,000 motor homes per year at $45,000 each, and 12,000 luxury motor coaches per year at $95,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 20,000 of these campers per year at $12,000 each. An independent consultant has determined that if Winnebagel introduces the new campers, it should boost the sales of its existing motor homes by 5,000 units per year, and reduce the sales of its motor coaches by 1,300 units per year. What is the amount to use as the annual sales figure when evaluating this project? Why? • • • • 2. Sales due solely to the new product line are: 20,000($12,000) = $240,000,000 Increased sales of the motor home line occur because of the new product line introduction; thus: • 5,000($45,000) = $225,000,000 in new sales is relevant. • Erosion of luxury motor coach sales is also due to the new mid-size campers; thus: 1,300($95,000) = $123,500,000 loss in sales is relevant. • The net sales figure to use in evaluating the new line is thus: $240,000,000 + 225,000,000 – 123,500,000 = $341,500,000 • 4. Calculating OCF • Consider the following income statement: • Fill in the missing numbers and then calculate the OCR What is the depreciation tax shield? Sales $912,400 Costs 593,600 Depreciation 135,000 EBIT Taxes (34) Net income ? ? ? Sales $ 912,400 Costs 593,600 Depreciation 135,000 EBT Taxes@34% Net income $ 183,800 62,492 $ 121,308 • • • • The OCF for the company is: OCF = EBIT + Depreciation – Taxes OCF = $183,800 + 135,000 – 62,492 OCF = $256,308 • The depreciation tax shield is the depreciation times the tax rate, so: • Depreciation tax shield = tc X Depreciation • Depreciation tax shield = .34($135,000) • Depreciation tax shield = $45,900 • The depreciation tax shield shows us the increase in OCF by being able to expense depreciation. • 5. OCF from Several Approaches • A proposed new project has projected sales of ¥9,200,000, costs of ¥5,120,000, and depreciation of ¥287,400. The tax rate is 35 percent. Calculate operating cash flow using the four different approaches described in the chapter and verify that the answer is the same in each case. Sales Variable costs Depreciation EBT Taxes@35% Net income ¥ 9,200,000 5,120,000 287,400 ¥ 3,792,600 1,327,410 ¥ 2,465,190 Using the most common financial calculation for OCF, we get: • OCF = EBIT + Depreciation – Taxes = ¥3,792,600 + 287,400 – 1,327,410 • OCF = ¥ 2,752,590 • The top-down approach to calculating OCF yields: • OCF = Sales – Costs – Taxes = ¥9,200,000 – 5,120,000 – 1,327,410 • OCF = ¥ 2,752,590 • • • • The tax-shield approach is: OCF = (Sales – Costs)(1 – tC) + tC X Depreciation OCF = (¥9,200,000 – 5,120,000)(1 – .35) + .35(287,400) OCF = ¥ 2,752,590 • And the bottom-up approach is: • OCF = Net income + Depreciation = ¥2,465,190 + 287,400 • OCF = ¥ 2,752,590 • All four methods of calculating OCF should always give the same answer. • 13. Project Evaluation • Dog Up! Franks is looking at a new sausage system with an installed cost of $420,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $60,000. The sausage system will save the firm $130,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $28,000. If the tax rate is 34 percent and the discount rate is 10 percent, what is the NPV of this project? • 13. First we will calculate the annual depreciation of the new equipment. It will be: • Annual depreciation = $420,000/5 • Annual depreciation = $84,000 • Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so: • Aftertax salvage value = MV + (BV – MV)tc • Very often the book value of the equipment is zero as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes: • Aftertax salvage value = MV + (0 – MV)tc • Aftertax salvage value = MV(1 – tc) • We will use this equation to find the aftertax salvage value since we know the book value is zero. So, the aftertax salvage value is: • • Aftertax salvage value = $60,000(1 – 0.34) • Aftertax salvage value = $39,600 • Using the tax shield approach, we find the OCF for the project is: • OCF = $130,000(1 – 0.34) + 0.34($84,000) • OCF = $114,360 • Now we can find the project NPV. Notice we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value. • NPV = –$420,000 – 28,000 + $114,360(PVIFA 10%,5) + [($39,600 + 28,000) / 1.15] • NPV = $27,488.66 • 17. Calculating EAC • You are evaluating two different silicon wafer milling machines. The Techron I costs $210,000, has a threeyear life, and has pretax operating costs of $34,000 per year. The Techron II costs $320,000, has a five-year life, and has pretax operating costs of $23,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $20,000. If your tax rate is 35 percent and your discount rate is 12 percent, compute the EAC for both machines. Which do you prefer? Why? • 17.We will need the aftertax salvage value of the equipment to compute the EAC. Even though the equipment for each product has a different initial cost, both have the same salvage value. The aftertax salvage value for both is: • Both cases: aftertax salvage value = $20,000(1 – 0.35) = $13,000 • To calculate the EAC, we first need the OCF and NPV of each option. The OCF and NPV for Techron I is: • • OCF = – $34,000(1 – 0.35) + 0.35($210,000/3) = $2,400 • • NPV = –$210,000 + $2,400(PVIFA 12%,3) + ($13,000/1.123) = –$194,982.46 • EAC = –$194,982.46 / (PVIFA 12%,3)= – $81,180.75 • And the OCF and NPV for Techron II is: • OCF = – $23,000(1 – 0.35) + 0.35($320,000/5) = $7,450 • • NPV = –$320,000 + $7,450(PVIFA 12%,5) + ($13,000/1.145) = –$285,767.87 • • EAC = –$285,767.87 / (PVIFA 12%,5) = –$79,274.79 • The two milling machines have unequal lives, so they can only be compared by expressing both on an equivalent annual basis, which is what the EAC method does. Thus, you prefer the Techron II because it has the lower (less negative) annual cost. • 18. Calculating a Bid Price • Osaka Enterprises needs someone to supply it with 150,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you've decided to bid on the contract. It will cost you ¥17,580,000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that in five years, this equipment can be salvaged for ¥480,000. Your fixed production costs will be ¥4,245,000 per year, and your variable production costs should be ¥106.20 per carton. You also need an initial investment in net working capital of ¥652,800. If your tax rate is 35 percent and you require a 16 percent return on your investment, what bid price should you submit? • 18. To find the bid price, we need to calculate all other cash flows for the project, and then solve for the bid price. The aftertax salvage value of the equipment is: • Aftertax salvage value = ¥480,000(1 – 0.35) = ¥312,000 • Now we can solve for the necessary OCF that will give the project a zero NPV. The equation for the NPV of the project is: • NPV = 0 = – ¥17,580,000 – 652,800 + OCF(PVIFA 16%,5) + [(¥652,800 + 312,000) / 1.165] • Solving for the OCF, we find the OCF that makes the project NPV equal to zero is: • OCF = ¥17,773,446.17 / PVIFA 16%,5 = ¥5,428,177.20 • The easiest way to calculate the bid price is the tax shield approach, so: • OCF = ¥5,428,177.20 = [(P – v)Q – FC ](1 – tc) + tcXD • ¥5,428,177.20 = [(P – ¥106.20)(150,000) – ¥4,245,000 ](1 – 0.35) + 0.35(¥17,580,000/5) • P = ¥177.55 • 19. Cost-Cutting • Proposals Massey Machine Shop is considering a fouryear project to improve its production efficiency. Buying a new machine press for $480,000 is estimated to result in $180,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $70,000. The press also requires an initial investment in spare parts inventory of $20,000, along with an additional $3,000 in inventory for each succeeding year of the project. If the shop's tax rate is 35 percent and its discount rate is 15 percent, should Massey buy and install the machine press? • 19. First, we will calculate the depreciation each year, which will be: • D1 = $480,000(0.2000) = $96,000 • D2 = $480,000(0.3200) = $153,600 • D3 = $480,000(0.1920) = $92,160 • D4 = $480,000(0.1152) = $55,296 • The book value of the equipment at the end of the project is: • BV4 = $480,000 – ($96,000 + 153,600 + 92,160 + 55,296) = $82,944 • The asset is sold at a loss to book value, so this creates a tax refund. • After-tax salvage value = $70,000 + ($82,944 – 70,000)(0.35) = $74,530.40 • So, the OCF for each year will be: • OCF1 = $180,000(1 – 0.35) + 0.35($96,000) = $150,600.00 • OCF2 = $180,000(1 – 0.35) + 0.35($153,600) = $170,760.00 • OCF3 = $180,000(1 – 0.35) + 0.35($92,160) = $149,256.00 • OCF4 = $180,000(1 – 0.35) + 0.35($55,296) = $136,353.60 • Now we have all the necessary information to calculate the project NPV. • We need to be careful with the NWC in this project. Notice the project requires $20,000 of NWC at the beginning, and $3,000 more in NWC each successive year. • We will subtract the $20,000 from the initial cash flow, and subtract $3,000 each year from the OCF to account for this spending. • In Year 4, we will add back the total spent on NWC, which is $29,000. • The $3,000 spent on NWC capital during Year 4 is irrelevant. Why? • Well, during this year the project required an additional $3,000, but we would get the money back immediately. • So, the net cash flow for additional NWC would be zero. With all this, the equation for the NPV of the project is: • NPV = – $480,000 – 20,000 + ($150,600 – 3,000)/1.15 + ($170,760 – 3,000)/1.152 + ($149,256 – 3,000)/1.153 + ($136,353.60 + 29,000 + 74,530.40)/1.154 • NPV = –$11,481.36 Example: Setting the Bid Price設定 投標價格 • Consider the following information: – Army has requested bid for multiple use digitizing devices (MUDDs) – Deliver 4 units each year for the next 3 years – Labor and materials estimated to be $10,000 per unit – Production space leased for $12,000 per year – Require $50,000 in fixed assets with expected salvage of $10,000 at the end of the project (depreciate straight-line) – Require initial $10,000 increase in NWC – Tax rate = 34% – Required return = 15%