COST ACCOUNTING - St.Joseph's College

advertisement

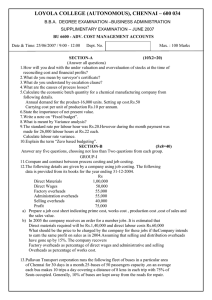

CLASS: B.B.A. 11A/ 110 St. JOSEPH’S COLLEGE (AUTONOMOUS) TIRUCHIRAPPALLI – 620 002 SEMESTER EXAMINATIONS – APRIL 2011 TIME: 3 Hrs. MAXIMUM MARKS: 100 SEM SET PAPER CODE TITLE OF THE PAPER II 2010 08UBU230204 COST ACCOUNTING SECTION – A Answer all the questions: 20 x 1 = 20 Fill in the blanks: 1. ______ is the technique and process of ascertaining the cost of activities, processes, products or services. 2. ______ is known as automatic inventory system. 3. ______ means the allotment of whole items of cost to cost centres or cost units. 4. ______ refers to the loss which is unavoidable in a manufacturing process. 5. In cost accounts, ______ are absorbed on the basis of pre – determined rates. Choose the correct answer: 6. ______ is a form of specific order costing, the attribution of costs to batches a) Service costing b) Process costing c) Batch costing 7. A written request to a supplier for specified goods at an agreed upon price is called as ______ a) Purchase order b) Purchase requisition c) Receiving report 8. ______ expenses incurred for actual sales and promotion of sales a) Distribution overhead b) Administrative off c) Selling overhead 9. ______ costing, each contract is treated as a separate const unit and assigned a number to ascertain the cost and profit a) Service costing b) Contract costing c) Job costing 10. An abnormal gain in a process occurs in which of the following situations a) When actual losses are greater than the normal loss level b) When costs are reduced through increased machine speed c) When actual losses are less than the normal level d) When the process output is greater than planned State True or False: 11. The cost of converting raw materials to finished product is known as conversion cost. 12. Purchase order is prepared by the purchasing department. 13. Measurement of labour turnover gives an idea of the degree of mobility of labour. 14. Cost of indirect materials is apportioned to various departments. 15. Process costing is applied in garment industry. Match the following: 16. 17. 18. 19. 20. Indirect cost a) Dividend paid Any scheme of wage payment should b) Overhead based on Lighting c) Specific order costing Contract costing d) Time and Motion study Appropriation of profits e) Floor area SECTION – B Answer all the questions: 21. a. b. 22. a. 5 x 4 = 20 Distinguish between financial accounting and cost accounting. OR From the following particular prepare cost sheet: Direct materials – 8,000; Direct wages – 6,000; Direct Expenses – 2,500; Administrative overheads – 4,000; Factory overheads – 5,000; Sales – 40,000. From the following information, calculate (i) Maximum stock level (ii) Minimum stock level (iii) Re-order level Minimum consumption Normal consumption Maximum consumption Re – order quantity Re – order period Normal order period 240 units per day 300 units per day 420 units per day 3,600 units 10 to 15 days 12 days OR b. Discuss the various elements of cost. 23. a. John Industries Ltd,. has four departments. A, B, and C are production departments and D is the service department. The actual expenses for a month were as follows: Rent 6,000 Repairs of plant 3,600 Depreciation 2,700 Insurance of stock 3,000 Lighting changes 600 Employees insurance employers 900 liability Supervision 9,000 Power 5,400 The following information is also available Area Sq. ft No. of workers Total wages (`) Value of plant (`) Value of stock (`) Dept. A 300 48 8,000 24,000 15,000 Dept. B 200 32 6,000 18,000 9,000 Dept. C 180 24 4,000 12,000 6,000 Dept. D 100 16 2,000 6,000 - Apportion the costs to four departments on the most equitable method. b. 24. a. OR During the year 31.3.2010 the factory overhead costs of three production departments of an organization are as under. x = ` 47,500 y = ` 88,900 z = ` 62,750 The basis of appointment of overheads is given below: Dept. x – `5 per machine hour for 10,000 hours. Dept. y – 75% of direct labour cost of ` 1,20,000 Dept. z – ` 4 per unit for 15,000 units. Prepare a statement showing department wise under or over absorption of overheads. The following were the expenses on a contract which commenced on 1st January 2010. ` Materials purchased 10,000 Materials at the end 1,250 Direct wages 15,000 Plant issued 5,000 Direct expenses 8,000 The contract price was ` 1,50,000. It was duly received when the contract was completed on 30th September 2010. Change indirect expenses at 15% on wages and provide `1,000 for depreciation on plant. Prepare the contract account and contractee’s account. OR b. Product A passes through three distinct processes. The product is transferred to finished stock after the third process. Prepare the process accounts from the information given below: Process I (`) Process II (`) Process III (`) 4,000 1,500 650 600 1,600 400 550 900 - Direct materials Direct labour Direct expenses The production overheads during the period were ` 6,000. It is to be apportioned to different processes on the basis of 150% of direct labour. There was no opening or closing stock. Production during the period was 200 units. 25. a. The financial books of a company show a net profit of ` 2,57,510 for the year ending 31st December. The cost accounts show a net profit of ` 3,44,800 for the same corresponding period. The following facts are brought to light. Prepare a reconciliation statement. ` Under – recovery of factory overheads in cost A/c’s. 6,240 Over –recovery of overheads in cost A/c’s 3,400 Depreciation in financial accounts 22,400 Depreciation in cost accounts 25,000 Interest on investments not included in cost 16,000 Loss of obsolescence charged in financial A/c’s 11,400 Income tax debited in financial accounts 80,600 Bank interest and dividend credited to financial A/c’s 2,450 Loss in stock not changed 13,500 OR b. Prepare a production budget for 3 months ending March 31, 2009 for a factory producing four products on the basis of the following information. Type of product Estimated stock on Jan. 1st 2009 (units) Estimated sales during Jan–Mar 2009 (units) Desire closing stock March 31 2009 (units) A 2,000 10,000 5,000 B 3,000 15,000 4,000 C 4,000 13,000 3,000 D 5,000 12,000 2,000 SECTION – C Answer any FOUR questions: 26. 27. 28. 29. 4 x 15 = 60 Prepare a cost sheet of machine and calculate the price at which the company should quote for the manufacture of a machine requiring materials of ` 1,250, productive wages ` 750 and factory overhead ` 150. So that the price may yield a profit of 20% on the selling price. You are given the accounts of a company manufacturing the type of machines referred to above for the 6 months ending 31st December and further details. Materials used 1,50,000 Productive wages 2,40,000 Factory overhead 24,000 Other expenses 17,640 From the particulars given below, prepare stores Ledger A/c under a (i) simple average price method and (ii) weighted average price method. Date Particulars Units Rate P/U (`) Jan.1, 1998 Balance 100 6 Jan. 5 Purchase 600 7 Jan. 20 Issues 400 Feb. 5 Issues 200 Feb. 6 Purchases 500 8 March 10 Issues 400 March 12 Issues 200 The following details pertain to the production department of a factory. (`) Material consumed 60,000 Direct wages 36,000 Machine hours 18,000 Labour hours worked 27,000 Factory overheads 54,000 Output during the year 9,000 Calculate overhead absorption rate under different methods possible from the above data. Lakshmi Industries Ltd., is engaged in the manufacture of chemical x which is obtained after it passes through three distinct process. You are required to prepare process accounts, abnormal gain and abnormal loss accounts. Materials Process I (`) 5,200 Process II (`) 3,960 Process III (`) 5,924 Direct wages 4,000 6,000 8,000 Production OH 18,000 1,000 units at ` 6 per unit were introduced in process I production OH is to be distributed at 100% on wages. 30. Actual output Normal loss Value of scrap P/U (`) Process I 950 5% 4 Process II 840 10% 8 Process III 750 15% 10 Draw up a flexible budget for overhead expenses on the basis of the following data and determine the OH rates at 70%, 80% & 90? Plant capacity. At 70% capacity At 80% capacity (`) At 90% capacity Variable OH Indirect Labour - 12,000 - Stores including spaces - 4,000 - Semi – variable OH power (30% fixed, 70% variable) - 20,000 - Repairs and maintenance (60% fixed, 40% variable) - 2,000 - Fixed OH: Depreciation - 11,000 - Insurance - 3,000 - Salaries - 10,000 - - 62,000 - Estimated direct labour hours – 1,24,000 hrs. **************