7. OVERHEADS - II

advertisement

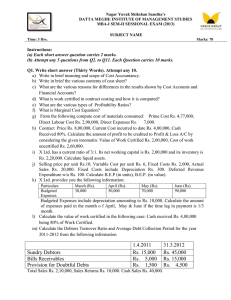

MASTER MINDS No.1 for CA/CWA & MEC/CEC 7. OVERHEADS - II SOLUTIONS TO ASSIGNMENT PROBLEMS PROBLEM NO.1 Particulars Production (Units) Semi Variable Cost (Rs.) Quarter I 36,000 2,80,000 Quarter II 42,000 3,10,000 Difference 6,000 30,000 Variable Cost per Unit = Change in Semi Variable Cost 30,000 = = Rs.5 per units Change in Pr oduction 6,000 units Total Fixed Cost = Semi Variables Cost – (Production x Variable Cost per Unit) Total fixed cost in Quarter I: = 2,80,000 – (36,000 × 5) = 2,80,000 – 1,80,000 = 1,00,000 Total fixed cost in Quarter II: = 3,10,000 – (42,000 × 5) = 3,10,000 – 2,10,000 = 1,00,000 PROBLEM NO.2 a) Rate capacity : it is a capacity which is indicated by its manufactures = 36.5 tones 36 .5 x(365 − 65days ) b) Practical capacity = 30tonnes 365 c) Normal capacity: it is the capacity of plant utilized based on sales expectancy: 25 tones d) Actual capacity: It is a capacity which is actually achieved = 25.2 tones PROBLEM NO.3 Absorbed overheads = Actual Man days x Rate = 1,50,000 x 50 = Rs. 75,00,000 Under absorption of overheads = Actual overheads – Absorbed overheads = 79,00,000 – 75,00,000 = Rs. 4,00,000 Reasons for under – absorption: 1. Defective Planning 4,00,000 x 60% = Rs.2,40,000 2. Increase in overhead cost 4,00,000 x 40% = Rs.1,60,000 Treatment in Cost Accounts: i. The unabsorbed overheads of Rs. 2,40,000 on account of defective planning to be treated as abnormal and thus be charged to costing profit & loss account. IPCC_34e_Costing_Overheads-II_Assignment Solutions _________________31 Ph: 98851 25025/26 www.mastermindsindia.com ii. The balance of unabsorbed overheads i.e. Rs. 1,60,000 be charged as below on the basis of supplementary overhead absorption rate Supplementary Rate = Rs. 1,60,000 / (30,000 + 5,000 + 50% of 10,000) = Rs. 4 per unit a. To cost of sales Account = 30,000 x4 b. To finished stock account = 5,000 x 4 c. To WIP account = 50% of 10,000 x 4 Rs. 1,20,000 Rs. 20,000 Rs. 20,000 Rs. 1,60,000 PROBLEM NO.4 Calculation of Under Recovery of Overhead Particulars Amount Manufacturing overheads incurred 8,50,000 Less: Manufacturing Overheads recovered 7,50,000 Under recovery of Overhead 1,00,000 Treatment of Under Recovery of Overhead can be done in 3 Methods: Method – 1: Carry forward to subsequent years: Assuming that the industry is a seasonal one (or) a newly started one, it is appropriate to carry forward the under recovery of overheads. Therefore, Effect on Profits isNil. Method – 2: Transfer to Profit and Loss Account: Assuming that, the under recovery has resulted due to abnormal reasons the loss has to be taken to Costing Profit and Loss Account. Therefore, Effect on Profits is that they will decrease by Rs. 1,00,000. Method – 3: Use of Supplementary Rate: Supplementary Rate = Underre cov ery 1,00,000 = = Rs. 0.0416.66/Actual base 24,00,000 Under Recovery adjusted towards Finished Goods = Rs, 4,80,000 X 0.04166= Rs. 20,000 (approx.) Under Recovery adjusted towards Work-In-Progress = Rs. 2,40,000 X 0.04166 = Rs. 10,000 (approx.) Under Recovery adjusted towards Cost of Goods Sold =Rs.16,80,000 X 0.04166 = Rs. 70,000 (approx.) Therefore, Effect on Profits is that they will decrease by Rs.40,000 (70,000 – 20,000 – 10,000). PROBLEM NO.5 i) Total production OH’s incurred 6,00,000 (-) written off obsolete stores 45,000 (-) Wages paid for strike period 30,000 (75,000) Net production OH’s actually incurred 5,25,000 Oh’s Recovered (48,000 x 10) 4,80,000 Under recovery of OH’s 45,000 ii) Under recovery of OH’s 45,000 IPCC_34e_Costing_Overheads-II_Assignment Solutions _________________32 MASTER MINDS No.1 for CA/CWA & MEC/CEC (45,000 x 1/3) Rs.30,000 Rs.15,000 Due to normal increase Due to defective in costs (Positive Transfer to costing Supplementary Rates) & Increase c/o WIP Increase C/o by Rs.5000 Finished goods sales by by Rs 2500 Rs 22 500 / Increase cost of PROBLEM NO.6 Calculation of Predetermined Machine Hour Rate Particulars Power Basis of apportionment 75:60 (W.N-1) Total A 15,000 Spare parts 9,900 Consumables 5,000 Depreciation Insurance Indirect labour 12% on cost – SLM Basis 1:2 (W.N – 2) Direct labour hrs (2:3) (W.N – 3) Floor space – 3:4 Building maintenance Total (A) Machine hrs (B) Machine Hour Rate (A/B) W.N-1: Calculation of Kilo Watt hours Ratio 36,000 3,000 46,000 7,000 B 8,333 3,300 (3,000 X 110%) 2,000 12,000 10,000 × 12% 10% 6,667 6,600 (5,000X110%X120%) 3,000 24,000 20,000 × 12% 10% 1,000 18,400 (40KX115%X2/5) 3,000 48,033 25,000 2,000 27,600 (40,000X115%X3/5) 4,000 73,867 30,000 1.92 2.46 Department KW Rating (1) Machine hours (2) Total (1x2) A 3 25,000 75,000 B 2 30,000 60,000 W.N-2: Insurance on machinery (to be apportioned on the basis of cost) 10,000 10 % 20,000 Value of Machinery of Department – B = 10% Value of Machinery of Department – A = = Rs. 1,00,000 = Rs. 2,00,000 WN-3: Calculation of Revised Indirect Wages: IPCC_34e_Costing_Overheads-II_Assignment Solutions _________________33 Ph: 98851 25025/26 www.mastermindsindia.com Particulars Amount Indirect Wages estimated 40,000 Add: General increase in indirect wages 6,000 Revised Indirect Wages 46,000 PROBLEM NO.7 Fixed expenses per month (Rs.) Rent (one fourth of the total) 75.00 Lighting (one fifth of the total) 16.00 Foreman’s salary (one sixth of the total) 160.00 Sundry expenses–oil, waste etc. 9.00 Insurance (1% on the value of the machine per year) 8.33 Total constant expenses per month 268.33 Total number of hours per annum 4,380 Total number of hours per month 365 Fixed expenses per hour = 0.735 Rs.268 .33 365hrs Variable expenses per hour: Depreciation: Cost of the machine 10,000 Less: Scrap value 900 9,100 Depreciation per annum Depreciation per hour = 910 0.208 910 4,380hrs Repairs for the whole life 18,000 Rs.18,000 4,380 X10 years 0.411 Electricity for one hour : 15 units @ 0.05 P 0.750 Machine hour rate 2.104 for one hour PROBLEM NO.8 No. of machine/hrs = 200 X 75% =150hours Calculation of total cost relating to machine: Depreciation of machine (1,08,000X10%X1/12) 900 Power 1,500 Supervision charges 3,000 Electricity 1,500 R&M 1,500 Insurance of P&M 12,000 IPCC_34e_Costing_Overheads-II_Assignment Solutions _________________34 MASTER MINDS No.1 for CA/CWA & MEC/CEC Other general expenses 10,800 Wages(w.n.1) 3,727 Total cost 34,927 Computation of machine hour rate 34,927 150hrs = = Rs.233per machine Computation of wages payable to worker: a. Wages for 8 hrs (40+12) 52 b. No. of working hours for the month (assumed that worker worked for 200 hrs) 200 hrs c. Basic wages 1,300 d. D.A(100% of C) 1,300 e. BASIC + D.A 2,600 f. Bonus(1/3 on 2,600) 867 g. Leave with pay (10% on 2,600) 260 Total 3,727 PROBLEM NO.9 Computation of machine hour rate of new Machine: Total (Rs.) A. Standing Charges: Per hour (Rs.) 1,000 I. Insurance Premium 9,000 X II. Re nt 1 9 2,880 1 X2,400 X12 10 3,880 0.97* B. Machine expenses: I. Repairs and Maintenance [5,000/4,000] − 10,000 10 X4,000 10,00,000 II. Depreciation 1.25 24.75 III. Electricity 8 units x Rs. 3.75 30.00 Machine hour rate 56.97 Working Note: 1 Calculation of productive Machine hour rate Total hours Less: Non-Productive hours 4,200 200 4,000 * 3,880/ 4000 = 0.97 PROBLEM NO.10 Calculation of OHRR for each machine (without use of crane): IPCC_34e_Costing_Overheads-II_Assignment Solutions _________________35 Ph: 98851 25025/26 Particulars a. Over heads b. Machine hrs c. OHRR(a/b) www.mastermindsindia.com A B 639 588 (160 + 428) 1.09 C 697 707(130 + 577) 0.99 Over heads per machine to be added for above OHRR when crane is used = = 951 480 (480 + 0) 0.74 570 (160 + 130 + 480 ) 570 = Rs.0.74 per machine 770 h THE END IPCC_34e_Costing_Overheads-II_Assignment Solutions _________________36