Activity-based costing

advertisement

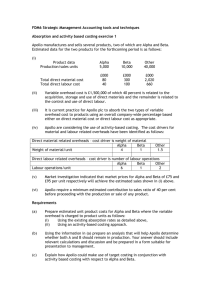

Activity-based costing 1 Introduction In the past, overhead costs were relatively small, and the problems arising from inappropriate overhead allocations were not so significant But nowadays, factories are highly automated, resulting in increasing depreciation charges, maintenance cost and machinery set-up cost Errors in overhead absorption may seriously affect the management decisions 2 The Activity-based costing (ABC) system is developed to provide better approach for assigning overheads to products and computing product costs 3 Limitation of traditional costing Traditional systems adopt volume-related allocation bases e.g. direct labour hour and machine hour. However, different resources are used in non-volume related support activities e.g. materials ordering, machinery set-up, production scheduling and first-item inspection 4 Traditional systems allocate overheads to products in proportion to their production volumes. High overheads are allocated to the high-volume products. As a result, the highvolume simple products may be over-costed while the low-volume complex products may be under-costed 5 Introduction to Activity-based costing The activity-based costing system asserts that products create demand for activities and activities bring about the costs to be incurred 6 What steps? 1. 2. 3. 4. 5. Identity major activities performed by the business Calculate the total cost of each activity over the period (i.e. cost centre or cost pool) Determine the cost driver for each activity. Cost drivers are the factors which cause the activity cost pool to increase Calculate the cost driver rate (i.e. total cost in a cost pool/ no. of cost driver) Assign the cost-centre overheads to the products according to their cost driver rates 7 Example 8 Martin Ltd. Manufactures tow products. Product A is a highVolume product while Product B is a low-volume product. Details of production are shown as follows: Product A Product B Materials cost per unit $130 $130 Direct Labour cost per hour $50 $50 Direct machine hour per unit 4 hrs 4 hrs Direct labour hour per unit 2 hrs 2 hrs Output 10 100 No. of purchase orders 3 4 No. of set up 40 80 Overhead costs are shown as follows: Factory power Machinery set-up costs Materials handling and dispatch $ 6600 4800 2100 13500 9 Required Calculate the product costs using: (a) Absorption costing based on machine hour (b) Activity-based costing 10 (a) Absorption costing based on machine hour Direct Materials Direct labour Overheads ($13500*4/440) Product cost per unit Product A $ 130 100 Product B $ 130 100 123 353 123 353 4*10+100*4 11 (b) Activity based Costing Product A $ 130 100 Direct Materials Direct labour Overheads Factory power (6600*4/440) 60 Machinery set-up cost (4800*40/120*1/10) 160 (4800*80/120*1/10) Materials handling & dispatch (2100*3/7*1/10) 90 (2100*4/7*1/100) Product cost per unit 540 Product B $ 130 100 60 32 12 334 12 Objective Allocation of overhead Traditional Activity based Ensure Focus all overheads are absorbed into the total production cost The product cost enable the production cost and stock valuation the basis volumerelated criteria e.g. machine hours and direct labour hours on the activities incurred Assign to each product only those costs that would be avoided if the production was discontinued The basis of nonvolume-related activities e.g. the no. of purchase order, production runs and deliveries 13 Traditional Assignment Overheads cost of overhead are assigned to each department Activity based Overheads are assigned to the cost centre for each activities Adoption of a single Numerous cost overhead absorption rates is drivers are used for rate used different activities 14 Cost driver analysis Traditional costing systems assume that all overheads increase in proportion to the number of units produced In a complex manufacturing environment, a greater number of cost drivers are used for cost accumulation 15 Unit-level activities Batch-level activities Production -level activities Costs are incurred for each unit Produced. For example, •Direct materials •Direct labour •Factory power Costs are incurred for each batch produced. For example, •Purchase orders •Production runs •Number of inspection Costs are incurred to support a product Types or process. For example, •Engineering change orders •Product development •Process design •Test routines Cost per unit Cost per unit in batch Cost per unit in batch 16 Advantages of Activity-based costing More realistic cost assignment Better decision-making Better control over cost 17 Limitation of Activity-based costing Difficult to apportion common costs Difficult to implement Inconsistent with the generally accepted accounting principles (GAAP) 18