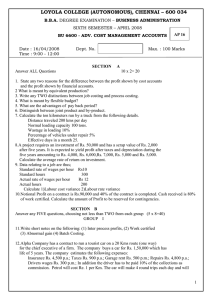

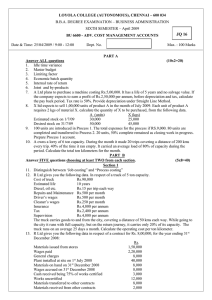

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

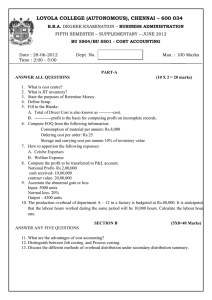

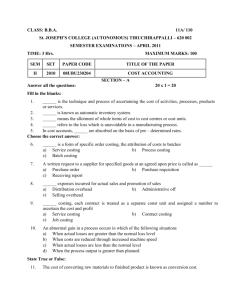

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.B.A. DEGREE EXAMINATION –BUSINESS ADMINISTRATION SUPPLIMENTARY EXAMINATION – JUNE 2007 BU 6600 - ADV. COST MANAGEMENT ACCOUNTS Date & Time: 25/06/2007 / 9:00 - 12:00 Dept. No. Max. : 100 Marks SECTION-A (10X2=20) (Answer all questions) 1.How will you deal with the under valuation and overvaluation of stocks at the time of reconciling cost and financial profits? 2.What do you mean by surveyor’s certificate? 3.What do you understand by escalation clause? 4.What are the causes of process losses? 5.Calculate the economic batch quantity for a chemical manufacturing company from following details. Annual demand for the product-16,000 units. Setting up cost.Rs.50 Carrying cost per unit of production Rs.10 per annum. 6.State the importance of net present value. 7.Write a note on “Fixed budget”. 8.What is meant by Variance analysis? 9.The standard rate per labour hour was Rs.20.However during the month payment was made for 26,000 labour hours at Rs.22 each. Calculate labour rate variance. 10.Explain the term “Zero based budgeting”. SECTION-B (5x8=40) Answer any five questions, choosing not less than Two questions from each group. GROUP-I 11.Compare and contrast between process costing and job costing. 12.The following details are given by a company using job costing. The following data is provided from its books for the year ending 31-12-2004. Rs Direct Materials 1,00,000 Direct Wages 50,000 Factory overheads 55,000 Administration overheads 55,000 Selling overheads 40,000 Profit 75,000 a) Prepare a job cost sheet indicating prime cost, works cost , production cost ,cost of sales and the sales value. b) In 2005 the company receives an order for a number jobs .It is estimated that Direct materials required will be Rs.1,40,000 and direct labour costs Rs.60,000 What should be the price to be charged by the company for these jobs if theCompany intends to earn the same profit on sales as in 2004.Assuming that selling and distribution overheads have gone up by 15%. The company recovers Factory overheads as percentage of direct wages and administrative and selling Overheads as percentage of works cost. 13.Pallavan Transport corporation runs the following fleet of buses in a particular area of Chennai for 30 days in a month.25-buses of 50 passengers capacity ,on an average each bus makes 10 trips a day covering a distance of 8 kms in each trip with 75% of Seats occupied. Generally, 10% of buses are kept away from the roads for repair. Monthly expenses Rent Road tax Salary of chief operating manager Salary of three assistant managers Salary of four supervisors Wages of thirty cleaners Wages of twenty five drivers Wages of twenty five conductors Consumable stores Diesel Lubricants Replacement of tyres Miscellaneous expenses Depreciation Work shop expenses Rs 2,500 500 1,500 800 each 400 each 100 each 240 each 200 each 4,500 34,000 5,500 1,750 2,750 6,500 3,500 Calculate the cost per passenger km of operating the service. 14. A manufacturing company’s product passes through two distinct processes A and B and then to finished product. The normal loss is estimated as follows. Process-A – 5%input , process-B-10% of input. The scrap value of the loss in process A is Rs.8 per 100 units and in process B Is Rs.10 per 100 units. The process figures are as follows. Process-A Process-B Rs Rs Materials 3,000 1,500 Wages 3,500 2,000 Factory expenses 1,000 1,000 5,000 units were introduced into process A at a cost of Rs.2,500.The outputs were; Process-A ; 4,700 units ,Process- B ; 4,300 units. Prepare Process cost accounts showing the cost of output. GROUP-II 15.Briefly explain the classification of budgets on the basis of functions. 16.The following figures relate to a product for the quarter ending31-3-2005 are available. Budgeted sales ; January – 3,00,000 units February - 2,40,000 units March - 3,60,000 units Stock position; 1-1-2005 – 50% of January’s sales 31-3-2005- 80,000 units. 31-1-2005-40% of February’s sales. 28-2-2005-60% of March’s sales. You are required to prepare a production budget for the quarter ending 31-3-2005. 17.From the following particulars ,calculate the Material variances. a) Material cost variance b) Material price variance c) Material usage variance d)Material mix variance. Material Standard Qty Standard price Actual Qty Actual price KGS Rs KGS (Rs) X 20 5 24 4.00 Y 16 4 14 4.50 Z 12 3 10 3.25 --------48 48 2 18.From the following particulars ,find out the profitable product mix and prepare a Statement of profitability. Product-A 1,500 60 Maximum production(units) Selling price per unit(Rs) Requirements per unit; Direct material (kg) Direct labour (hrs) Variable overheads(Rs) Cost of direct material per k.g.(Rs) Fixed overheads (Rs) Direct wages per hour (Rs) Product-B 2,000 55 5 4 9 5 4 2 3 3 14 5 4 2 Product-C 1,000 50 4 2 6 5 4 2 Total availability of direct material 12,000.kgs. Total availability of direct labour hours 10,000. All products A,B and C are produced from the same direct materials using the same type Of machines.Consider both material and labour as key factors. SECTION-C (Answer any TWO Questions). (2x20=40) 19.a)The following transactions have been extracted from the financial books of -J. Ltd, for the year ending 31-12-2004. Units RS Sales Materials Wages Factory overheads Office and administration exps. Selling and distribution expenses Closing stock of finished goods 20,000 1,230 W.I.P. ----------Materials Labour Factory overheads 2,50,000 1,00,000 50,000 45,000 26,000 18,000 15,000 3,000 2,000 2,000 Goodwill written off 20,000 Interest on capital 2,000 In cost books factory overheads are charged at 100% on wages , administration Overheads at 10% on factory cost and selling and distribution overheads at Re.1 Per unit sold. Prepare; i) A statement showing profit as per cost accounts ii) Profit and loss account as per financial books and iii) A statement of reconciliation reconciling profit as per cost accounts and financial accounts. OR 3 19.b) A construction company having an authorized capital of Rs.1,00,000 divided into 1000 ordinary shares of Rs.100 each , commenced operations on 1-1-2005 and during the period it was engaged in one cotract. The contract price was Rs.4,00,000 The trial balance extracted from their books on 31-12-2005 stood as follows. Rs Rs Share capital Sundry creditors Land & building Cash at bank Materials Plant Wages Expenses Cash received being 80% of work certified. --80,000 --8,000 34,000 9,000 80,000 15,000 1,05,000 5,000 --1,60,000 2,48,000 2,48,000 Of the plant and materials charged to the contract plant costing Rs.2,000 and Materials costing Rs.2,000 were destroyed in an accident . On 31-12-2005, plant Which costs Rs.4,000 was returned to stores. Value of material on site was 4,000 And cost of work done but not certified was Rs.2,000. Charges depreciation at 10% On plant and carry to profit& loss a/c two third of profit. Prepare contract account For the year and balance sheet as on 31-12-2005 and show the amount to be credited To P&L A/C. 20.a) The cost of an article at a capacity level of 5,000 units is given below; Material cost Labour cost Power Repairs Stores Inspection Depreciation Administrative overheads Selling overheads Rs 25,000 (100% variable) 15,000 (100% variable) 1,250 (100%Variable) 2,000 (75% variable) 1,000 (100% variable) 500 (20% variable) 10,000 (100% variable) 5,000 (25% variable) 3,000 (25% variable) 62,750 Cost per unit Rs.12.55 Calculate the total cost and cost per unit of the product at production levels of 4,000 and 6,000 units. . OR 20.b)-1). A Ltd company has Rs.80,000 to invest .It has two attractive proposals at hand for consideration. The alternatives are; Investment outlay Year; 1 2 3 4 Proposal –X Rs. 80,000 32,000 32,000 36,000 ---1,00,000 Proposal-Y Rs. 80,000 30,000 30,000 30,000 10,000 1,00,000 4 Required ; a) Which investment proposal would you recommend under pay- back period Method. b) Would your decision be different if proposal Y has Rs.40,000 in the third year Instead of Rs.30,000 cash inflow?. 2.A Company is considering two mutually exclusive projects. Both require an initial Cash outlay of Rs.10,000 each and have a life of 5 years. The company’s required rate of return is 10% and pays a tax at 50% rate. The projects will be depreciated on a straight line basis. The net cash flows before taxes and depreciation are expected to be as follows. Year 1 2 3 4 5 Project-I Rs. 4,000 4,000 4,000 4,000 4,000 Project-II Rs. 6,000 3,000 2,000 5,000 5,000 Present value at 10% 0.909 0.826 0.751 0.683 0.621 Calculate ; Net present value of each project. Advise the company as to which project should be accepted and why? ***************** 5