Приложение 1

advertisement

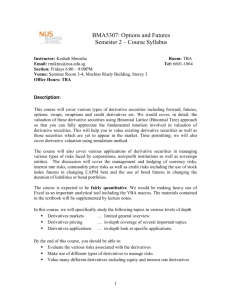

Derivatives 1. Goals and objectives of the discipline This course sets following goals: To develop the ability of students to master knowledge and to understand at the advanced level character and ways of use of financial derivatives; To provide students with opportunity to develop ability to critically analyze academic literature in the field of derivative financial instruments; To provide students with ability to critically evaluate this complex specialized field of knowledge from the point of view of studying risk management and writing a dissertation in the field of financial engineering. 2. Requirements to the results of the discipline: As the result of the study of this discipline the following competences should be formed by student: ОК – 1 ability to improve and develop the intellectual and common cultural level ОК – 3 ability to independently acquire (including through information technology) and to use in practical activity new knowledge and skills, including new fields of knowledge not directly related to the field of activity ОК – 4 ability to make organizational and managerial decisions and readiness to take responsibility for them including the emergency situations ПК -1 ability to generalize and critically evaluate the results obtained by domestic and foreign researchers, to identify perspective fields of study, to make the research program ПК -6 ability to evaluate the efficiency of projects taking into account the uncertainty factor ПК -7 ability to develop strategies of economic agents in different markets ПК -8 ability to prepare analytical materials for evaluation of activities in the field of economic policy and for making strategic decisions at micro and macro level ПК -9 ability to analyze and use various sources of information for economic calculations ПК -10 ability to make the forecast of basic social-economic indicators of the performance of the enterprise, industry, region and economy as a whole ПК -11 ability to manage economic services and divisions in enterprises and organizations with different ownership forms, in the state and municipal authorities 3. The essence of the discipline № Name of the section of discipline п/п Contents 1 Introduction to the derivatives market and overview of financial mathematics 2 Forward contracts 3 Futures market 4 Fixed income theory 5 Swaps 6 Introduction to options 7 Options: Binomial estimate and stochastic models 8 Black-Scoles-Merton model of options pricing and estimation of options with different underlying assets 9 Risk management 10 Empirical studies Total: 8/16/84 The final form of control - test 5. Main reading - Hull, J.C. (2008), Options Futures and Other Derivatives, 7th edition, Prentice Hall Additional reading 1. McDonald, R (2006), Derivative Markets, 2nd edition, Pearson International Edition 2. Neftci, N., (2000). An Introduction to the Mathematics of Financial Derivatives, 2nd edition, Salih Academic Press 3. Baxter, M. and A. Rennie (1996), Financial Calculus: An Introduction to Derivative Pricing, Cambridge University Press. 4. Brandimarte, P. (2006), Numerical Methods in Finance and Economics: A MATLAB-based Introduction, 2nd edition, Wiley. 5. Dixit, A. and R. Pindyck (1994), Investment Under Uncertainty, Princeton. 6. Jarrow, R. and S. Turnbull (2000), Derivative Securities, 2nd edition, South-Western College Publishing, Thomson Learning. 7. Lamberton, D. (2007), Introduction to Stochastic Calculus Applied to Finance, 2nd Edition, Chapman & Hall. 8. McDonald, Robert (2006), Derivative Markets, 2nd edition, Pearson International Edition. 9. Stulz, R.M. (2003), Risk Management & Derivatives, South-Western College Publishing, Thomson Learning. 10. Tuckman, (2002), Fixed Income Securities, 2nd edition, Wiley. 11. Watsham, T. and K. Parramore (1997), Quantitative Methods in Finance, 2nd edition, Thomson Learning. 2