Money and Banking - University of South Carolina

advertisement

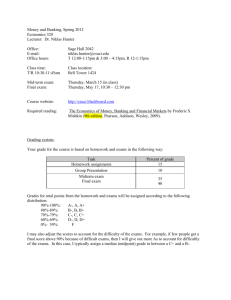

ECON 301 Money and Banking, Fall 2008, University of South Carolina Instructor: Christian Jensen E-mail: cjensen@moore.sc.edu Office: BA 418 Assistant: Supratim Das Gupta (dasgupta@mailbox.sc.edu) Lectures: Tuesday and Thursday 8.00-9.15 in BA 582. Office hours: Tuesday and Thursday 9.30-10.30, and by appointment (e-mail). Required materials: Money and Banking: A Policy-Oriented Approach by Dean Croushore (Houghton Mifflin, 2007, also available as e-book) and scientific calculator. Optional materials: Study Guide to Accompany Money and Banking: A Policy-Oriented Approach (Houghton Mifflin, 2007). Description: We will study the roles that money, interest rates and financial intermediaries play in the U.S. economy. The aim is to provide an overview of the U.S. financial system and an understanding of the theory and practice of monetary policy. Assignments: Class time will be spent on the more difficult material and homework assignments. You are required to read extensively and work through the material on your own, as there is not enough class time to cover everything. In addition, 24% of your final grade will depend on your presentations of homework assignments in class. Since we are constantly building on the previous chapters, it is important that you not fall behind. Attendance: You should plan to attend all class sessions, as 24% of your final grade depends on your participation and presentations of homework assignments in class. Attending class without participating counts the same as not attending at all. You can miss 10% of classes without it affecting your grade directly, whether or not you have a valid excuse, anything more than this will deteriorate your grade. Prerequisites: This course has no formal prerequisites, but is computationally intensive. You need to know how to compute percentages, fractions, growth rates and powers using a scientific calculator. Basic algebra is also required. Webpage: All materials and information will be available through Blackboard at http://blackboard.sc.edu. Collaboration: You are encouraged to work with fellow students when preparing for class, exams and for homework assignments, however, copying is not accepted. Grading: Two midterms and a final (24% each), class participation and homework assignments (24%), portfolio project (4% plus 4 bonus points based on return over the semester). Any evaluation that is missed without valid and documented justification will receive a score of zero. Exams will test both what is covered in class and in the reading assignments. The grading scale is the following: 0-59: F 60-64: D 65-69: D+ 70-74: C 75-79: C+ 80-84: B 85-89 B+ 90-100: A Extra credit: There will be no extra-credit, apart from the four bonus points allocated according to the relative return on your portfolio project. Course outline: I. Money and the financial system A. Introduction to money and banking (chapter 1) B. The financial system and the economy (chapter 2) C. Money and payments (chapter 3) D. Interest rates (chapters 4, 5 & 6) E. Stocks and other assets (chapter 7) II. Fundamentals of Banking A. How banks work (chapter 8) B. Government’s role in banking (chapter 9) III. Business cycles A. Economic growth and business cycles (chapters 10 & 12) B. Economic interdependence (chapter 14) IV. Monetary Policy A. The Federal Reserve System (chapter 15) B. Monetary control (chapter 16) C. Monetary policy: goals and tradeoffs (chapter 17) D. Rules for monetary policy (chapter 18)