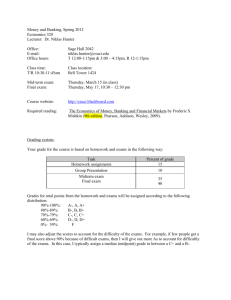

The University of Wisconsin-Milwaukee

advertisement

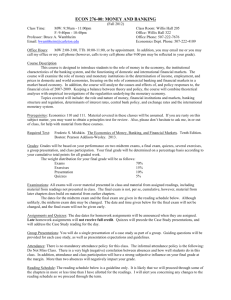

The University of Michigan-Dearborn Department of Social Sciences ECON 311, Money and Banking Winter 2005 Instructor: Ilir Miteza Office hours: TR 9:15-9:45 and 11:20-12:20, or by appointment Office: SSB, Room 2260 Phone: 313-583-6407 E-Mail: imiteza@umd.umich.edu Class Meetings: 1600 SSB, TR 1:05 – 2:20pm Course Description: Econ 311 deals certainly with money, but also with financial instruments that are analogous to money. It deals with banks, and at the same time with financial institutions that compete with banks. In effect it is the study of the financial system, its regulation, and its most important components like money, the banking industry, and the central bank. We will focus mostly on the U.S. financial system while paying some attention to other countries’ systems. We will examine institutions as well as economic theory and policy. A significant amount of time will be devoted to understanding how financial markets function in a financially advanced economy, how institutions and instruments have developed, how efficient the financial system is in allocating resources. Macroeconomics and monetary policy also take a fair share of the course time. Required Text: F. S. Mishkin, The Economics of Money, Banking, and Financial Markets, 7th Edition, Addison Wesley. A powerful Companion Website can be accessed for free at www.awlonline.com/mishkin. The web site features a collection of news articles relevant to each chapter, current weekly news, along with questions to answer, glossary flashcards to review the key terms from the textbook, multiple choice quizzes to test understanding of each chapter, web links to the websites mentioned in the textbook, etc. Course Website Use the links on my web page to stay current with announcements, problem sets, review sheets, answer sheets and notes. http://www-personal.umd.umich.edu/~imiteza/ 1) Notes, materials and announcements will be posted on the UM Coursetools website: https://coursetools.ummu.umich.edu/ 2) Assignments, interactive tutorials, and online experiments will be found at www.aplia.com Students are responsible for staying current with both websites. There is a term fee for signing up at Aplia.com Attendance and Participation: You are expected to attend all lectures. Poor attendance is usually correlated with lower grades. During the semester there will be several unannounced graded in-class assignments. Some exam questions will reflect material not found in the textbook, but discussed or presented in lectures. The intention is to have the class discussions elaborate and expand upon the assigned readings rather than having class lectures simply replicate these materials. Good class participation will be considered "at the margin" for grading purposes. Examinations and Grading Policy: There will be four non-cumulative exams covering material discussed in class as well as additional assignments – three midterms and a final. Out of three midterm exams, the worst will be dropped. Each remaining midterm weighs 30%, the final exam weighs 20% and home assignments will account for 20% of the final grade. Grading will be based on a curve where the median is assigned a C+. There is no absolute curve. Extra Credit: Details and options on extra credit assignments will be discussed in class in due time. Make-up Exams: Please ensure that you have no scheduling conflicts during lecture times for this semester because make-up exams will be given only in the case of well-documented emergencies on the scheduled exam day and if I am informed as soon as possible. Students that plan to miss exams for religious reasons should notify me in advance. Articles: I will assign readings from articles (mostly emailed to the class list) that are relevant to the lectures, and that may be included in exams. The University of Michigan-Dearborn Department of Social Sciences Academic Integrity: The University of Michigan – Dearborn values academic honesty and integrity. Each student has a responsibility to understand, accept, and comply with the University’s standards of academic conduct as set forth by the Code of Academic Conduct, as well as policies established by the schools and colleges. Cheating, collusion, misconduct, fabrication, and plagiarism are considered serious offenses. Violations will not be tolerated and may result in penalties up to and including expulsion from the University. Students With Disabilities: The University will make reasonable accommodations for persons with documented disabilities. Students need to register with the Disability Resource Services every semester they are taking classes. DRS is located in Counseling and Support Services in 1060 UM. To be assured of having services when they are needed, students should register no later than three weeks after the first day of classes (by September 26, 2001). For more information contact Nancy Lehnert, Disability Resource Services Assistant; University of Michigan-Dearborn; 313-593-5430. E-mail Communication: I will only use your UMD email address for class or individual communications. If you do not check your UMD e-mail account on a regular basis, you need to set up the “forward” option so as to have your UM-D email forwarded automatically to your preferred e-mail address. Tentative Course Outline Week of CHAPTER TOPICS I. Jan. 10 Jan. 17 1. Why Study Money, Banking, and Financial Markets? 2. An Overview of the Financial System 3. What is Money? II. Jan. 24 Jan. 31 INTRODUCTION FINANCIAL MARKETS 4. Understanding Interest Rates 5. The Behavior of Interest Rates 6. The Risk and Term Structure of Interest Rates 7. Stock market, rational expectations, and the efficient market hypothesis FIRST EXAM III. 9. FINANCIAL INSTITUTIONS The Banking Firm and the Management of Financial Institutions Feb. 7 10. Banking Industry: Structure and Competition Feb. 14 11. Economic Analysis of Banking Regulation Feb. 21 13. Financial Derivatives Mar. 7 SECOND EXAM IV. CENTRAL BANKING AND THE CONDUCT OF MONETARY POLICY 14. Structure of Central Banks and the Federal Reserve System Mar. 14 15. Multiple Deposit Creation and the Money Supply Process Mar. 21 17. Tools of Monetary Policy Mar. 28 THIRD EXAM 18. Conduct of Monetary Policy: Goals and Targets 18. Conduct of Monetary Policy: Goals and Targets V. MONETARY THEORY Apr. 11 24. Aggregate Demand and Supply Analysis Apr. 18 26. Money and Inflation Apr. 4 FINAL EXAM *Note: midterm and quiz dates are approximate.