ACC

advertisement

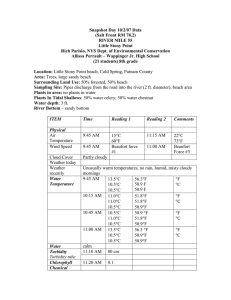

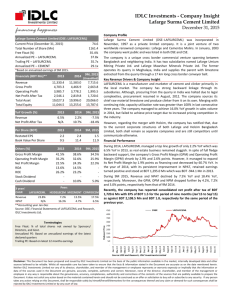

ACC: High input costs erode margins ACC has announced its 1QCY11 results. The company has reported 14% YoY rise in sales and 13% YoY decline in net profits. Here is our analysis of the results. Performance summary On a standalone basis, net sales increase by 14.1% YoY led by higher sales volume. Rising input costs cause operating profits to decline by 11% YoY. Higher interest and depreciation costs further lead the bottomline to drop by 13% YoY. Standalone financial performance snapshot (Rs m) 1QCY10 1QCY11 Change Net sales 21,018 23,982 14.1% Expenditure 14,796 18,439 24.6% Operating profit (EBITDA) EBITDA margin 6,222 5,542 -10.9% 29.6% 23.1% Other income 609 669 9.9% Interest 127 253 98.5% 1125 20.3% Depreciation 935 Profit before tax/(loss) 5,768 4,834 -16.2% Tax 1717 1327 -22.7% Net profit 4,051 Net profit margin 19.3% 3,507 -13.4% 14.6% No of shares (m) 187.7 Diluted EPS (Rs)* 54.4 P/E (times) 20.7 *trailing twelve month earnings What has driven performance in 1QCY11? On a standalone basis, ACC's net sales rose by 14.1% YoY during the quarter ended March 2011. The rise in revenue was led by a 10.4% YoY rise in sales volume and a marginal 3.4% YoY increase in cement realisations. However, operating profit dropped by 10.9% YoY on the back of steep rise in input costs. The cost of manufacturing escalated due to rising cost of energy, fuel and raw materials like fly ash and slag. Coal prices rose substantially in both domestic and international markets. Transport costs also went up due to rising inflation. Depreciation and interest expenses were higher due to the ongoing capacity expansion and commission of various projects. As a result, net profits declined by 13.4%.The net profit margin declined from 19.3% in 1QCY10 to 14.6% in 1QCY11. What to expect? The company's sales and realisations have shown some improvement in the current quarter when compared with the preceding two quarters. However, considering that this is the peak season for cement demand, the trend may not continue going forward. The cement industry is still dealing with significant overcapacity. On the other hand, the slowdown in construction and infrastructure spending has further played spoilsport. Hence, in the short to medium term, the scenario for the cement industry seems bleak. At the current price of Rs 1,127, the stock of ACC is trading at an EV/tonne over Rs 6,400 based on our CY12 estimates, making it expensively valued as per the replacement cost method. ***************************************************************************************************************************** ***** Disclaimer: This Service is provided on an 'As Is' basis by pardiwala securities pvt ltd. pardiwala securities pvt. ltd and its Affiliates disclaim any warranty of any kind, imputed by the laws of any jurisdiction, whether express or implied, as to any matter whatsoever relating to the Service, including without limitation the implied warranties of merchantability, fitness for a particular purpose. Neither pardiwala securities pvt ltd nor its affiliates will be responsible for any loss or liability incurred to the user as a consequence of his or any other person on his behalf taking any investment decisions based on the above recommendation. Use of the Service is at any persons, including a Customer's, own risk. The investments discussed or recommended through this service may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors as they believe necessary. Information herein is believed to be reliable but pardiwala securities pvt. ltd and its affiliates do not warrant its completeness or accuracy