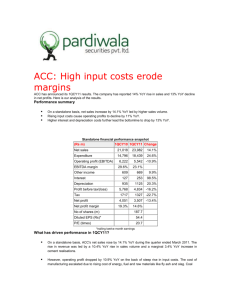

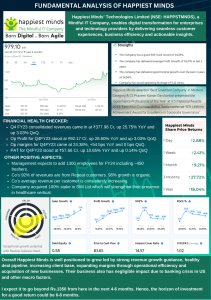

NEXTRON INDUSTRIES Overview: - Respected, old and local manufacturing company - Electronics (esp. automotive) - Strong reputation for delivering high-quality electronics - Quality leading to long-standing partnerships Problem: - Declining profitability Requirements: - Cost reduction without compromising quality Observations: - YoY Revenue has declined - YoY COGS has increased - YoY Ops. Expense has increased marginally - YoY Production has decreased marginally - YoY Downtime has increased significantly (100% from 2020 to 2022) - YoY decrease in Inventory turnover ratio but increase in Inventory Units - YoY Defect Rate has increased significantly Inference: - Revenue has decreased whereas COGS has increased is an indicator that either the same stock is sold at low price or low valued stocks were liquidated significantly higher in number than high value stocks - Significant increase in downtime combined with a drastic increase in defect rate is a clear indicator that there are lapses in the manufacturing process. This could be due to machine error (old machines, repairs, maintenance shutdowns etc.) or due to human error - Inventory, in absolute terms, has increased marginally but Inventory Turnover Ratio has decreased significantly point to the fact that over stocking has been done Recommendations: - Nextron is a reputed OEM with good relationships in the Automotive Industry. It goes without saying that Automotive Industry is a bulk purchaser of electronic goods and it is highly unlikely that Automotive Industries change OEMs easily. Considering declining revenue, Nextron must immediately seek to take a price increase in the market. For products sold in high volumes, the per product price jump can be miniscule and Nextron can charge the same considering their brand value and reputation - There seems to be major QA/QC issues in the manufacturing process. A significant rise in number of defects makes it evident that there are errors or loopholes in manufacturing that needs urgent attention. If it is machine based downtime, then maintenance and repairs needs to be done on urgent basis. If is human based downtime, then appropriate actions like manpower training or turnover is utmost necessary - Nextron needs to bring in high value and high volume clients. Data clearly shows that production capacity is significantly high as compared to the annual liquidation of stock. Nextron can clearly leverage the global semi conductor chip shortage wherein those with available stocks are charging a premium over the same - As per the data provided, it seems that Nextron is purely an OEM to Automotives. Electronics has various applications in other Industries too and Nextron can look to diversify their portfolio by supplying to other non-Automotive industries and include products which are both, revenue generating as well as profit making, i.e., high volume and high value. Summary: - Price increase leveraging old relations, proven quality and good reputation - Fix QA/QC to minimize defects - Increase customer base in the same segment - Diversify portfolio - Create customer base in new segments with the tendency to bring in high value and high volume clients