ENERGY SECTOR Christian Moore Sung bae, Mun

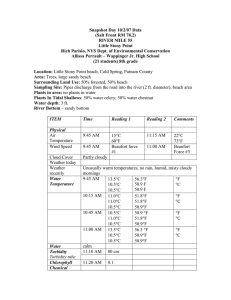

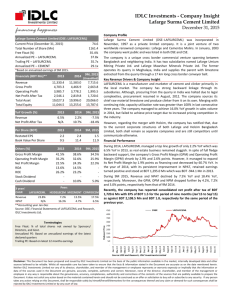

advertisement

ENERGY SECTOR Christian Moore Sung bae, Mun AGENDA • Overview • Business Analysis • Economic Analysis • Financial Analysis • Valuation Analysis • Reccomendation S&P 500 SIM INDUSTRIES • Petroleum- oil companies • Gas- natural gas extraction, coal gas extraction, coal manufacture. • Electrical Power • Coal • Nuclear Power • Renewable Energy BIGGEST NAMES IN ENERGY • Exxon Mobil Corp- $409B • Chevron Corp- $226.75B • Schlumberger Ltd- $125.72B • Conoco Phillips- $88.42B • Occidental Petroleum- $68.86B • EOG Resources- $51.81B • Halliburton Co- $46.35B • Anadarko Petroleum Corp- $46.34B • Phillips 66- $42.98B • The Williams Companies Inc- $41.50B SECTOR PERFORMANCE • QTD returns of -2.99% • YTD returns of -1.59% TOTAL RETURNS S&P 500 Energy (Sector) (TR) 1,010.69 2.04 % -2.88 % -2.88 % 0.27 % PRICE RETURNS S&P 500 Energy (Sector) 641.32 2.04 % -2.99 % -2.99 % -1.59 % Business Analysis • Energy Sector takes hold in the Early recovery stage as higher production typically requires more energy. • Slows down at full recovery when there’s more risk, investors begin to think defensively and focus on Staples, Healthcare, Utilities, and Financials. FIVE FORCES Threat of Substitutes is Low • Renewable and Nuclear energy usage has decreased in the past year. • Petroleum and Natural Gas make up 59% of energy consumption THREAT OF NEW ENTRANTS IS LOW • Volatile prices – oil and gas • Specialized work forces • Economies of scale • Industry expertise needed • High Capital Cost • Geopolitical Factors • Highly Regulated BARGAINING POWER OF SUPPLIERS IS MEDIUM • Not many companies have large market caps and small companies aren’t very able to attain a share of the market. • However in the oil industry OPEC controls 40% of the world’s supply of oil and can influence that portion of the energy market BARGAINING POWER OF BUYERS IS HIGH • Very comparable services • Customers can pick and choose the lowest price options and find their own deals RIVALRY WITHIN INDUSTRY IS LOW • The largest few companies hold nearly half of production. • The industry is highly concentrated ECONOMIC ANALYSIS S&P 500 VS ENERGY SECTOR INDUSTRY PERFORMANCE LAST 10 YEARS REAL GDP VS ENERGY SECTOR CRUDE OIL PRICE: BRENT VS. S&P 500 ENERGY INDEX GAS RIG COUNT VS. S&P 500 ENERGY INDEX CONSUMER CONFIDENCE VS. S&P 500 ENERGY INDEX SECTOR GROWTH SECTOR GROWTH SECTOR GROWTH ROE- CRUDE OIL COMPARISON NET DEBT TO ASSETS TURNOVER AND R&D FINANCIAL ANALYSIS SALES/EARNINGS OVERVIEW 2005 Income & Expenses per Share Sales 2006 2007 2008 366.98 396.21 434.29 2009 2010 2011 2012 2013 546 365.88 423.42 514.95 549.09 547.77 Growth (YoY) 26.63 7.96 9.61 25.72 -32.99 15.73 21.62 Earnings 34.51 42.5 45.71 52.99 23.14 34.12 Growth (YoY) 44.31 23.18 7.54 15.93 -56.33 47.45 6.63 2014 2014E 2015E 563.8 597.23 583.98 -0.24 2.93 46.48 44.66 42.73 45.66 36.23 -3.93 -4.31 6.86 9.03 -2.22 44.99 45.01 5.27 0.04 FINANCIALS 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Gross Margin 20.59 21.34 19.62 18.51 15.04 17.13 18.43 17.52 16.75 17.11 Growth (YoY) -11.34 3.66 -8.09 -5.65 -18.72 13.89 7.54 -4.93 -4.41 2.2 EBITDA Margin 18.42 21.28 21.06 19.65 17.11 19 19.78 18.81 18.35 18.59 3.54 15.56 -1.03 -6.7 -12.94 11.08 4.12 -4.93 -2.46 1.31 Operating Margin 14.64 16.77 16.01 14.67 9.43 12.21 13.84 12.41 11.34 11.17 Growth (YoY) 11.79 14.59 -4.52 -8.41 -35.73 29.53 13.35 -10.3 -8.69 -1.49 Profit Margin 10.21 11.22 10.87 6.53 4.22 8.58 9.09 8.35 7.84 8.05 Growth (YoY) 24.56 9.86 -3.12 -39.88 -35.42 103.3 5.95 -8.09 -6.09 2.61 Return on Assets 13.32 12.93 11.91 8 3.5 7.67 8.63 7.57 6.59 6.72 Growth (YoY) 39.73 -2.95 -7.84 -32.85 -56.24 119.05 12.56 -12.35 -12.94 1.96 Return on Common Equity 29.43 27.91 25.32 17.12 7.47 16 17.93 15.72 13.61 13.97 Growth (YoY) 30.47 -5.16 -9.29 -32.38 -56.34 114.1 12.04 -12.33 -13.42 2.65 Return on Capital 22.66 21.65 19.89 14.39 6.29 12.83 14.35 12.56 10.64 11.18 Growth (YoY) 34.89 -4.46 -8.09 -27.65 -56.32 104.09 11.79 -12.45 -15.26 5.02 R&D Expense 1.14 1.34 1.85 1.76 1.8 1.73 1.84 2.12 1.94 1.96 Growth (YoY) 19.11 17.89 38.01 -4.69 2.15 -3.95 6.37 15.06 -8.13 0.75 0.311% 0.338% 0.426% 0.322% 0.492% 0.409% 0.357% 0.386% 0.354% 0.348% Growth (YoY) % of sale REFERENCE ITEMS 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 6.71 4.58 3.52 4.49 1.27 3.01 2.8 1.14 1.45 1.3 Growth (YoY) 2.7 -31.8 -23.2 27.55 -71.67 137.04 -7.18 -59.4 28.17 -10.31 Dividend Yield 1.56 1.5 1.25 2.17 2.1 1.81 1.91 2.26 2.09 2.4 Growth (YoY) Dividend Yield (Gross) -14.31 -3.62 -17.02 74.01 -3.08 -14.13 5.46 18.35 -7.24 14.7 1.56 1.5 1.25 2.17 2.1 1.81 1.91 2.26 2.09 2.4 Growth (YoY) -14.31 -3.62 -17.02 74.01 -3.08 -14.13 5.46 18.35 -7.24 14.7 1.56 1.5 1.25 2.17 2.1 1.81 1.91 2.26 2.09 2.4 -14.31 -3.62 -17.02 74.01 -3.08 -14.13 5.46 18.35 -7.24 14.7 Free Cash Flow Yield Dividend Yield (Net) Growth (YoY) VALUATION ANALYSIS SECTOR VS. S&P 500 P/S S&P 500 P/E VS. ENERGY SECTOR SECTOR VS S&P 500 P/B SECTOR VS. S&P 500 P/CF 10-YEAR TECHNICAL ANALYSIS 5-YEAR TECHNICAL ANALYSIS RECOMMENDATION • SIM should overweight the Energy sector in relation to the S&P by 500 by 100 basis points. • Current Price of oil is nearly $78, down from a 52-week high of $107. This extends an opportunity to beat out the S&P 500 by investing in the underpriced commodity. • One risk of overinvesting in energy is presented by the possibility of tighter regulations on carbon emissions, also future stabilization or decrease in demand of oil could pose a threat, but not for a few years.