GIPCL SWOT Analysis: Strengths, Weaknesses, Opportunities, Threats

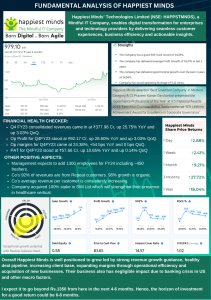

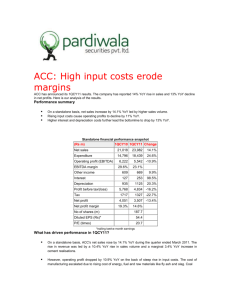

advertisement

SWOT Analysis of GIPCL: Strengths: Rising Net Cash Flow and Cash from Operating activity Growth in Net Profit with increasing Profit Margin (QoQ) Company able to generate Net Cash - Improving Net Cash Flow for last 2 years Company with Zero Promoter Pledge Inverted Hammer (Bullish Reversal) Company with Low Debt Book Value per share Improving for last 2 years Weaknesses: Companies with growing costs YoY for long term projects Inefficient use of shareholder funds - ROE declining in the last 2 years Decline in Quarterly Net Profit (YoY) Degrowth in Quarterly Revenue and Profit in Recent Results Recent Results: Declining Operating Profit Margin and Net Profits (YoY) MFs decreased their shareholding last quarter Inefficient use of assets to generate profits - ROA declining in the last 2 years Decline in Quarterly Net Profit with falling Profit Margin (YoY) Recent Results : Fall in Quarterly Revenue and Net Profit (YoY Opportunities: Companies with current TTM PE Ratio less than 3 Year, 5 Year and 10 Year PE Stock with Low PE (PE < = 10) Threats: Increasing Trend in Non-Core Income