30th April 2013 Shoppers stop Q4FY13 Results: Above estimates

advertisement

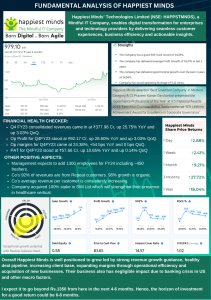

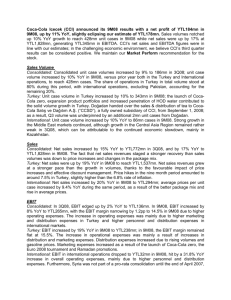

Shoppers stop Q4FY13 Results: Above estimates RETAIL : Quarterly Update 30th April 2013 Shoppers Stop’s Q4FY13 results (standalone) were above our estimates largely on account better than expected EBITDA margins. The variance is mainly on account of higher than expected gross margins expansion.Hyper city’s performance was in line with our expectations; volume growth of 3% during the quarter after decline witnessed in last 4 consecutive quarters was encouraging. Shoppers Stop Standalone Revenues grew by 17% YoY led by Same Store Sales (SSS) of 10% as against 12.5% in Q3FY13 and 10% in Q4FY12. Volume growth at 1% remained muted during the quarter. LTL sales growth of stores < 5 years was impressive at 19%. EBITDA margins at 5.7% decreased by 50 bps (YoY) despite improvement in gross margins (120 bps (YoY) (likely on account of higher apparel share) which were partially offset by significant increase in employee cost (growth of 29%YoY) and other operating expenses (up 80 bps YoY). We note that the lease charges remained flat on sequentially basis while the electricity expenses declined by 10% (QoQ). Inventory /sqft increased to Rs 720 as against Rs668 in Q4FY12. Apparels maintained healthy share of revenue mix at 60.3% as against 57.4% in Q4FY12. ASP increased by 8% YoY contributing to growth. Capex during the quarter was Rs337 mn. Hypercity Hypercity’s revenues grew by 7% YoY led by 11% SSS (adjusted for Ex-mobile) as against 6% SSS in Q4FY12 and 5% in Q3FY13. LTL volume was positive 3% after 4 consecutive quarters of decline. The business is realigned as the Mobile retiling business is now being run as the mobile store as a concessionaire. We highlight that during the quarter the total area under operation reduced from 1.23mnsqft to 1.15mn sqft would likely be on account of downsizing of its existing stores (possibly Amritsar store) Company has recorded Store level EBITDA positive from last 7 consecutive quarters at Rs 10.7mn and company level EBITDA loss stood at Rs85 mn driven by 9% (YoY) increase in Store operating expenses. The company incurred a loss of Rs219 mn during the quarter and we estimate that Rs219 mn of fresh capital was infused in the company during the period. We note that Hypercity’s loans from Under Review SHOP IN | CMP RS 373 Abhishek Ranganathan (+ 9122 6667 9952) abhishekr@phillipcapital.in Neha Garg (+ 9122 6667 9996) ngarg@phillipcapital.in Shareholders/group Rs835mn. companies have remain flat QoQ at Store additions The company opened 1 Home Stop, 1 MAC standalone, 1 Clinique and 1 Crossword stores during the quarter resulting in an addition of 0.05msf. During the quarter, company shifted 1 Jaipur shoppers stop store to new location Jaipur Trade Park. The total area under shoppers stop (standalone) is now at 3.39 msf and Hyper city at 1.15 msf. Hypercity’s Performance Q4FY1 Q3FY1 2 3 Particulars (Rs Mn) Retail Sales (Net of VAT) Gross Margin Gross Margin% DC Cost Damages / Others Net Margin Net Margin% Store Operating Expenses Other Retail Operating Income Store EBIDTA 1,637 346 21.2% 22 14 311 18.98 % 346 1,996 422 21.2% 26 Q4 FY13 YoY 1,757 369 21.0% 23 -12% -13% 8% 9 38% 337 9% -12% 1% 9% -1% -10% 52 42% 873 11 % -9% 10 386 19.30 % 19.20% 422 378 36 57 1 20 QoQ 7% 7% Store EBIDTA % to Sales 0.07% 1.00% 0.60% SO Expenses 95 93 96 1% COMPANY EBIDTA (94) (72) (85) -9% Exceptional Item Depreciation 43 82 53 23% Finance Charges 85 82 80 -6% PAT (222) (236) (219) -2% Source: Company, PhillipCapital India Research -14% -13% -48% 40.00 % 4% 18% -35% -2% -7% Standalone Performance _____________Standalone _____________ Rs Mn Income Gross Profit Q4FY12 5,863 1,928 Q4FY13 6,757 2,303 YoY Growth 15% 19% Commen ts Growth led by 10% LTL sales Gross Margin 32.9% 34.1% EBITDA 363 383 EBITDA Margin 6.2% 5.7% Depreciation 115 125 Interest 74 79 PBT 218 214 Tax 81 62 PAT 137 152 PAT Margin 2.3% 2.2% Source: Company, PhillipCapital India Research 5% 9% 6% -2% -23% 10% Balance sheet (Consolidated) (Rs Mn) EQUITY AND LIABILITIES SHAREHOLDERS' FUNDS Share capital Reserves and surplus Net Worth Minority Interest NON CURRENT LIABILITIES Long-term borrowings Deferred tax liabilities(net) Other long-term liabilities Total Non Current Liabilites CURRENT LIABILITIES Short-term borrowings Trade payables Other current liabilities Short-term provisions Total Current Liabilites Total ASSETS NON CURRENT ASSETS Total Fixed assets Goodwill on consolidation Non current investments Deferred tax assets (net) Long term loans and advances Other non-current assets Total Non Current Assets CURRENT ASSETS Inventories Trade Receivables Cash and cash equivalents Short term Loans and advances Other current assets Total Current Assets Total Mar-12 Mar-13 YOY 413 4,748 5,160 39 415 4,594 5,009 46 1% -3% -3% 16% 944 2 8 955 1,662 63 0 1,725 76% 2568% -98% 81% 2,883 3,198 1,729 100 7,909 14,064 3,044 3,814 1,619 113 8,591 15,371 6% 19% -6% 13% 9% 9% 6,481 987 0 0 2,155 54 9,678 6,740 987 0 2,396 92 10,215 4% 0% 0% -100% 11% 71% 6% 3,311 263 150 587 74 4,386 14,064 3,698 322 268 757 111 5,156 15,371 12% 22% 78% 29% 49% 18% 9% Source: Company, PhillipCapital India Research Balance sheet (Standalone) (Rs Mn) EQUITY AND LIABILITIES SHAREHOLDERS' FUNDS Share capital Reserves and surplus Net Worth NON CURRENT LIABILITIES Long-term borrowings Long-term provisions Total Non Current Liabilites CURRENT LIABILITIES Short-term borrowings Trade payables Other current liabilities Short-term provisions Total Current Liabilites Total Mar-12 Dec-12 Mar-13 413 414 6,172 6,436 6,585 6,851 350 2 352 475 101 576 415 6,523 6,938 YOY QoQ 1% 6% 5% 0% 1% 1% 1,125 221% 137% 63 2564% -38% 1,188 237% 106% 1,841 1,698 1,943 2,361 3,297 2,847 1,423 1,670 1,361 93 4 103 5,718 6,669 6,254 12,655 14,096 14,380 6% 14% 21% -14% -4% -18% 11% 2570% 9% -6% 14% 2% ASSETS NON CURRENT ASSETS Total Fixed assets 4,466 4,729 4,834 8% 2% Non current investments 2,842 3,182 3,309 16% 4% Long term loans and advances 2,503 2,763 2,754 10% 0% Other non-current assets 79 Total Non Current Assets 9,811 10,674 10,976 12% 3% CURRENT ASSETS Inventories 2,120 2,445 2,438 15% 0% Trade Receivables 192 241 204 6% -15% Cash and cash equivalents 71 65 117 64% 82% Short term Loans and advances 389 594 586 50% -1% Other current assets 71 78 59 -18% -25% Total Current Assets 2,844 3,422 3,403 20% -1% Total 12,655 14,096 14,380 14% 2% Source: Company, PhillipCapital India Research . – For additional reports visit Bloomberg, Thomson Analytics Regards, Abhishek Ranganathan, CFA Vice President Retail, Real Estate | Institutional Equity Research PhillipCapital (India) Private Limited No. 1, 2nd Floor, Modern Centre, 101 K.K. Marg, Jacob Circle, Mahalaxmi, Mumbai 400 011 Tel: +9122 6667 9952 (D), +9198204 98743 (M) abhishekr@phillipcapital.in | www.phillipcapital.in