Referred to Committee on

advertisement

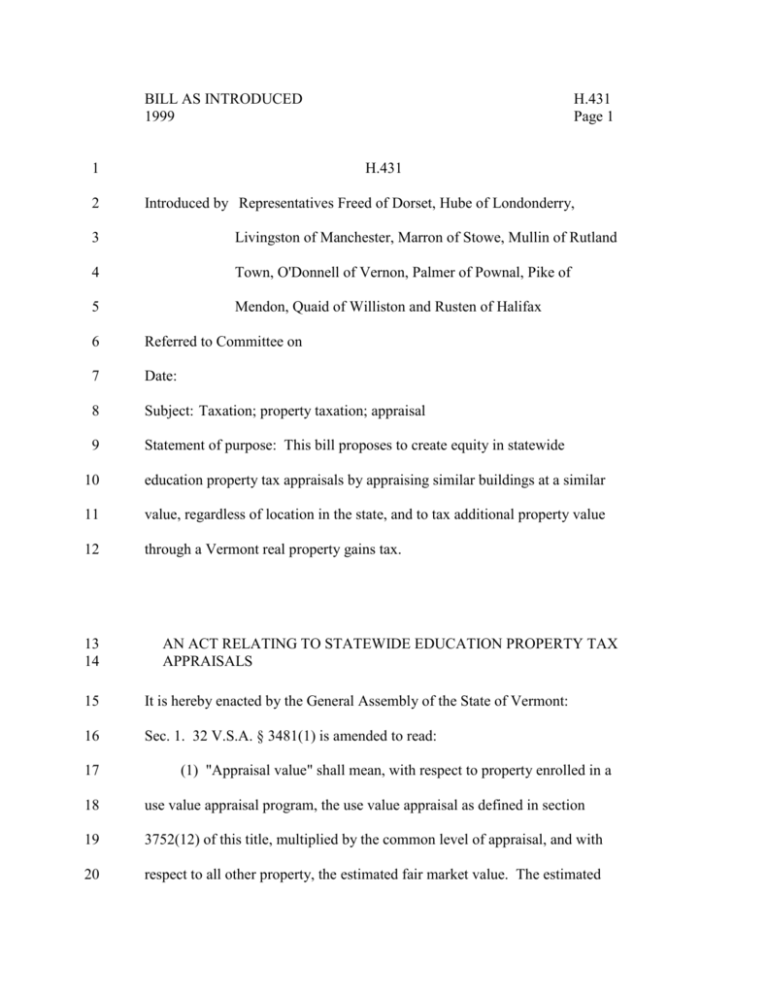

BILL AS INTRODUCED 1999 1 2 H.431 Page 1 H.431 Introduced by Representatives Freed of Dorset, Hube of Londonderry, 3 Livingston of Manchester, Marron of Stowe, Mullin of Rutland 4 Town, O'Donnell of Vernon, Palmer of Pownal, Pike of 5 Mendon, Quaid of Williston and Rusten of Halifax 6 Referred to Committee on 7 Date: 8 Subject: Taxation; property taxation; appraisal 9 Statement of purpose: This bill proposes to create equity in statewide 10 education property tax appraisals by appraising similar buildings at a similar 11 value, regardless of location in the state, and to tax additional property value 12 through a Vermont real property gains tax. 13 14 AN ACT RELATING TO STATEWIDE EDUCATION PROPERTY TAX APPRAISALS 15 It is hereby enacted by the General Assembly of the State of Vermont: 16 Sec. 1. 32 V.S.A. § 3481(1) is amended to read: 17 (1) "Appraisal value" shall mean, with respect to property enrolled in a 18 use value appraisal program, the use value appraisal as defined in section 19 3752(12) of this title, multiplied by the common level of appraisal, and with 20 respect to all other property, the estimated fair market value. The estimated BILL AS INTRODUCED 1999 H.431 Page 2 1 fair market value of a property is the price which the property will bring in the 2 market when offered for sale and purchased by another, taking into 3 consideration all the elements of the availability of the property, its use both 4 potential and prospective, any functional deficiencies, and all other elements 5 such as age and condition which combine to give property a market value. 6 Those elements shall include a consideration of a decrease in value due to a 7 housing subsidy covenant as defined in section 610 of Title 27, or the effect of 8 any state or local law or regulation affecting the use of land, including but not 9 limited to chapter 151 of Title 10 or any land capability plan established in 10 furtherance or implementation thereof, rules adopted by the state board of 11 health and any local or regional zoning ordinances or development plans. 12 except that, for purposes of the education property tax grand list under chapter 13 135 of this title, fair market value shall mean: 14 (A) For buildings, the replacement cost minus depreciation, based on 15 valuation and depreciation tables designated by the director of property 16 valuation and review. Such tables shall be subject to approval by the 17 legislative committee on administrative rules of the general assembly. 18 (B) For land, a uniform per acre value determined by the director of 19 property valuation and review, subject to approval by the legislative committee 20 on administrative rules of the general assembly, allowing for broad 21 classification of land values by use, including recreational, developable, forest, BILL AS INTRODUCED 1999 H.431 Page 3 1 agricultural, commercial and industrial uses; except that land eligible for 2 inclusion in a homestead owned by the occupant, as defined under subdivision 3 5961(1) of this title, shall have no value for purposes of this section. 4 Sec. 2. 32 V.S.A. chapter 235 is added to read: 5 6 7 8 9 CHAPTER 235. TAX ON REAL PROPERTY CAPITAL GAIN § 9901. TAX IMPOSED (a) There is imposed a tax of 10 percent on the gain from the sale or exchange of real property in Vermont. (b) “Gain,” as used in this chapter, shall mean the gain as realized under 10 federal tax law, except that the basis of the property as determined under 11 federal tax law shall be increased by three percent per year of the transferor's 12 ownership. 13 (c) The tax imposed under subsection (a) of this section shall be decreased 14 by 25 percent of the transferor's marginal federal income tax rate for the tax 15 year, multiplied by the amount of gain on the property taxable under federal 16 law in that tax year. 17 § 9902. ADMINISTRATION 18 Sections 10006 through 10010 of this title shall apply to real property 19 transfers under this chapter in the same manner in which they apply to transfers 20 of land in chapter 236 of this title.