Document

advertisement

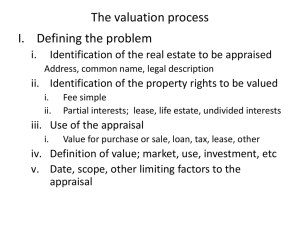

Presented to: CCCMAC 05/03/14 Research Valuation and Advisory Services Presented by: Cameron McAlpine, BA, AACI 1 Altus Group About Altus Five primary business units: – Research, Valuation and Advisory (Appraisals) – Cost Consulting & Project Management (Construction) – Realty Tax Consulting – Geomatics (Surveying) – ARGUS Software (Real Estate Financial Modeling) 3 International Scope 4 Altus Group Research, Valuation & Advisory (RVA) 13 offices across Canada and approx. 300 staff 80+ Accredited Appraisers 2 large offices in Ontario – Toronto and Ottawa covering all of the province Research services provided through Altus InSite Advisory services through Altus Economic Consulting Specialization by property type and service Largest database of sale and lease transactions in Canada Appraisal Management Expertise 5 Appraisals What is an Appraisal? “A formal opinion of value: prepared as a result of a retainer; intended for reliance by identified parties, and for which the appraiser assumes responsibility.” ( Definition, S6.2 of CUSPAP) 7 Appraisal Institute of Canada The Appraisal Institute of Canada acts as the governing body for appraisers in Canada The Appraisal Institute of Canada sets out guidelines for the required content of an appraisal report Each AIC member must follow a set of standards and code of conduct set out in the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP) Majority of financial institutions require appraisals signed by an AACI designated member for lending purposes. Website: www.aicanada.ca 8 Highlighted Key Elements Define the value of the property you are appraising – Go Dark Value – Insurable Replacement Cost – Market Value “The most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably and assuming the price is not affected by undue stimulus.” Definition of Market Value (CUSPAP) Effective date of an appraisal – Identifies the date as to which the valuation was concluded 9 Highlighted Key Elements Highest and Best Use – Properties are appraised as to their Highest and Best Use – Optimum use that is legally allowed and financially viable. Valuation Methodology – Cost Approach – Direct Comparison Approach – Income Approach 10 Approach to Value Approach to Value: Cost Approach: The Cost Approach involves adding the market value of the land to the depreciated value of the building and site improvements. Rarely used as it does not reflect market conditions. Direct Comparison Approach: In the Direct Comparison Approach, an opinion of value is developed by applying a comparative analysis of properties that are similar to the subject property that have recently sold, are listed for sale or are under contract, which focuses on the similarities and differences that affect value. 12 Example: Vacant Industrial Building 25,000 s.f. industrial building, used for warehouse storage. Well located in Markham, 10 years old, attractive office, good shipping and parking. Review of recent sales and listings show other vacant buildings have sold between $100 and $110 per square foot. Discussions with real estate agents active in the market reveal good demand for industrial buildings. Overall, a value of $110 p.s.f. was selected. Building value of $2,750,000. 13 Approach to Value: Income Approach: The Income Approach is typically used as the primary method of valuation when a property is expected to be acquired by an investor Two primary income valuation procedures are: Direct Capitalization Discounted Cash Flow (DCF) 14 Approach to Value: Direct Capitalization: – This procedure involves dividing stabilized annual net income by a singular rate that takes into account all of the comparative investment characteristics of the property. – Cap Rate derived from sales of comparable investment properties. Discounted Cash Flow (DCF): – The Discounted Cash Flow Procedure calculates the present value of the future cash flows over a specified time period, including the potential proceeds of a deemed disposition, to determine market value. 15 Value Equation I (Income) V = (Value) R (Capitalization Rate) 16 4 Key Elements to Income Value 4 Main Elements to Income Value 1. Level of Occupancy Leased vs. Vacant 2. Level of Income Relationship to market rent for the space 3. Duration of Income Length of the lease term(s) 4. Quality of Income Who is/are the tenant(s) securing the income 18 Example – Investment Scenario Small, 5 unit retail plaza (15,000 sq. ft.). Fully leased, generates $255,000 per year in income. Rents are close to market levels. Lease terms are all about 4 years long. Local businesses with only limited operating histories. Research determined comparable properties sell for 6.50% to 7.00% capitalization range. Overall, a 6.75% cap rate was determined to be appropriate. Value concluded at $3,780,000 ($250 per square foot). 19 Different Asset Classes Multi Residential – Other Key Factors Location – Access to employment, transportation and amenities In place rents within building – Rent control can limit upside potential Demographic profile of the neighbourhood – Investors prefer neighbourhoods that offer potential income growth Gross Rents – Operating costs and realty taxes efficiencies fall directly to the bottom line 21 Office – Other Key Factors Location Location Location Strength of surrounding office node is a key value driver Vacancy levels and trends New Inventory 22 Retail – Other Key Factors Location/visibility to a good flow of traffic Sales volumes Presence of anchor tenants to attract customer traffic Percentage rent clauses (Participation Rent) 23 Industrial – Other Key Factors Functionality of building Adaptability of uses 24 DISCUSSION 2525