12 KW 12th ed Intangible Assets

advertisement

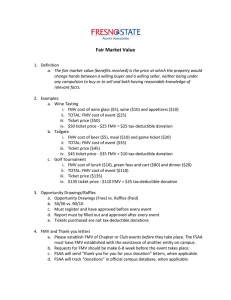

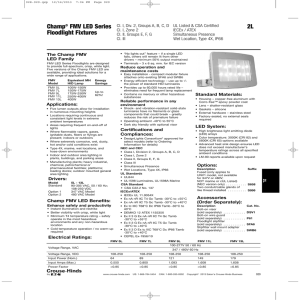

chapter 12 Intangible Assets Keiso Weygandt twelfth edition Lack physical substance not financial instruments Trademarks or tradenames Copyright Franchise Patent indefinite number of renewals for 10 years each life of the creator plus 70 years 20 years Exercise 12-3 Purchased intangibles are recorded at cost the fair market value of what is given up of what is received whichever is more clearly evident internally created intangibles - generally the costs are expensed as incurred Review material on impairment on pages 534-37 Exercise 12-7 &12-11(3) 1) recoverability test net future cash flows, including disposal, exceed the carrying value 2) calculate loss carrying value less FMV or carrying value less the present value of net future cash flows the difference between writing down the cost of an asset and adjustments indefinite life not amortized test for impairment annually but skip the recoverability test go directly to CV v FMV limited life amortize the cost over the expected useful life related assets may limit the useful life legal or regulatory test for impairment recoverability test CV v FMV Trademarks or tradenames indefinite number of renewals for 10 years each Company names purchased purchase cost internal attorney fees, registration fees, design costs, consulting fees, cost of successful legal defense Copyright life of the creator plus 70 years purchased purchase cost internal cost of successful legal defense Franchise Patent 20 years purchased purchase cost internal cost of successful legal defense R&D must be expensed Goodwill Exercise 12-12 & Problem 12-5 excess of price paid over the FMV of the identifiable assets negative goodwill / badwill / bargain purchase p 583 Impairment of Goodwill special case 1) does CV of the business that was purchased exceed the FMV yes / no 2) use the FMV of the net identifiable assets to determine the implied Good will if CV of Goodwill exceeds the implied value write down the Goodwill Research and Development expense Exercise 12-17 Materials, equipment & facilities, purchased intangibles capitalize if it has alternate uses Personnel contract services don't allocate G&A overhead to inflate R&D expense Start up costs Initial operating losses Advertising costs expense as incurred loss expense Appendix A Software costs internal use - software developed for internal use prior to the "application development" stage after the "application development" stage Exercise 12-19 expense capitalize external use - software developed to be sold prior to "technological feasibility" expense all costs to R&D unless they have alternate uses "technologically feasible" when working model detailed program design after "technologically feasible" capitalize Amortization the greater of 1) straight line 2) ratio of ( current revenue / anticipated total revenues )

![Quiz chpt 12 13 Fall 2009[1].doc](http://s3.studylib.net/store/data/008065145_1-9341d7c32393454ecadd4d67922dfd05-300x300.png)