Objectives Chapter 12

advertisement

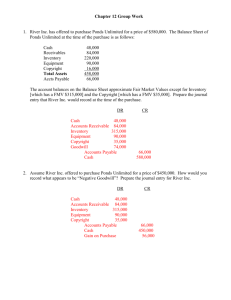

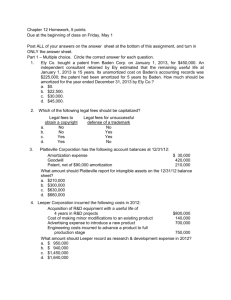

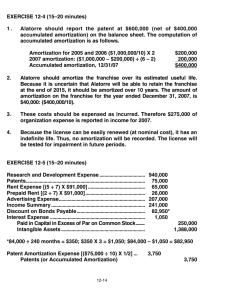

Objectives Chapter 12 • You should be able to – – – – – – – – Explain valuation and amortization of intangible assets Distinguish between amortization, expensing, and impairment Categorize specifically identifiable intangible assets Calculate and record goodwill and assign the cost of purchased goodwill to periods which benefit from it Define and identify research and development costs Account for R&D under US GAAP, identify the date of technological feasibility, and categorize In-Process-R&D Account for R&D under IFRS, capitalize development expenditures Describe the presentation of intangibles and related items What is an Intangible Asset? Definition: Types: Capitalized Intangible Assets Valuation Amortization E12-1 (Classification Issues – Intangibles) 1. Investment in a subsidiary company 2. Timberland. 3. Cost of engineering activity required to advance the design of a product to the manufacturing stage. 4. Lease prepayment (6 months’ rent paid in advance). 5. Cost of equipment obtained. 6. Costs of searching for applications of new research findings. 7. Costs incurred in the formation of a corporation. 8. Operating losses incurred in the start-up of a business. 9. Training costs incurred in start-up of new operation. 10. Purchase cost of a franchise. 11. Goodwill generated internally. 12. Cost of testing in search for product alternatives. 13. Goodwill acquired in the purchase of a business. 14. Cost of developing a patent. 15. Cost of purchasing a patent from an inventor. 16. Legal costs incurred in securing a patent. 17. Unrecovered costs of a successful legal suit to protect the patent. 18. Cost of conceptual formulation of possible product alternatives. 19. Cost of purchasing a copyright. 20. Research and development costs. 21. Long-term receivables. 22. Cost of developing a trademark. 23. Cost of purchasing a trademark. E12-4 Intangible Amortization 1. Corp. purchased patent for $1,000,000 on 1.1.12, remaining legal life 10 years, expiring on 1.1.22. During 2014, Corp. determines patent’s economic benefits not longer than 6 years from date of acquisition. What is Balance sheet amount net of accumulated amortization at 12.31.14? 2. Corp. bought franchise on 1.1.13 for $400,000. Previous corp.’s carrying value $500,000 and had a estimated useful life of 30 years. Because Corp. must enter a competitive bidding at end of 2015, it is unlikely that the franchise will be retained beyond 2022. What amount should be amortized for the year ended 12.31.2014? 3. On 1.1.14 Corporation incurred organization costs of $275,000. What amount of organization expense should be reported in 2014? 4. Corporation purchased the license for distribution of a popular product on 1.1.14 for $150,000. Product expected to generate cash flows for an indefinite period of time. The license has an initial term of 5 years but by paying a nominal fee, Corp. can renew the license indefinitely for successive 5 year terms. What amount should be amortized for the year ended 12.31.14? E12-6 (Recording and Amortization of Tangibles) Company, organized in 2013, has set up a single account for all intangible assets. Debit entries that have been recorded during 2014: 1/2 Purchased patent (8-year life) $350,000 4/1 Purchased Goodwill (indefinite life) 360,000 7/1 Purchased franchise w/ 10-year life; (exp. 7/24) 450,000 8/1 Payment for copyright (5-year life) 156,000 9/1 Research and development costs 215,000 $1,531,000 Journal Entries: E12-7 Accounting for Trade Name In early 2013 Corporation applied for a trade name, incurring legal costs of $16,000. In January 2014, Corporation incurred legal fees in a successful defense of its trade name. a. Compute 2013 amortization, 12.31.13 book value, 2014 amortization, and 12.31.14 book value if amortize name over 10 years. b. Compute the 2014 amortization and book value assuming that at the beginning of 2014 corporation determines that the trade name will provide no future benefits beyond 12.31.17. c. Ignore b., compute 2015 amortization and 12.31.15 book value, assuming that at the beginning of 2015, based on new market research, corporation determines FMV of trade name is $15,000. Estimated future cash flows from trade name is $16,000 on 1.3.15. E12-10 Accounting for Patents During 2010 Corp. spent $170,000 in R&D costs. As a result a new product was patented. The patent was obtained 10.1.10 and had a legal life of 30 years and a useful life of 10 years. Legal costs of $18,000 related to the patent were incurred as of 10.1.10. a. Prepare required JE for 2010 and 2011. b. On 6.1.12, $9,480 was spent to successfully prosecute a patent infringement suit. Estimated useful life was extended to 12 years from 6.1.12. Prepare all required JE for 2012 and 2013. c. In 2014, determined a competitor’s product makes patent worthless by 12.31.15. Prepare all required JE for 2014 and 2015. Goodwill Only recorded when purchased, not when generated internally If net assets purchased, Goodwill = Purchase Price – ΣFMV (net assets), recorded with the other assets & the liabilities on the acquirer’s books. If stock > 20% but < 50% purchased, Goodwill is buried in the investment in affiliate account If stock > 50% purchased, Goodwill is reported on the consolidated balance sheet E12-13 (Accounting for Goodwill) On 7/1/2014, B Corp. purchased Y Company by paying $250,000 cash and issuing a $100,000 note payable. At 7/1/2014, the balance sheet of Y Company was: Cash Receivables Inventory Land Buildings (net) Equipment (net) Trademarks $ 50,000 90,000 100,000 40,000 75,000 70,000 10,000 $435,000 Accounts payable Stockholders’ equity $200,000 235,000 $435,000 BV = MV except land (FMV=$60,000), inventory (FMV=$125,000), trademarks (FMV=$15,000). (a) Prepare the July 1 entry for B Corp. to record the purchase. (b) Prepare the 12/31 entry for amortization of intangibles. The trademark has an estimated useful life of 4 years with a residual value of $3,000. Goodwill Impairment Goodwill only has value as part of net assets Cashflows projected from net assets imply a value for the going concern Goodwill must be written off completely before net assets are written down, so impairment loss is only on GW As of 12/15/2011: Goodwill impairment follows “assessment of qualitative factors” rather than required annual impairment testing => Goodwill impairment needs a “triggering event” just like PPE impairments Example: Ex 12-15 E12-15 (Goodwill Impairment) Net assets of the C Division of Santana, Inc. C Division Net Assets at 12/3/14 (in millions) Cash Receivable Property, plant, and equipment (net) Goodwill Less: Notes Payable Net assets $ 50 200 2,600 200 (2,700) $350 C Division develops nuclear-powered aircraft. If successful, traveling delays associated with refueling could be substantially reduced. To date, management has not had much success and is deciding whether to impair (what is the triggering event?). Estimated future net cash flows $400 million. Management has also received an offer to purchase the division for $335 million. All identifiable assets’ and liabilities’ NBV=FMV. (a) Journal entry (if any) to record the impairment at 12/31/14. (b) At 12/31/15 the division’s FMV is $345 million. JE (if any) to record this increase in fair value. Research & Development Costs US GAAP vs. IFRS Research Development Technological Feasibility IPR&D 1) R & D Activities a) Laboratory research aimed at discovery of new knowledge. b) Searching for applications of new research findings. c) Conceptual formulation and design of possible product of process alternatives. d) Testing in search for or evaluation of product or process alternatives. e) Modification of the design of a product or process. f) Design, construction, and testing of preproduction prototypes and models. g) Design of tools, jugs, molds, and dies involving new technology. h) Design, construction, and operation of a pilot plant not useful for commercial production. i) Engineering activity required to advance the design of a product to the manufacturing stage. 2) Activities Not Considered R & D a) Engineering follow-through in an early phase of commercial production. b) Quality control during commercial production including routine testing. c) Trouble-shooting breakdowns during production. d) Routine, n-going efforts to refine, enrich, or improve the qualities of an existing product. e) Adoption of an existing capability to a particular requirement or customer’s need. f) Periodic design changes to existing products. g) Routine design of tools, jigs, molds, and dies. h) Activity, including design and construction engineering related to the construction, relocation, re-arrangement, or start-up of facilities or equipment. i) Legal work on patent applications, sale, licensing, or litigation. E12-16 (Accounting for R & D) In 2013 Co. spends $325,000 on a research project, but by 12/31/2013 it is unclear whether any benefit will be derived from it. (a) What account should be charged for the $325,000, and how should it be shown in the financial statements? (b) The project is completed and patented in 2014. The R&D to complete is $110,000. The administrative and legal expenses in 2014 total $16,000. Expected useful life of 5 years. JEs (including full year amortization) in 2014? (c) In 2015, the company defends the patent with legal costs of $47,200, extending the patent life to 12/31/22. JEs (including amortization) in 2015? (d) Additional engineering and consulting costs incurred in 2015 required to advance the design of a product to the manufacturing stage total $60,000. Proper accounting treatment?