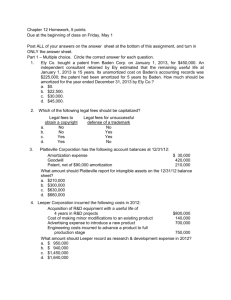

Chapter 12

advertisement

CHAPTER 12 Intangible Assets ……..…………………………………………………………... Valuation Purchased – recorded as an asset at cost Internally-created most costs are expensed – valuation is too subjective to capitalize legal costs to obtain the intangible may be capitalized Amortization Limited life intangibles limited through legal or contractual provisions, obsolescence, competition amortized Indefinite life not amortized the “40-year “ rule has been dropped! Types of Intangible Assets 1) Marketing-related intangibles: eg. Trademark capitalize design and registration fees indefinite life 2) Customer-related intangibles: eg. Customer list capitalize acquisition costs 3) Artistic-related intangibles: eg. Copyright capitalize costs to acquire and defend amortize over useful life 4) Contract-related intangibles: eg. Franchise initial cost amortized if life is limited annual payments are not capitalized 5) Technology-related intangibles: eg. Patent R&D related to the development of a product or process is not capitalized patent costs are amortized over legal or useful life 6) Goodwill Goodwill Recognizing goodwill when an entire business is purchased excess of cost over fair value of identifiable assets Write-off of goodwill indefinite life: do not amortize record decrease in value if goodwill becomes impaired Negative goodwill fair value of assets is greater than cost recorded as an extraordinary gain Exercise 12-1 1. Investment in subsidiary 2. Timberland 3. Pre-manuf. engineering 4. Lease prepayment 5. Equipment 6. Search of research 7. Start-up costs 8. Oper. losses during start-up 9. Training during start-up 10. Cost of franchise 11. Goodwill made internally 12. Testing for new products 13. Goodwill: purch of business 14. Patent development 15. Patent purchase 16. Legal costs to acquire patent 17. Legal costs to defend patent 18. Product formulation 19. Copyright purchase 20. R&D costs 21. Long-term receivables 22. Trademark development IMPAIRMENT OF INTANGIBLE ASSETS Limited-Life Intangibles Rules for long-lived assets apply (Chapter 11) 1. Recoverability test for impairment future net cash flows (undiscounted) < carrying value 2. If impaired, calculate the amount of the loss. carrying value - fair value of the asset 3. Entry: Loss on Impairment Patents 150,000 150,000 Indefinite-Life Intangibles Other than Goodwill Test for impairment at least annually 1. Fair value test for impairment fair value of the asset < carrying value 2. If impaired, record the difference as a loss. (as with limited-life intangibles) Goodwill Test for impairment is a two-step process 1. Fair value test on the reporting unit fair value of the unit < carrying value Cash & Receiv. PP&E Goodwill Less: Notes Payable Value of unit Carrying Value $ 1,050 8,700 2,100 (950) $10,900 Fair Value $10,000 Perhaps based on expected net cash flows. 2. Fair value test of goodwill fair value of goodwill < carrying value Cash & Receiv. PP&E Less: Notes Payable Identifiable Assets Goodwill Value of Unit 3. Entry: Carrying Value $ 1,050 8,700 (950) $ 8,800 2,100 $10,900 Fair Value $ 1,050 8,400 (950) $ 8,500 ? $10,000 R&D AND SIMILAR COSTS R&D R: search for new knowledge D: translate into new or significantly improved product does not include routine alternatives to existing products Accounting for R&D charge to expense when incurred assets may be capitalized & depreciated if they have alternative future uses R&D includes reasonable indirect costs Start-up costs expensed as incurred assets are capitalized Initial operating losses reported like any other operating losses Advertising costs expensed as incurred or the first time the advertising takes place Computer software costs PRESENTATION Balance Sheet Intangible assets (Note C) Goodwill (Note D) $3,840 2,575 Grouped into two categories Contra accounts not shown. Notes Detail on types of intangible assets. Estimated amortization for next 5 years. Changes in value of goodwill. Income Statement Included in continuing operations: R&D expenses (disclosed separately) Amortization expense Intangible impairment losses Goodwill impairment losses (unless the operating unit is discontinued.)