Slides

advertisement

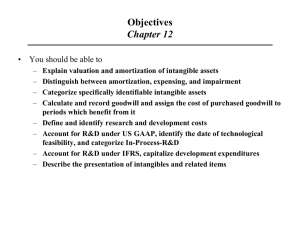

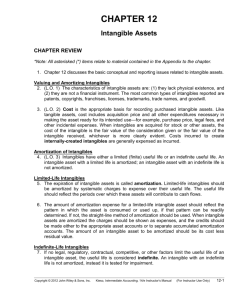

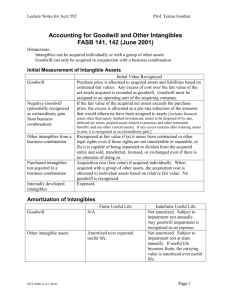

CHAPTER 12 INTANGIBLE ASSETS Sommers – ACCT 3311 Discussion Questions Q12-1 What are the two main characteristics of intangible assets? Normally classified as long-term asset. Common types of intangibles: Patents Trademarks or trade names Copyrights Goodwill Franchises or licenses Valuation of Intangibles Purchased Intangibles: Recorded at cost. Includes all costs necessary to make the intangible asset ready for its intended use. Typical costs include: ► Purchase price. ► Legal fees. ► Other incidental expenses. Internally Created Intangibles: Generally expensed. Only capitalize direct costs incurred in developing the intangible, such as legal costs. Example 1: Acquisition of Intangibles Freitas Corporation was organized early in 2011. The following expenditures were made during the first few months of the year: Attorneys’ fees in connection with the organization of the corporation $ 12,000 State filing fees and other incorporation costs 3,000 Purchase of a patent 20,000 Legal and other fees for transfer of the patent 2,000 Purchase of furniture 30,000 Pre-opening salaries 40,000 Total $107,000 Prepare a summary journal entry to record the $107,000 in cash expenditures. Example 1: Continued Discussion Questions Q12-2 If intangibles are acquired for stock, how is the cost of the intangible determined? Amortization of Intangibles Limited-Life Intangibles: Amortize by systematic charge to expense over useful life. Credit asset account for amortization. Useful life should reflect the periods over which the asset will contribute to cash flows. Amortization should be cost less residual value. Indefinite-Life Intangibles: No foreseeable limit on time the asset is expected to provide cash flows. No amortization. Must test indefinite-life intangibles for impairment at least annually. Example 2: Amortization Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $700,000 on January 1, 2009. Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou’s accounting records at a net book value of $350,000 when Lou sold it to Janes. b. During 2011, a franchise was purchased from the Rink Company for $500,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. Prepare the entries necessary in 2009 and 2011 to reflect the above information. Also, prepare a schedule showing the intangible asset section of Janes’ December 31, 2011, balance sheet. Example 2: Continued Example 3: Amortization & Defense On January 2, 2011, David Corporation purchased a patent for $500,000. The remaining legal life is 12 years, but the company estimated that the patent will be useful only for eight years. In January 2013, the company incurred legal fees of $45,000 in successfully defending a patent infringement suit. The successful defense did not change the company’s estimate of useful life. Prepare journal entries related to the patent for 2011, 2012, and 2013. Example 3: Continued Example 3: Continued Calculation of revised annual amortization: December 31, 2013 Discussion Questions Q12-12 What is goodwill? Discussion Questions Q12-12 What is negative goodwill? Goodwill Conceptually, represents the future economic benefits arising from the other assets acquired in a business combination that are not individually identified and separately recognized. Only recorded when an entire business is purchased. Goodwill is measured as the excess of ... cost of the purchase over the FMV of the identifiable net assets purchased. Internally created goodwill should not be capitalized. Example 4: Goodwill on Purchase Global Corporation purchased the net assets of Local Company for $300,000 on December 31, 2012. The balance sheet of Local Company just prior to acquisition is: Assets Cash Receivables Inventories Equipment Total Liabilities and Equities Accounts payable Common stock Retained earnings Total $ $ $ $ Cost 15,000 10,000 50,000 80,000 155,000 25,000 100,000 30,000 155,000 $ FMV 15,000 10,000 70,000 130,000 225,000 $ 25,000 $ 25,000 $ FMV of Net Assets = $200,000 Example 4: Continued Global Corporation purchased the net assets of Local Company for $300,000 on December 31, 2012. The value assigned to goodwill is determined as follows: Book Value = $130,000 Revaluation $70,000 Fair Value = $200,000 Goodwill $100,000 Purchase Price = $300,000 Example 4: Continued Global Corporation purchased the net assets of Local Company for $300,000 on December 31, 2012. The value assigned to goodwill is determined as follows: Calculation of Goodwill: Cash $ 15,000 Receivables 10,000 Inventories 70,000 Equipment 130,000 Accounts payable (25,000) FMV of identifiable net assets 200,000 Purchase price 300,000 Goodwill $ 100,000 Example 4: Continued Global Corporation purchased the net assets of Local Company for $300,000 on December 31, 2012. Prepare the journal entry to record the purchase of the net assets of Local. Journal entry recorded by Global: Cash 15,000 Receivables 10,000 Inventory 70,000 Equipment 130,000 Goodwill 100,000 Accounts payable Cash 25,000 300,000 Example 5: Goodwill on Purchase Johnson Corporation purchased all of the outstanding common stock of Smith Corporation for $11,000,000 in cash. The book value of Smith’s net assets (assets minus liabilities) was $7,800,000. The fair values of all of Smith’s assets and liabilities were equal to their book values with the following exceptions: Book Value Fair Value Receivables $1,300,000 $1,100,000 Property, plant, & equipment 8,000,000 9,400,000 Intangible assets 200,000 1,200,000 Calculate the amount paid for goodwill. Example 5: Continued Other goodwill Issues Goodwill Write-off Goodwill considered to have an indefinite life. Should not be amortized. Only adjust carrying value when goodwill is impaired (next time). Bargain Purchase Purchase price less than the fair value of net assets acquired. Amount is recorded as a gain by the purchaser. Example 6: Amortization The following information concerns the intangible assets of Epstein Corporation: a. On June 30, 2011, Epstein completed the purchase of the Johnstone Corporation for $2,000,000 in cash. The fair value of the net identifiable assets of Johnstone was $1,700,000. b. Included in the assets purchased from Johnstone was a patent that was valued at $80,000. The remaining legal life of the patent was 13 years, but Epstein believes that the patent will only be useful for another eight years. c. Epstein acquired a franchise on October 1, 2011, by paying an initial franchise fee of $300,000. The contractual life of the franchise is 10 years. Prepare year-end adjusting journal entries to record amortization expense on the intangibles at December 31, 2011. Also, prepare the intangible asset section of the December 31, 2011 balance sheet. Example 6: Continued Comprehensive Problem