written

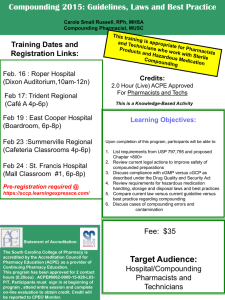

advertisement

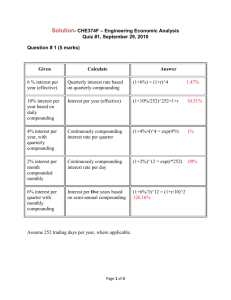

Assignment 1 Solutions Summer 2001 Question 1 In 1851 an ancestor of yours made a chair that he sold for $3.50. In 2001 that piece of furniture is now worth $7,500 to a collector. What would be the holding period return on this chair if it had been held for the entire time? What would this be on an effective annual basis? Holding Period Return = (FV - PV) / PV x 100% =214,186% Effective Annual Rate =(1+HPR)^(1/150) - 1 or =(FV/PV) ^(1/150) - 1 =5.25% Assignment 1 Solutions Summer 2001 Question 2 Rank the following rates from highest to lowest effective annual rate; 19% with annual compounding, 18.75% with semi-annual compounding, 18% APR, with monthly compounding, and 17.5% with continuous compounding. Step 1: convert all rates into EAR. 19% with annual compounding = 19% EAR 18.75% with semi-annual compounding = (1 + 0.1875/2)^2 - 1 = 19.63% 18% APR, with monthly compounding = (1 + 0.18/12)^12 - 1 = 19.56% 17.5% with continuous compounding = FVIFA(17.5%,1) - 1 = e^0.175 - 1 = 19.12% Step 2: rank from highest to lowest. 1. 18.75% with semi-annual compounding 2. 18% APR, with monthly compounding 3. 17.5% with continuous compounding 4. 19% with annual compounding Assignment 1 Solutions Summer 2001 Question 3 The grand prize of a lottery promises to pay the winner $1,000 per week for the rest of their life. How much is this prize worth if the appropriate effective annual discount rate is 6% and the winner is expected to live for 30 years after winning? What if the winner was younger and expected to live for 45 years? Step 1: find weekly discount rate. rw = (1 + 0.06)^(1/52) - 1 rw = 0.001121184 Step 2: find PV for 30 x 52 week annuity PV = $1,000 x PVIFA(0.001121184, 1560) PV = $1,000 x (1 - 1/(1 + r)^n)/r PV = $736,622.96 Step 3: find PV for 45 x 52 week annuity PV = $1,000 x PVIFA(0.001121184, 2340) PV = $1,000 x (1 - 1/(1 + r)^n)/r PV = $827,116.64 Assignment 1 Solutions Summer 2001 Question 4 To settle a debt of $449.98, a friend of yours has offered to pay you $39.98 per month for a year. What rate of interest is implied by these repayment terms on an APR and effective annual basis? Since this is a 12-th order polynomial if we try to solve it algebraically, we will use trial and error (or spreadsheet) to find the appropriate monthly discount rate. Find the PV of the annuity payments at rm = 0.5% PV = $39.98 x (1 - 1/(1 + r)^n)/r = $464.62 This is too high so raise the discount to 1.5% PV = $39.98 x (1 - 1/(1 + r)^n)/r = $436.08 This is too low, raise the discount rate to 1.0% PV = $39.98 x (1 - 1/(1 + r)^n)/r = $449.98 This is the correct amount. If using solver or goal seek, rm = 0.999929594265684% Convert to APR = 1% x 12 = 12% Convert to EAR = 1.01^12 -1 = 12.68%