Word Wall Recall Interest: Simple vs. Compound Note Practice

advertisement

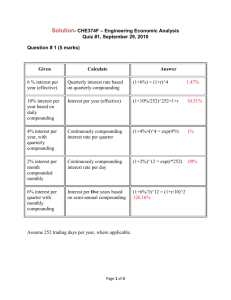

Today's Plan ­ Monday, May 9, 2011 ­ Word Wall ­ Recall Interest: Simple vs. Compound Note ­ Practice Today's Learning Goals By the end of class today students will: ­ Understand the difference between the Simple and Compounding Interest formulas for calculating a future value ­ Use the formulas to find future values ** Interest Quiz: Thursday ** 1 Word Wall From the list of words at the start of chapter 7 (pg 405) Choose one word/phrase to illustrate. Complete word wall entries contain: 1. The word/phrase 2. The definition (found in the chapter or the back of the book) 3. An illustration/calculation to demonstrate the meaning This is for a bonus mark on Thursday's quiz Another option: write all definitions and submit for bonus 2 Compound Interest: A Review Simple Interest vs. Compound Interest I = Prt A = P(1+i)n I = amount of interest P = principal r = annual rate t = time in years A = total amount P = principal i = interest rate per compounding period n = total number of compounding periods ­ interest is totaled and paid at the end ­ interest is added in at every compounding period ­ total amount grows much faster ­ graph is exponential 3 Compounding Periods Rate: is usually given as an annual rate Time: is usually given in years, if it isn't then change to years Compounding: Means: To find i: annually 1 time a year use interest rate use # of years semi­annually 2 times a year rate / 2 years x 2 quarterly 4 times a year rate / 4 years x 4 monthly 12 times a year rate / 12 years x 12 bi­monthly 6 times a year years x 6 weekly 52 times a year rate / 52 years x 52 bi­weekly 26 times a year rate / 26 years x 26 daily 365 times a year rate / 365 years x 365 rate / 6 To find n: 4 Future Value: NPin ­ we use this acronym to stand for finding the future value of the investment/loan N = # of compounding periods (ex. quarterly, N=4) P = starting amount (principal) i = interest rate per compounding period n = total # of compounding periods A = final amount 5 ex. Joel gets $1000 for graduation and wants to invest it for 5 years. He finds an investment option with an annual interest rate of 3.5% if he leaves the money locked in for 5 years. How much will he have after the investment is up? 6 Practice: Pg 406 #1,2,3 7