Why Your Bank Hopes You Can't Tell The Difference

Name_________________________ Block________ Date_______________

APR and APY: Why Your Bank Hopes You Can't Tell The Difference

It is often purported that Albert Einstein referred to compound interest as the greatest force on earth. Strong words from one of the smartest men to ever live. Although this article's intention is not to ponder Einstein's most compelling views, we do intend to demonstrate the importance of understanding the difference between annual percentage rate (APR) and annual percentage yield (APY). For most people, these terms are applied to loans and investment products, but they are not created equal and they significantly affect how much you earn or must pay in these transactions.

What Is Compounding?

At its most basic, compounding refers to earning interest on previous interest. All investors want to maximize compounding on their investments, while at the same time minimize it on their loans.

Compounding is especially important in our APR vs. APY discussion because many financial institutions have a sneaky way of quoting interest rates that use compounding principles to their advantage. Being financially literate in this area will help you spot which interest rate you are really getting.

Defining APR and APY

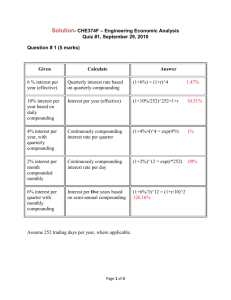

APR is the annual rate of interest without taking into account the compounding of interest within that year. Alternatively, APY does take into account the effects of intra-year compounding. This seemingly subtle difference can have important implications for investors and borrowers. Here is a look at the formulas for each method:

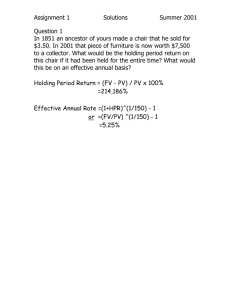

For example, a credit card company might charge 1% interest each month; therefore, the

APR would equal 12% (1% x 12 months = 12%). This differs from APY, which takes into account compound interest. The APY for a 1% rate of interest compounded monthly would be 12.68% [(1 + 0.01)^12 – 1= 12.68%] a year. If you only carry a balance on your credit card for one month's period you will be charged the equivalent yearly rate of 12%.

However, if you carry that balance for the year, your effective interest rate becomes

12.68% as a result of compounding each month.

The Borrower's Perspective

As a borrower, you are always searching for the lowest possible rate. When looking at the difference between APR and APY, you need to be worried about how a loan might be

"disguised" as having a lower rate.

For example, when looking for a mortgage you are likely to choose a lender that offers the lowest rate. Although the quoted rates appear low, you could end up paying more for a loan than you originally anticipated.

This is because banks will often quote you the annual percentage rate (APR). As we learned earlier, this figure does not take into account any intra-year compounding either semi-annual (every six months), quarterly (every three months), or monthly (12 times per year) compounding of the loan. The APR is simply the periodic rate of interest multiplied by the number of periods in the year. This may be a little confusing at first, so let's look at an example to solidify the concept:

As you can see, even though a bank may have quoted you a rate of 5%, 7%, or 9% depending on the frequency of compounding (this may differ depending on the bank, state, country, etc), you could actually pay a much higher rate. In the case of a bank quoting an APR of 9%, this does not consider the effects of compounding. However, if you were to consider the effects of monthly compounding, as APY does, you will pay 0.38% more on your loan each year - a significant amount when you are amortizing your loan over a 25- or 30-year period.

This example should illustrate the importance of asking your potential lender what rate he or she is quoting when seeking a loan. It is also important when comparing borrowing prospects to compare "apples to apples" so to speak (comparing the same figures), so that you can make the most informed decision.

The Lender's Perspective

Now as you may have already guessed, it is not hard to see how standing on the other side of the lending tree can affect your results in an equally significant fashion, and how banks and other institutions will often entice individuals by quoting APY. Just as individuals who are seeking loans want to pay the lowest possible rate of interest, the same individual wants to receive the highest rate of interest when they themselves are the lender.

For example, suppose that you are shopping around for a bank to open a savings account with; obviously, you are seeking the highest rate of interest. It is in the bank's best interest to quote you the APY, as opposed to the APR. They want to quote the highest possible rate they can to entice you with to their bank. They are much less likely to quote you the APR because this rate is lower than the APY given that there is some compounding during the year.

Again, it is important for the individual to acknowledge the distinction between these two rates, because they can significantly affect that amount of interest that can be accumulated in a savings account.

It should be noted that different countries have different rules and regulations in place to combat some of the unscrupulous activity surrounding quoting rates that has arisen in the past; however, there is no better insulator against these ruses than knowledge.

Summary

Whether you are shopping for a loan or seeking the highest rate of return on a savings account, be mindful of the different rates that a bank or institution quotes. Depending on which side of the lending tree you stand on, banks and institutions have different motives for quoting different rates. Always ensure you understand which rates they are quoting and then compare the equivalent rates between alternatives.

Source: http://www.investopedia.com/articles/basics/04/102904.asp

Homework: Due 12/7/15

1) Read and take directed notes on the article

2) Create a PowerPoint (or Google Slides Presentation) explaining the similarities and differences between APY & APY

Minimum 4 slides