Chapter12Review

advertisement

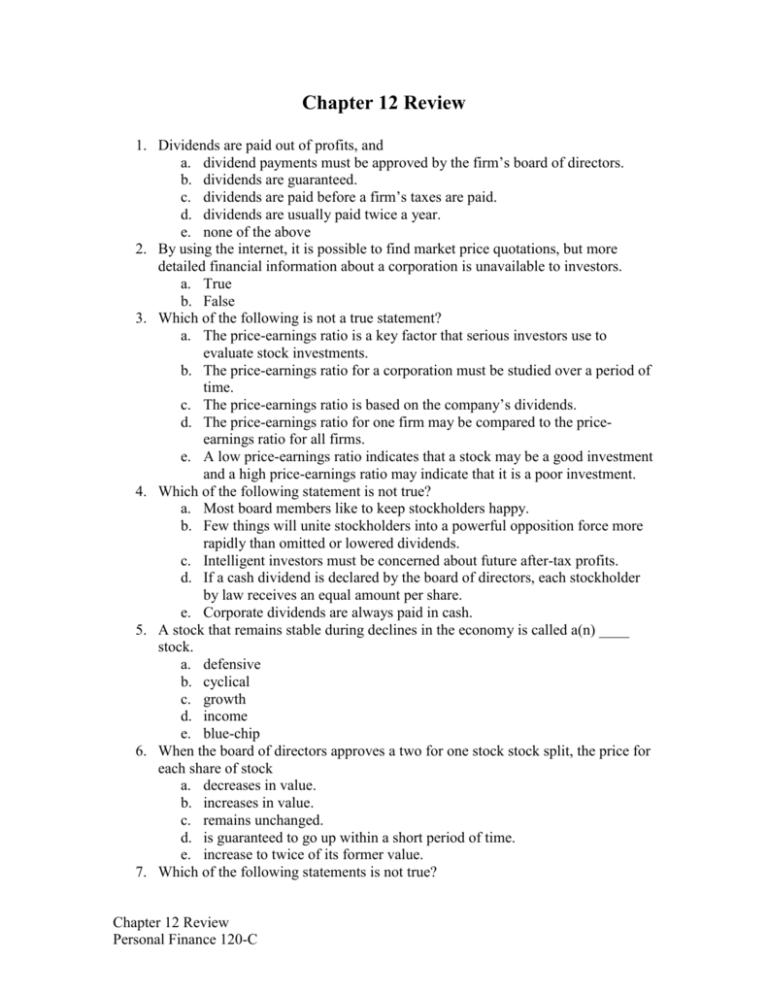

Chapter 12 Review 1. Dividends are paid out of profits, and a. dividend payments must be approved by the firm’s board of directors. b. dividends are guaranteed. c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possible to find market price quotations, but more detailed financial information about a corporation is unavailable to investors. a. True b. False 3. Which of the following is not a true statement? a. The price-earnings ratio is a key factor that serious investors use to evaluate stock investments. b. The price-earnings ratio for a corporation must be studied over a period of time. c. The price-earnings ratio is based on the company’s dividends. d. The price-earnings ratio for one firm may be compared to the priceearnings ratio for all firms. e. A low price-earnings ratio indicates that a stock may be a good investment and a high price-earnings ratio may indicate that it is a poor investment. 4. Which of the following statement is not true? a. Most board members like to keep stockholders happy. b. Few things will unite stockholders into a powerful opposition force more rapidly than omitted or lowered dividends. c. Intelligent investors must be concerned about future after-tax profits. d. If a cash dividend is declared by the board of directors, each stockholder by law receives an equal amount per share. e. Corporate dividends are always paid in cash. 5. A stock that remains stable during declines in the economy is called a(n) ____ stock. a. defensive b. cyclical c. growth d. income e. blue-chip 6. When the board of directors approves a two for one stock stock split, the price for each share of stock a. decreases in value. b. increases in value. c. remains unchanged. d. is guaranteed to go up within a short period of time. e. increase to twice of its former value. 7. Which of the following statements is not true? Chapter 12 Review Personal Finance 120-C a. When an investor buys stocks and assumes they will increase in value, he or she is using a procedure called buying long. b. Selling short is selling stock that has been borrowed from a brokerage firm. c. When you sell short, you buy today, knowing that you must sell or over your short transaction at a later date. d. In a short transaction, if the stock increases in value, the investor loses money. e. To make money in a short transaction, you must be correct in predicting that a stock will decrease in value. 8. A small-cap stock is defined as a corporation that has total capitalization of a. more than $250 million. b. less than $300 million. c. less than $400 million. d. less than $500 millions. e. no capitalization. 9. The practice of churning usually increases investor profits. a. True b. False 10. A proxy is a legal form that lists the issues to be decided at a stockholders’ meeting and requests that stockholders transfer their voting rights to some individual or individual. a. True b. False 11. A stock that pays higher than average dividends is called an income stock. a. True b. False 12. Dollar-cost averaging enables investors to avoid the problem of buying high and selling low. a. True b. False 13. An investment bank is a financial institution where large corporations can deposit excess cash for short periods of time. a. True b. False 14. By using the Yahoo Finance Web site, an investor can find information on all of the following except a. a stock screener. b. the corporation’s stock symbol. c. current market values. d. research information. e. future market values. 15. A limit order is a request that a stock be purchased or sold at the current market price. a. True b. False Chapter 12 Review Personal Finance 120-C 16. ABC Corporation has assets that total $12 million and liabilities that total $4 million. It also has 500,000 shares of stock outstanding. What is ABC’s book value? a. $32 b. $24 c. $16 d. $8 e. $0 17. Which of the following I not a true statement? a. An investment bank is a financial firm that assists organizations in raising funds. b. A large corporation often uses an investment bank to sell and distribute a new stock issue. c. New stock offerings are called IPO’s. d. Initial Public Offerings are considered a conservative investment. e. The investment bank resells a new stock issue to its customers. 18. Assume that you purchases 100 shares of Home Depot stock for $40 a share, that you received an annual dividend of $0.50 a share, and that you sold your Home Depot stock for $80 a share at the end of the year. What is the total return for your investment? (Ignore commissions and other fees for this question). a. $10 b. $60 c. $760 d. $860 e. $1,060 19. A request that a stock be bought or sold at the current market price is called a ____ order. a. market b. limit c. stop d. round e. discretionary 20. Many investors and analysts believe that a corporation’s ability or inability to generate earnings in the future may be one of the most significant factors that account for an increase or decrease in the value of a stock. a. True b. False Chapter 12 Review Personal Finance 120-C