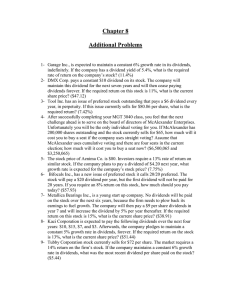

div policy

advertisement

DIVIDEND POLICY: A major function of the financial manager is to implement a dividend policy. Dividend policy is discretionary, that is, the amount of the quarterly dividends is determined by the board of directors. The criteria for determining a dividend policy should be "what policy will maximize the stock price?" The accounting is straightforward: Net Profits (EAC) is split into dividends and retained earnings. There is no third bucket where profits end up. Here are some abstract of various theoretical dividend policy models: 1. Modigliani & Miller (MM) say that dividends don't matter, "dividends are irrelevant", that stock price is determined by "basic earning power [ROA] of firm", not by dividend policy. MM acknowledge a "signaling effect" and offer a "clientele theory". 2. Gordon & Lintner says dividends are everything, that investors have a preference for liquidity. MM call this the "Bird in the hand theory". P0=D1/(ke-g) . 3. Harkavy did empirical test to find a slight positive correlation between payout ratios and stock price. Both MM and Gordon/Lintner claim that Hakavey's study lends credibility to their respective theories. 4. Walter's theory of Residuals: Walters posited that firms should use EAC to fund projects whose IRR* are expected to be greater than the stockholders required rate of return. Dollars not expended on these projects should be paid out to stockholders in the form of dividends. Realworld models: 5. 6. 7. 8. 9. Constant dollars: Pay out same amount every quarter. Constant dollars with a kicker: Add a bonus every now and then. Constant increases: Increase dollar amount every quarter. Constant payout ratio: Hold the proportion of payout (div/EAC) constant each quarter. Tie changes in dividends to changes in CPI: Increase div by cost of living. Go back to corporate finance