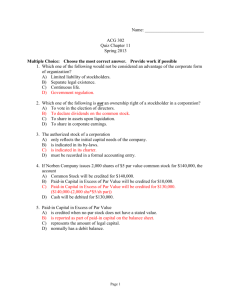

Characteristics of a Corporation

advertisement

Chapter 12 notes Characteristics of a Corporation 1. Separate legal existence ---- The corporation is separate and distinct from its owners. 2. Limited liability of stockholders ------ The liability of all stockholders is normally limited to their investment in the corporation 3. Transferable ownership rights ------- The corporation issues stock to stockholders and in turn all the stockholders have the right to transfer the stock that they own at will. 4. Ability to acquire capital ------- The corporation has the ability to obtain capital through the issuance of stock. All publicly owned corporations can issue stock in public stock exchanges to raise capital within a short period. 5. Continuous life ------- The life of a corporation may be perpetual or it may be limited to a specific number of years (the life is stated in the corporate charter). 6. Corporation management -------- Stockholders do not manage the corporation. The corporation is managed by a board of directors and a group of professional managers headed by the Chief Executive Officer. 7. Government regulation -------- A corporation is subject to numerous state and federal regulations 8. Additional Taxes -------- A corporation has to pay corporate income tax and the dividends declared given to stockholders are taxed again at personal income level. 9. From P538 to P542, the text talks about different features in corporate stock issuance and stockholder’s equity accounts. Common stocks (with par/stated value) are recorded at par/stated value by crediting common stock. Any money paid per share in excess of par/stated is credited to ‘Paid-in capital in Excess of Par/stated Value’. When issuing no-par common stock, total price paid will be credited to common stock. When the company buys back its own shares, we will debit an account called Treasury stock. When the company sells treasury shares, treasury stock will be credited and any gain or loss will go into ‘paid-in capital from Treasury stock’. There is another type of stock called preferred stock with the following features: 1. Dividends rate is stated in the sale contract either as amount per share or a percentage of par value. 2. Preferred stockholders have the right to receive dividends before common stockholders 3. If cumulative dividend feature is in the contract, when no dividends or insufficient dividends are declared for a year, preferred stockholders can make up for the deficiency in later years. Dividends owed is called dividends in arrears 4. Preferred stocks have a preference on corporate assets if the corporation fails. The corporation is not obligated on dividend until it is declared by the board-of-directors. Dividends usually come out of ‘retained earnings account’. There are three important dates for dividends: 1. Declaration date -------- The day when board of directors declares the amount of dividends payout. 2. Record date --------- Any stockholder who is officially in the stockholder registry on this day will receive dividends 3. Payment date -------- payment is distributed From P556 to P558, Stock dividends and stock split are described and compared. Basically, when stock dividends are declared, money is transferred from retained earnings to common stock. When there is a stock split, no accounting entry is entered. The stock market price is reduced and the number of outstanding shares goes up accordingly. On P561, there are generally three restrictions on the retained earnings account: 1. Legal restrictions ----- Rules imposed by the state government 2. Contractual restrictions --------- imposed by commercial contracts 3. Voluntary restrictions --------- might be for future expansion use