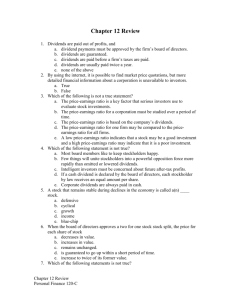

Chapter 7

advertisement

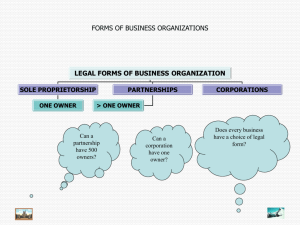

The Valuation and Characteristics of Stock Chapter 7 © 2003 South-Western/Thomson Learning Common Stock Background Stockholders own the corporation, but in many instances the corporation is widely held • Stock ownership is spread among a large number of people Because of this, most stockholders are only interested in how much money they will receive as a stockholder • Most equity investors aren’t interested in a role as owners 2 The Return on an Investment in Common Stock The future cash flows associated with stock ownership consists of Dividends The eventual selling price of the shares If you buy a share of stock for price P0, hold it for one year during which time you receive a dividend of D1, then sell it for a price P1, you return, k, would be: k= D1+ P1 -P0 P0 or k= D1 P0 dividend yield + P1-P0 A capital gain (loss) occurs if you sell the stock for a price greater (lower) than you paid for it. P0 capital gains yield 3 The Return on an Investment in Common Stock We can solve the previous equation for P0, the stock’s price today: kP0 D1 P1 P0 P0 kP0 D1 P1 1 k P0 D1 P1 D1 P1 P0 1 k The return on our stock investment is the interest rate that equates the present value of the investment’s expected future cash flows to the amount invested today, the price, P0 4 The Nature of Cash Flows from Stock Ownership Comparison of Cash Flows from Stocks and Bonds The expected receipt of dividends and the future selling price of stock is similar to what a bondholder expects in terms of interest and principal repayment • However, with bondholders: • • • • A guarantee is associated with their interest payments Interest payments are constant The maturity value of a bond is fixed When the bond matures, the investor receives contracted par or face value from the issuing company • When stock is sold, the investor receives money from another investor 5 The Basis of Value The basis for stock value is the present value of expected cash inflows even though dividends and stock prices are difficult to forecast Must make assumptions about what the future dividends and selling price will be • Discount these assumptions at an appropriate interest rate P0 = D1 PVFk,1 D2 PVFk,2 Dn PVFk,n Pn PVFk,n 6 The Intrinsic (Calculated) Value and Market Price A stock’s intrinsic value is based on assumptions made by a potential investor Must estimate future expected cash flows • Need to perform a fundamental analysis of the firm and the industry Different investors with different cash flow estimates will have different intrinsic values 7 Growth Models of Common Stock Valuation Realistically most people tend to forecast growth rates rather than cash flows Because forecasting exact future prices and dividends is very difficult 8 Developing Growth-Based Models A stock’s value today is the sum of the present values of the dividends received while the investor holds it and the price for which it is eventually sold P0 = D1 D2 2 1 k 1 k Dn 1 k n Pn 1 k n An Infinite Stream of Dividends Many investors buy a stock, hold for awhile, then sell, as represented in the above equation • However, this is not convenient for valuation purposes 9 Developing Growth-Based Models A person who buys stock at time n will hold it until period m and then sell it Their valuation will look like this: Pn = Repeating this process until infinity results in: P0 i=1 Dn + 1 Dm Pm +…+ + m-n m-n 1 + k 1 + k 1 + k Di 1 + k i Conceptually it’s possible to replace the final selling price with an infinite series of dividends 10 Working with Growth Rates Growth rates work like interest rates If growth is expected to be 6% next year then $100 experiencing a 6% growth will increase by $6, or $100 x 6% • The ending value after 6% growth will be $106, or $100 + $6, or $100 x (1.06) 11 The Constant Growth Model If dividends are assumed to be growing at a constant rate forever and we know the last dividend paid, D0, then the model simplifies to: 1 D 1 i P0 0 i i=1 1 + k Which represents a series of fractions as follows P0 = D0 1 g 1 k D0 1 g 1 k 2 2 D0 1 g 3 1 k 3 If k>g the fractions get smaller (approach zero) as the exponents get larger If k>g growth is normal If k<g growth is supernormal • Can occur but lasts for limited time period 12 Constant Normal Growth—The Gordon Model Constant growth model can be simplified to K must be D1 P0 k g greater than g. The Gordon model is a simple expression for forecasting the price of a stock that’s expected to grow at a constant, normal rate 13 The Zero Growth Rate Case— A Constant Dividend If a stock is expected to pay a constant, non-growing dividend, each dollar dividend is the same Gordon model simplifies to: D P0 k A zero growth stock is a perpetuity to the investor 14 The Expected Return Can recast Gordon model to focus on the return (k) implied by the constant growth assumption D1 k g P0 The expected return reflects investors’ knowledge of a company If we know D0 (most recent dividend paid) and P0 (current actual stock price), investors’ expectations are input via the growth rate assumption 15 Two Stage Growth At times a firm’s future growth may not be expected to be constant For example, a new product may lead to temporary high growth The two-stage growth model allows us to value a stock that is expected to grow at an unusual rate for a limited time Use the Gordon model to value the constant portion Find the present value of the non-constant growth periods 16 Practical Limitations of Pricing Models Stock valuation models give approximate results because the inputs are approximations of reality Bond valuation is precise because inputs are exact • With bonds future cash flows are contractually guaranteed in amount and time Actual growth rate can be VERY different from predicted growth rates Even if growth rates differ only slightly, it can make a big difference in our decision So, it’s best to allow a margin for error in your estimations 17 Practical Limitations of Pricing Models Stocks That Don’t Pay Dividends Some firms don’t pay dividends even if they are profitable Many companies claim they never intend to pay dividends • These firms can still have a substantial stock price Firms of this type typically are growing and are using their profits to finance their growth • However rapid growth won’t last forever • When growth slows, the firm will begin paying dividends • It’s these distant dividends that impart value 18 Some Institutional Characteristics of Common Stock Corporate Organization and Control Controlled by Board of Directors (elected by stockholders) Board appoints top management who then appoint middle/lower management Board consists of: top management and outside members (major stockholders, top executives at other firms, former presidents, etc.) In widely held corporations, top management is effectively in control of the firm because no stockholder group has enough power to remove them Preemptive Rights If firm issues new shares, existing shareholders have right to purchase pro rata share of new issue Common, but not required by law 19 Voting Rights and Issues Each share of common stock has one vote in the election of directors, which is usually cast by proxy A proxy fight occurs if parties with conflicting interests solicit proxies at the same time 20 Majority and Cumulative Voting Majority voting gives the larger group control of the company Cumulative voting gives minority interest a chance at some representation on the board Shares With Different Voting Rights Different classes of stock can be issued with different rights • Some stock may be issued with limited or no voting rights 21 Stockholders’ Claim on Income And Assets Stockholders have claim on the firm’s net income What is not paid out as dividends is retained (Retained Earnings) for investment in new projects Leads to future growth Common stockholders are last in line to receive income or assets, and bear more risk than other investors However, residual interest is large when firm does well 22 Preferred Stock Preferred stock is often referred to as a hybrid between common stock and bonds because: No maturity date (like common stock) Fixed dividend payment (similar to bond interest payment) 23 Valuation of Preferred Stock There is no growth rate in preferred stock dividends, so growth rate equals 0 The dividend at time 1 is the same as the dividend at time 0, so there is usually no time period associated with the numerator Valuation is that of a perpetuity P p D p k 24 Characteristics of Preferred Stock Cumulative Feature Common dividends can’t be paid unless the dividends on cumulative preferred are current Preferred stock never returns principal (like a bond does upon maturity) Preferred stockholders cannot force a firm into bankruptcy (like bondholders) Preferred stockholders received preferential treatment over common stockholders in the event of bankruptcy, but have a lower priority than bondholders Preferred stockholders do not have voting rights (like common stockholders do) Dividend payments to preferred stockholders are not tax deductible to the firm 25 Securities Analysis Securities analysis is the art and science of selecting investments Fundamental analysis looks at a company and its business to forecast value Technical analysis bases value on the pattern of past prices and volumes The Efficient Market Hypothesis says information moves so rapidly in financial markets that price changes occur immediately, so it is impossible to consistently beat the market to bargains 26