Key parameters and characteristics of Russia's insurance industry

advertisement

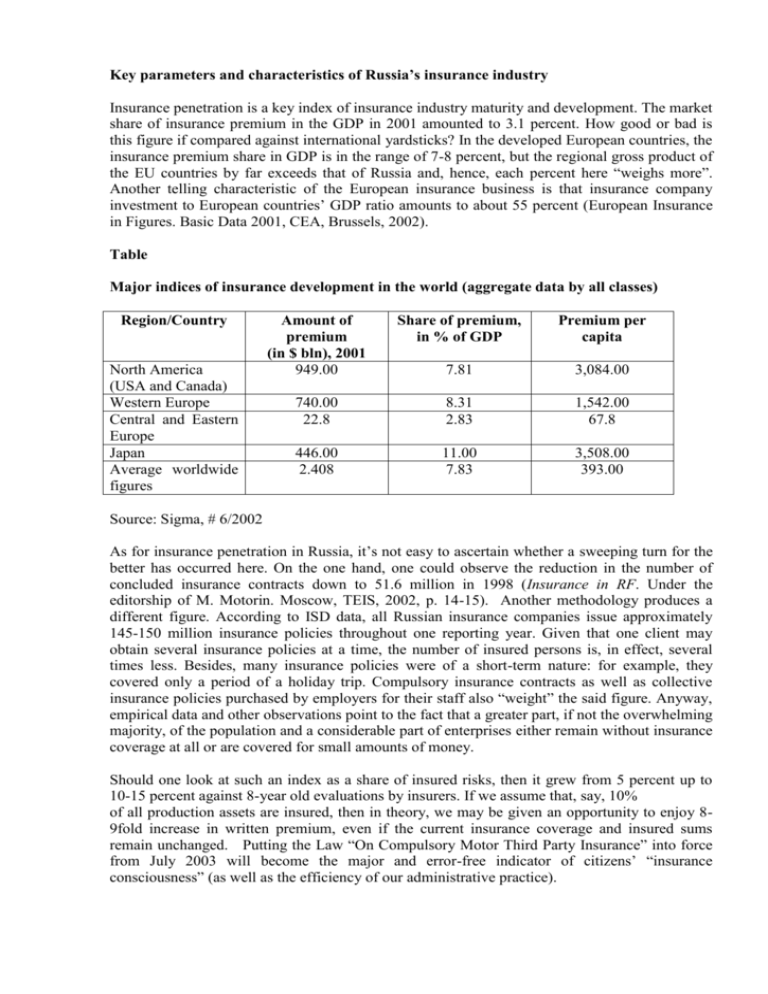

Key parameters and characteristics of Russia’s insurance industry Insurance penetration is a key index of insurance industry maturity and development. The market share of insurance premium in the GDP in 2001 amounted to 3.1 percent. How good or bad is this figure if compared against international yardsticks? In the developed European countries, the insurance premium share in GDP is in the range of 7-8 percent, but the regional gross product of the EU countries by far exceeds that of Russia and, hence, each percent here “weighs more”. Another telling characteristic of the European insurance business is that insurance company investment to European countries’ GDP ratio amounts to about 55 percent (European Insurance in Figures. Basic Data 2001, CEA, Brussels, 2002). Table Major indices of insurance development in the world (aggregate data by all classes) Region/Country North America (USA and Canada) Western Europe Central and Eastern Europe Japan Average worldwide figures Amount of premium (in $ bln), 2001 949.00 Share of premium, in % of GDP Premium per capita 7.81 3,084.00 740.00 22.8 8.31 2.83 1,542.00 67.8 446.00 2.408 11.00 7.83 3,508.00 393.00 Source: Sigma, # 6/2002 As for insurance penetration in Russia, it’s not easy to ascertain whether a sweeping turn for the better has occurred here. On the one hand, one could observe the reduction in the number of concluded insurance contracts down to 51.6 million in 1998 (Insurance in RF. Under the editorship of M. Motorin. Moscow, TEIS, 2002, p. 14-15). Another methodology produces a different figure. According to ISD data, all Russian insurance companies issue approximately 145-150 million insurance policies throughout one reporting year. Given that one client may obtain several insurance policies at a time, the number of insured persons is, in effect, several times less. Besides, many insurance policies were of a short-term nature: for example, they covered only a period of a holiday trip. Compulsory insurance contracts as well as collective insurance policies purchased by employers for their staff also “weight” the said figure. Anyway, empirical data and other observations point to the fact that a greater part, if not the overwhelming majority, of the population and a considerable part of enterprises either remain without insurance coverage at all or are covered for small amounts of money. Should one look at such an index as a share of insured risks, then it grew from 5 percent up to 10-15 percent against 8-year old evaluations by insurers. If we assume that, say, 10% of all production assets are insured, then in theory, we may be given an opportunity to enjoy 89fold increase in written premium, even if the current insurance coverage and insured sums remain unchanged. Putting the Law “On Compulsory Motor Third Party Insurance” into force from July 2003 will become the major and error-free indicator of citizens’ “insurance consciousness” (as well as the efficiency of our administrative practice). Potential insured persons Among potential insured persons are not only those citizens, whom sociologists put into the well-to-do and better-off category (they account for about 5 percent), but also the middle-class Russians, whose standard of well-being has demonstrated an upward trend over the last few years. The latter account for about one third. After the 1998 default, one could observe more than conspicuous increase in written premium under voluntary insurance, which enabled insurance companies to surpass the pre-crisis level of 1997 as early as 2000. Table Insurance premium under voluntary insurance in RF, in $ bln Year 1997 1998 1999 2000 2001 Amount of premium under voluntary insurance 3.51 1.37 2.78 4.99 7.84 In 2002, the amount of premium written declined if adjusted for inflation. Nevertheless, insurance claims payments were growing much more rapidly than premium written. Such a gap can be accounted for by insurance companies abandoning wage schemes (payments on them were carried out automatically) and by the high loss ratio in motor insurance.