rPFM(08-INS)08

advertisement

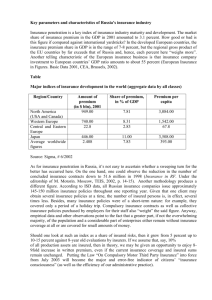

Personal Financial Management Semester 2 2008 – 2009 Gareth Myles g.d.myles@ex.ac.uk Paul Collier p.a.collier@ex.ac.uk Reading Callaghan: Chapter 9 McRae: Chapter 7 Insurance The lectures so far have been about generating and managing wealth Insurance can be seen as the protection of wealth Insurance The pooling of risks between a group of individuals A potentially large loss can be covered for a small price The premium purchases a policy to provide cover against carefully defined losses Principles of Insurance Example 1 Assume (1) A 1 in 1000 chance of a house fire (2) Each house is worth £100,000 (3) A community of 1000 houses 1 house per year will be lost on average The potential losses can be covered for £100 per year if all purchase insurance Issues that may arise? Principles of Insurance Example 2 It is also possible to interpret some investment activities as insurance A put option is the right to sell at a fixed price You hold a share and wish to avoid a loss if its price falls Buy a put option which can be exercised if the share price falls When to Insure? McRae provides the following table providing advice on when to insure Frequent Infrequent Small Loss Modify Self insure behaviour Large Loss Change Insure behaviour Forms of Insurance The most common forms of insurance are: Home/contents insurance cost of premium: sum insured, location (crime, flooding, subsidence) Direct Line Life insurance Premium depends on sum insured Characteristics of person (health, behaviour, history) Life Predictor Forms of Insurance Car insurance Cars are in categories 1 – 20 based on performance, repair cost and susceptibility to theft Group 1: Citroen C2 1.1, Fiat Seicento 1.1 Group 6: Ford Focus 1.8, Peugot 2.0 HDi Group 14: Mitsubishi Shogun Sport, BMW 318 Ci Group 17: Honda Civic Type R, Seat Leon Cupra Group 19: Nissan 350Z Group 20: Corvette, Mitsubishi Evo FQ360 Forms of Insurance Basic premium is then adjusted for Characteristics of driver: age, experience, occupation, no-claims bonus Form of use Location Parking Quotes can be obtained on-line Car insurance Compared to home insurance the characteristics of the party insured are much more important Forms of Insurance Extended Product Warranties Insure a product against failure or need for repair Usually sold with electrical items Typically appear very costly – but need to do some analysis to assess this Product Warranty Economics of Insurance Consider a population of size n each with asset worth Y Let p be probability of total loss Total loss each year is pnY If this loss is shared equally across the population, a fair premium is p = pY This premium is actuarially fair and a population-wide insurance plan would break even Is Insurance Fair? Television The television costs £659.95 The premium is £499.99 for 2 years This is fair for a 72% chance of total failure in this 2 year period Is failure rate this high? Other product warranties can be even higher Other forms of insurance House, life: clear probabilities, competitive Car: probability of very high loss events Why Insure? Would you buy insurance? Y-p insurance choice no insurance p 1–p 0 Y Let utility of wealth be U(W) U(Y – p) Choice then compares: (Expected Utility Theorem) pU(0) + (1 – p)U(Y) Choice Utility U(Y) U(Y - p) pU(0) + (1 - p)U(Y – p) U(0) 45o 0 Y-p Y Wealth Shape of utility: decreasing marginal utility of wealth Insurance Issues Moral Hazard Behaviour can change once insured Full insurance may not be possible Adverse Selection Bad risks will be attracted to insurance intended for good risks This can force good risks out of market