Private Health Insurance

advertisement

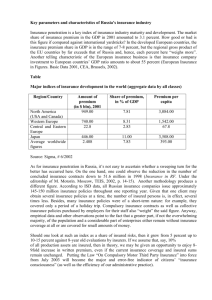

Private Health Insurance Farid Abolhassani Learning Objectives After working through this chapter, you will be able to: Explain the economic rationale for insurance and how insurance works in health care Give examples of how insurance companies try to counteract moral hazard and adverse selection Distinguish between the main types of managed care organizations Suggest reasons why private insurance fails to provide equity and efficiency Key Terms Actuarial (experience) rating Premium based on an individual’s risk of illness. Community rating Insurance premium based on pooled risk of a defined group of people. Diagnosis related group (DRG) Classification system that assigns patients to categories on the basis of the likely cost of their episode of hospital care. Used as a basis for determining the level of prospective payment by the purchaser. Health maintenance organization (HMO) Organization that provides comprehensive health care for a fixed, periodic per capita payment. Preferred provider organization (PPO) Private insurance that restricts choice to approved providers. Key Terms Out-of-pocket (direct) payment Payment made by a patient directly to a provider. Over the counter (OTC) drugs Non-prescription drugs purchased from pharmacists and retailers. Regulation Government intervention enforcing rules and standards. Universal coverage Extension of health services to the whole population. Unofficial payments Spending in excess of official fees, also called ‘under the table’ or ‘envelope’ payments. Public and private methods of financing health care Health care financing systems Privately financed Out of pocket payment Publicly financed Private health insurance Social insurance Taxation based systems Copayment and user fees Group/individual schemes Single fund General taxes Full payment HMOs/PPOs Multiple funds Hypothecated taxes The Premium Administration cost P=p×c+a Premium The cost to cover the loss Probability of the insured event P = 0.01 × 1500 + 5 = 20 The Premium Formula Validity Conditions There needs to be a large number of subscribers to pool the risks. The insured risks need to be independent. The probability of the insured event must be less than 1. People should not be able to influence their risk (moral hazard) and there should be no adverse selection. Moral Hazard Households Health Care Financial intermediary Free or low cost health care at the point of consumption Full reimbursement based on FFS Supplier-induced Demand Providers Neither the consumer nor the provider has an incentive to be cost-conscious Cost-sharing or Co-payment Schemes A flat rate charge for each unit of service; Co-insurance (the insured individual has to pay a certain proportion of each unit of health care consumed); A deductible (the individual pays 100 per cent of all bills in a given period up to some maximum amount beyond which insurance benefits are paid in full); Reduction of the overall impact of supplier induced demand A combination of the last two. People in low-income or high-utilization groups may be excluded from consumption as a result of lack of ability to pay Prospective Payment Schemes to countervail supplier-induced demand DRG-based payment Managed care: Health Maintenance Organizations (HMOs) Preferred Provider Organizations (PPOs) Health Maintenance Organizations HMOs provide (or arrange and pay for) Comprehensive health care; For a fixed, periodic per-capita payment (or premium) which is paid by the consumer (usually with a subsidy from employers or social security). Consumers do not usually pay charges at the point of use. The premium is set in advance and is independent of the volume of services provided to the individual during the period. Providers can be salaried or paid by FFS (fee-for-service). Types of HMO Staff model, in which all doctors are employed and/or contracted directly by the HMO; Group model, in which the HMO contracts with an independent group to provide services; Network model, in which more than one independent group is contracted to provide services; Independent practice association in which the HMO contracts several doctors in independent practice Preferred Provider Organizations Premiums are paid either by employers or are shared between employer and employee. Price at the point of use of services is zero. Insurers contract selectively with providers (e.g. primary care doctors and hospitals who provide care below a certain cost per case). The contract is on the basis of both a negotiated fee schedule which the preferred providers accept as payment in full and acceptance of utilization review. User charges and deductibles tend to be lower in PPOs than under previous private insurance arrangements. Medical Savings Accounts An individual- (or household-) specific account with balances earmarked for health care expenses A high-deductible, catastrophic insurance plan to cover expenses above the deductible. Main sources of failure in private insurance markets Moral hazard relates to potential changes in attitude of both consumers and providers under insurance arrangements, which may result in excess demand for health care.With full reimbursement of bills through insurance, neither the consumer nor the provider has an incentive to contain costs. Adverse selection arises from consumers having more complete information than insurers on their own health status, which may result in selecting plans that give them the greatest benefit. On the other hand, insurers can profit by excluding high-risk individuals. Diseconomies of small-scale operations Regulation of private insurance markets Premium regulation Benefit package regulation Profit regulation Offering tax relief to firms who enroll their employees in private insurance