Premium Finance – A Win-Win for all involved Parties

advertisement

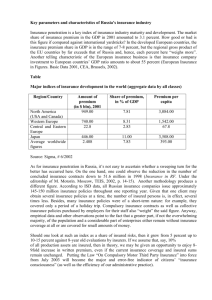

Premium Finance – A Win-Win for all involved Parties In a standard permanent life insurance purchase, the client determined that he / she needs the coverage. He / she will then purchase coverage and pay the premium payments. STANDARD SITUATION INSURANCE COMPANY PREMIUM Policy Contract CASH VALUE INSURED ASSETS PROTECTION DEATH BENEFIT In some situations, however, the assets that are used to pay for the premiums, are not that liquid or the future insured would like to keep the assets in their own portfolio. In these cases, the future insured may decide to finance the premiums. Based on the quality of the assets and the age and health of the client (that determined the remaining Cash Value in the policy), the rates for such lending are very competitive. Therefore, the insured can keep the performing assets, but, due to the lending, may still afford the coverage. PREMIUM FINANCE INSURANCE COMPANY PREMIUM Policy Contract CASH VALUE INSURED PROTECTION DEATH BENEFIT ASSETS FINANCIAL INSTITUTION Such scenario offers a solution to all involved parties: The Insured can maintain the assets and, in case of maturity, the death benefit will pay for the accrued loan. The Heirs may receive the assets without burden. The Insurance Carrier will receive all premium payments promptly. The Financial Institution will receive a risk-adjusted return for their lending. INTEC will help to find the right financial institution. We maintain close relationships to a host of financial institutions that are on stand-by to solve almost every need as long as there is bona-fide collateral available. PAGE 1 Intec Agent Services, LLC – 3960 Howard Hughes Parkway – Las Vegas, NV 89169 – www.intec-nv.com Minimum Criteria Premium Financing is a tool that requires assets to be provided for the Financing Institution. We are working with reputable institutions; most of them are banks. Among most of the Financial Institutions, the minimum criteria are: - Client has to have an individual net worth of $5 million or more - The Life Insurance Premium (level) must be higher than $100,00 p.a. How we process In order to best serve your client, we will send you a detailed questionnaire to assess your client’s situation. Based on our evaluation, we will determine to provide the case to 2-3 lending programs for an initial evaluation on an anonymous basis! If we are getting indication and terms from such financial institutions, we will ask the client to make a choice. They can either chose to use only one offer, or – provided we receive more offers – try to finance with several institutions. Intec will be the servicing agent, gearing all communication and requirements with the financial institution and your client as well as his bank to complete the financing. A standard turn-time us usually 4-6 weeks, assuming your client is providing all information needed. INQUIRY 2 DAYS QUESTIONAIRE INDICATIVE DOCUMENT OFFER (MAX 3) COMPLETION 5 DAYS 14 DAYS FINAL OFFER 14 DAYS CLIENT AGREES FINANCE CLOSING POLICY CLOSING 3 DAYS CLIENT AGREES It is your Client’s Choice! At no point in time you or your client has any obligation to use the offered financing. Only if the client agrees based on the indicative offer to proceed, we will provide the data to such institutions. Only if your client agrees to take the final offer, the contract will be binding and the collateral requirements become effective. Intec Agent Services, LLC – 3960 Howard Hughes Parkway – Las Vegas, NV 89169 – www.intec-nv.com PAGE 2