Tutorial 5 Ans

advertisement

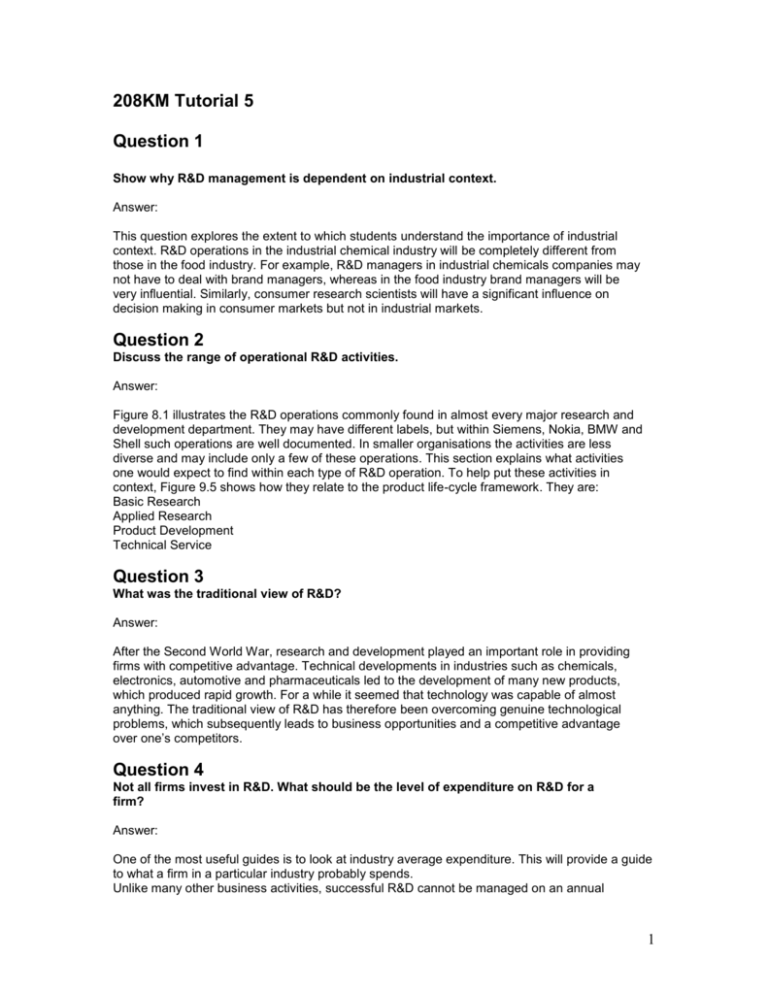

208KM Tutorial 5 Question 1 Show why R&D management is dependent on industrial context. Answer: This question explores the extent to which students understand the importance of industrial context. R&D operations in the industrial chemical industry will be completely different from those in the food industry. For example, R&D managers in industrial chemicals companies may not have to deal with brand managers, whereas in the food industry brand managers will be very influential. Similarly, consumer research scientists will have a significant influence on decision making in consumer markets but not in industrial markets. Question 2 Discuss the range of operational R&D activities. Answer: Figure 8.1 illustrates the R&D operations commonly found in almost every major research and development department. They may have different labels, but within Siemens, Nokia, BMW and Shell such operations are well documented. In smaller organisations the activities are less diverse and may include only a few of these operations. This section explains what activities one would expect to find within each type of R&D operation. To help put these activities in context, Figure 9.5 shows how they relate to the product life-cycle framework. They are: Basic Research Applied Research Product Development Technical Service Question 3 What was the traditional view of R&D? Answer: After the Second World War, research and development played an important role in providing firms with competitive advantage. Technical developments in industries such as chemicals, electronics, automotive and pharmaceuticals led to the development of many new products, which produced rapid growth. For a while it seemed that technology was capable of almost anything. The traditional view of R&D has therefore been overcoming genuine technological problems, which subsequently leads to business opportunities and a competitive advantage over one’s competitors. Question 4 Not all firms invest in R&D. What should be the level of expenditure on R&D for a firm? Answer: One of the most useful guides is to look at industry average expenditure. This will provide a guide to what a firm in a particular industry probably spends. Unlike many other business activities, successful R&D cannot be managed on an annual 1 budgetary basis. It requires a longer-term approach enabling knowledge to be acquired and built up over time. This often leads to tensions with other functions that are planning projects and activities. It is unusual for unlimited funds to be available, and hence business functions usually compete with other departments for funds. A great deal depends on the culture of the organisation and the industry within which it is operating (see Chapters 3 and 6). Pilkington, for example, spends proportionally large sums on R&D – many say too much – especially when one considers its more recent performance (Financial Times, 1998). Other companies spend very little on R&D but huge amounts on sales and marketing. This is the case for the financial services industry. So, one of the most difficult decisions facing senior management is how much to spend on R&D. Many companies now report R&D expenditure in their annual reports. It is now relatively easy to establish, for example, that Rubbermaid spent 14 per cent of sales on R&D in 1994; however, exactly how the company arrived at this figure is less clear. Question 5 What are the main strategic activities of R&D? Answer: The management of research and development needs to be fully integrated with the strategic management process of the business. This will enhance and support the products that marketing and sales offer and provide the company with a technical body of knowledge that can be used for future development. Too many businesses fail to integrate the management of research and technology fully into the overall business strategy process (Adler et al. (1992)). A report by the European Industrial Management Association (EIRMA, 1985) recognises R&D as having three distinct areas, each requiring investment: R&D for existing businesses, R&D for new businesses and R&D for exploratory research (see Figure 8.4). These three strategic areas can be broken down into operational activities: defend, support and expand existing businesses; drive new businesses; and broaden and deepen technological capability. Question 6 Discuss some of the strategic pressures on R&D. Answer: In virtually all R&D functions there is a trade-off between concentrating resources in the pursuit of a strategic knowledge competence and spreading resources over a wider area to allow for the building of a more general knowledge base. Figure 8.5 shows the demands on technical resources. The growth of scientific and technological areas of interest to the firm pressurises research management to fund a wider number of areas, represented by the upward curve. The need for strategic positioning forces the decision to focus resources and build strategic knowledge competencies, represented by the downward curve. Question 7 What is meant by technology leverage? Answer: While it is tempting to say that technology influences the competitive performance of all businesses, in reality some businesses are more heavily influenced than others. In many mature and established industries, the cost of raw materials is much more of an influence on the competitive performance of the business than are technology developments. For example, 2 the price paid for commodities like coffee, cocoa and sugar can dramatically influence profits in many food industries. Even if the business was to substantially increase the level of R&D investment, its competitive position would still be determined by raw material prices. Several attempts have been made by industry to quantify this factor when considering the level of R&D investment required. Scholefield (1993) developed a model using the concept of technology leverage. This is the extent of influence that a business’s technology and technology base have on its competitive position. In general, technology leverage will be low when the influence of raw material and distribution costs and economic growth is high. High-volume, bulk commodity products would fall within this scenario. 3