Multiplier and Accelerator

advertisement

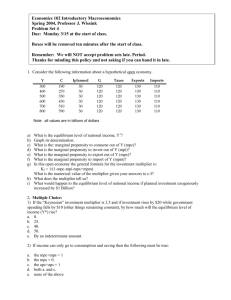

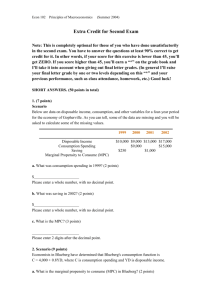

Multiplier and Accelerator Reference: Glanville, pgs. 265-270 Multiplier – increases and decreases in AD (that is C + I + G + (X – M)) has a bigger effect on RGDP than the actual size of the change. Initial Change – amount of the autonomous expenditure PLUS the amount of the expenditure which is income dependent autonomous expenditure: actual change in consumption, investment, government or net export spending -- the independent change income dependent change: how much new income results from the subsequent spending o each round of spending will have to take into account the leakages – savings, taxes, import spending o this will continue and continue Important things to know in calculating and using the multiplier – Marginal Propensity to Consume (MPC) – increase in consumption arising from the increase in income MPC = change in consumption / change in income MPCd: marginal propensity to consume DOMESTICALLY produced goods and services Multiplier = 1/1 minus MPCd Or Multiplier = 1/ 1 – MPC Multiplier = 1/ MPS + MRT + MPM where MPS = marginal propensity to save = ∆ savings/∆ income MRT = marginal rate of tax MPM = marginal propensity to import = ∆ imports/∆ income o Marginal Propensity to Withdraw = MPS + MRT + MPM Calculating the impact of a change in AD (an autonomous expenditure) Change in GDP = (1/1-MPCd) (change in the autonomous expenditure) The multiplier will always be >1 as its impact will be greater than the change in autonomous expenditure the higher the MPCd the higher the mulitiplier When the autonomous expenditure is POSITIVE it will cause RGDP growth When the autonomous expenditure is NEGATIVE it will cause a decline in RGDP Accelerator – this focuses on Investment within AD two kinds of investment o replacement investment for depreciated capital o new investment for increased AD – induced investment this is only necessary when capital is fully employed if capital is idle, it will be re-employed, if strong AD continues, companies will then consider capital expansion As AD increases, a company will have to replace depreciated capital and assess whether to expand capital capacity o Replacing depreciated capital tends to be a small-ish amount o Expanding capital tends to be a big-ish amount – expanding to meet a change in demand may require large investments in capital equipment to meet the new demand A whole new production line A new machine So, the level of induced investment is determined by the rate of change in National Income (GDP) o when it’s rising, firms want to meet it so they INVEST to expand capacity o this investment is subject to the multiplier effect in the economy and will accelerate growth in NI o when NI is stagnant or negative, investment will slow or stop o investment is strongly linked to CONFIDENCE in the marketplace Crowding Out – Government’s influence in the economy If govts run big deficits, they must borrow money to finance the borrowing – there is a limited amount of loanable funds, govts must compete with private sector borrowing for the funds Ex: US government runs a current account deficit (import values exceed export values) + a budget deficit (spends more than it receives in tax revenue) + initiating big stimulus programs (bank rescue, fiscal stimulus) These demands on the credit market may force private sector borrowing out Int rate int rate S I2 i1 D2 I D1 Qty of loanable funds I2 I1 Inv