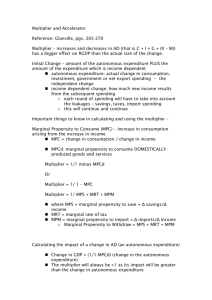

The Multiplier Effect

advertisement

The Multiplier Effect Government Investment and a Deflationary Gap Remember: Government spending and business investment are injections into the circular flow of income. Any injections are MULTIPLIED through the economy. How does this take place? Multiplier Example A government spends 100m dollars on a school building project. This 100m goes to a vast number of people for the factors of production they provide. (ex?) Labour in the form of Architects, engineers, builders etc. So the 100m goes into the pockets of these people. What do people do with this income? Spending Some of it goes back to the government as taxes. Some is saved. Some is spent on foreign goods. The rest is spent on domestic goods and services. The first 3 are withdrawals from the circular flow of income, why? What happens to the money spent domestically? These new recipients of the income behave in a similar fashion. They pay taxes, they save, the buy imports and the rest is spent on domestic produce. During each “round” some income is withdrawn from the circular flow and the rest stays to be respent. Simple example Govt. spends 100m on an economy in an attempt to stimulate spending and increase GDP. Of that 100m, 20% goes on taxes 10% is saved 10% is spent on imports Remaining 60% spent on domestic goods Marginal Propensity to Comsume or MPC So the MPC when expressed as a decimal is 0.6 The final result of the multiplier, when all the money has been spent and re-spent amounts to 250m or 2.5 times the original government spending of 100m. With example of an economy, any injection would contribute 2.5 times its amount to national income. Formulas MPC=Marginal Propensity to Consume MPW=Marginal Propensity to Withdraw MPW=Marginal Propensity to Save (MPS) + Marginal Rate of Taxation MRT + Marginal Propensity to Import MPM… or MPW=MPS+MRT+MPM 1 1 1 1-MPC or MPS+MPM+MRT = MPW Elasticity How large an effect will the multiplier have? Depends on the elasticity of supply. If there is plenty of “spare capacity” in an economy then the supply will be far more elastic and that will mean a larger effect. If we are close to full capacity with an inelastic PES then the multiplier’s effect lessens. Example Questions Work out the National Income increase of these 3 different economies if 50 million dollars is invested in each. Country A has an MPC of .75 Country B has an MPC of .80 Country C has an MPC of .50 In which country would the greatest degree of GDP increase take place? Withdrawals Work out the National Income increase of the economy below if 100 million dollars is invested and it’s MPW is as follows: MPS=0.2 MPT=0.3 MPM=0.3