Unfair Terms in Insurance Contracts Regulation Impact Statement

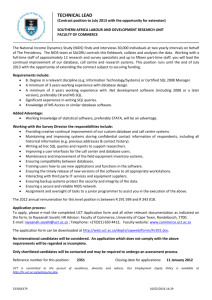

advertisement