FF46

advertisement

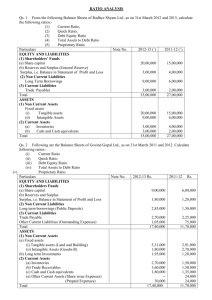

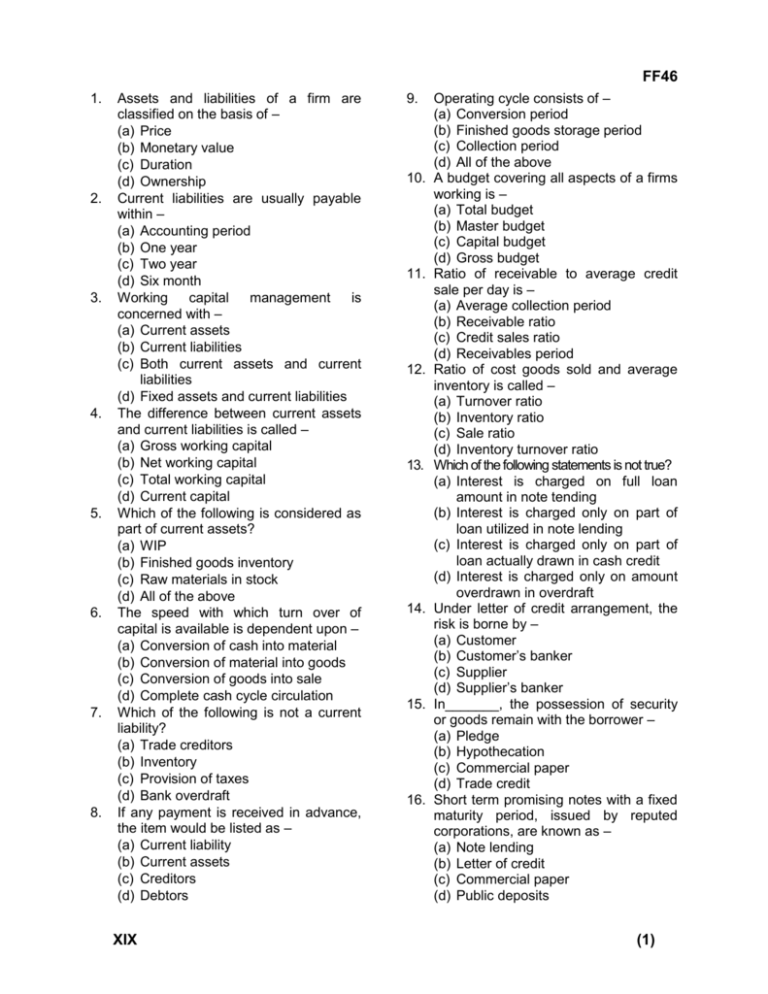

FF46 1. 2. 3. 4. 5. 6. 7. 8. Assets and liabilities of a firm are classified on the basis of – (a) Price (b) Monetary value (c) Duration (d) Ownership Current liabilities are usually payable within – (a) Accounting period (b) One year (c) Two year (d) Six month Working capital management is concerned with – (a) Current assets (b) Current liabilities (c) Both current assets and current liabilities (d) Fixed assets and current liabilities The difference between current assets and current liabilities is called – (a) Gross working capital (b) Net working capital (c) Total working capital (d) Current capital Which of the following is considered as part of current assets? (a) WIP (b) Finished goods inventory (c) Raw materials in stock (d) All of the above The speed with which turn over of capital is available is dependent upon – (a) Conversion of cash into material (b) Conversion of material into goods (c) Conversion of goods into sale (d) Complete cash cycle circulation Which of the following is not a current liability? (a) Trade creditors (b) Inventory (c) Provision of taxes (d) Bank overdraft If any payment is received in advance, the item would be listed as – (a) Current liability (b) Current assets (c) Creditors (d) Debtors XIX 9. 10. 11. 12. 13. 14. 15. 16. Operating cycle consists of – (a) Conversion period (b) Finished goods storage period (c) Collection period (d) All of the above A budget covering all aspects of a firms working is – (a) Total budget (b) Master budget (c) Capital budget (d) Gross budget Ratio of receivable to average credit sale per day is – (a) Average collection period (b) Receivable ratio (c) Credit sales ratio (d) Receivables period Ratio of cost goods sold and average inventory is called – (a) Turnover ratio (b) Inventory ratio (c) Sale ratio (d) Inventory turnover ratio Which of the following statements is not true? (a) Interest is charged on full loan amount in note tending (b) Interest is charged only on part of loan utilized in note lending (c) Interest is charged only on part of loan actually drawn in cash credit (d) Interest is charged only on amount overdrawn in overdraft Under letter of credit arrangement, the risk is borne by – (a) Customer (b) Customer’s banker (c) Supplier (d) Supplier’s banker In_______, the possession of security or goods remain with the borrower – (a) Pledge (b) Hypothecation (c) Commercial paper (d) Trade credit Short term promising notes with a fixed maturity period, issued by reputed corporations, are known as – (a) Note lending (b) Letter of credit (c) Commercial paper (d) Public deposits (1) FF46 17. ________ is an arrangement between a financial intermediary and the seller with regard to collection of accounts receivables – (a) Factoring (b) Discounting (c) Pledge (d) Security 18. Kannan committee was set up by RBI in the year – (a) 1987 (b) 1977 (c) 1981 (d) 1997 19. Discounting of bills is done by – (a) Banks (b) Customer (c) Seller (d) Government 20. Which company suggested bifurcation of cash credit limit? (a) Marathe committee (b) Tandon committee (c) Chore committee (d) Kannan committee 21. A statement showing estimated cash inflow and cash outflow is called – (a) Cash budget (b) Profit and loss statement (c) Master budget (d) Revenue budget 22. First step to reduce the collection cycle time is – (a) Regular follow-up (b) Reduction in mailing time (c) Prompt billing (d) Prompt cheque clearance 23. The system of collection though post office box known as – (a) Lock box system (b) P.O. box system (c) Box lock system (d) Post box system 24. A bank with which a firm has major account for disbursement, is called – (a) Collection bank (b) Concentration bank (c) Disbursement bank (d) Lock box bank XIX 25. Good inventory management helps in – (a) Reducing order cost (b) Avoiding lost cost (c) Gaining quantity discounts (d) All of the above 26. The term ‘inventory’ refers to – (a) Raw materials in stock (b) Work in progress (c) Finished goods in stock (d) All of the above 27. What is ‘E’ in EOQ? (a) Efficiency (b) Effective (c) Economic (d) Excellent 28. EOQ is the level at which – (a) Ordering cost is minimum (b) Carrying costs are minimum (c) Total cost are minimum (d) Set-up cost is minimum 29. A-B-C analysis is based on – (a) Total annual consumption value (b) Total purchase value (c) Unit highest price (d) Total inventory cost 30. Lead time is – (a) Time taken for collection of accounts receivables (b) Time between order placement and receipt of goods (c) Time taken for can version from material to goods (d) Time between submission of quotation and receipt of order 31. Safety stock is also known as – (a) Lead stock (b) Temporary stock (c) Buffer stock (d) All of the above 32. Which method of pricing of inventories takes material price at the value that is realizable at the time of issue? (a) LIFO (b) FIFO (c) Weighted average cost method (d) Replacement price method 33. LR means – (a) Lorry receipt (b) Late receipt (c) Low receivables (d) Latest receivables (2) FF46 34. IFCI was established in the year – (a) 1947 (b) 1948 (c) 1955 (d) 1966 35. Marketable receipt for funds deposited in a bank for a fixed period of time is called – (a) Certificate of deposit (b) Marketing security (c) Registered security (d) Treasury bill 36. Draft drawn on a specific bank for payment to exporter is – (a) Letter of credit (b) Banker’s acceptance (c) Overdraft (d) Banker’s cheque 37. LIC was formed in the year – (a) 1955 (b) 1966 (c) 1956 (d) 1967 38. Which financial institution is the oldest? (a) IFCI (b) IDBI (c) LIC (d) ICICI 39. The difference between current assets & current liabilities is known as – (a) Working capital (b) Gross working capital (c) Net working capital (d) Total working capital 40. _________ is a measure of the liquidity of the firm. (a) Net working capital (b) Gross working capital (c) Current assets (d) Current liabilities 41. The continuing flow from cash to supplies to sales to cash is known as – (a) Cash cycle (b) Operating cycle (c) Accounts cycle (d) Supply cycle 42. Any amount over & above permanent level of working capital is known as – (a) Temporary working capital (b) Variable working capital (c) Fluctuating working capital (d) All of the above XIX 43. Which of the following is not an example of current assets? (a) Cash (b) Inventory (c) Bank overdraft (d) Bank balance 44. In order of liquidity, which form of current assets would be highest? (a) Trade debtors (b) WIP inventory (c) Finished inventory (d) Bank balance 45. Which of the following relates to current liabilities? (a) Debtors (b) WIP (c) Cash (d) Wages 46. If a firm is able to sell its goods in cash, the operating cycle period is – (a) Increased (b) Decreased (c) Remains same (d) Not affected 47. Conversion period in an operating cycle is – (a) Period in selling finished goods (b) Period in collecting cash against credit sales (c) Period in producing goods from raw materials (d) Period in final packing & transportation 48. A budget coring all aspects of a firm’s working is called – (a) Master budget (b) Company budget (c) Operating budget (d) Production budget 49. The assets that are reading convertible into money reflect a firm’s _______. (a) Insolvency (b) Efficiency (c) Liquidity (d) Collection 50. ‘Quick assets’ mean – (a) Assets that can be acquired quickly (b) Assets that can be sold quickly (c) Current assets (d) Current assets minus inventories (3) FF46 51. Accounts receivable ratio is also known as – (a) Quick ratio (b) Conversion ratio (c) Debtors turnover ration (d) All of the above 52. A higher creditor turnover ratio may lead to – (a) Loss of goodwill (b) Loss of turnover (c) Delay in getting dues (d) More credit purchases 53. Commercial paper are used to finance – (a) Current transactions (b) Fixed assets (c) Permanent working capital (d) All of the above 54. Inventory purchased on credit are example of – (a) Creation lag (b) Storage lag (c) Sale lag (d) All of the above 55. If a bank accept a bill and pays immediately against a deal of credit sales, it is called – (a) Factoring (b) Collection (c) Discounting (d) Overdraft 56. The minimum criterion for extension of credit to a customer, is known as – (a) Credit policy (b) Credit standard (c) Credit period (d) Collection policy 57. Industrial finance corporation of India was established in the year – (a) 1947 (b) 1948 (c) 1951 (d) 1956 58. In securities, CDs means – (a) Compact disc (b) Comprehensive discount (c) Certificate of deposit (d) Certificate of discount XIX 59. Draft drawn on a specific bank against which an exporter can obtain payable for supplies, is known as – (a) Letter of credit (b) Banker’s acceptance (c) Banker’s cheque (d) Overdraft 60. Which of the following is not a section criteria for marketable securities? (a) Amount of investments (b) Liquidity (c) Taxability (d) Interest rate risk 61. Which method is used to evaluate the price of raw materials (a) Standard price method (b) LIFO (c) Replacement / current price method (d) All of the above 62. Quick test is a ratio of quick assets and – (a) Current assets (b) Current liabilities (c) Accounts payable (d) Accounts receivable 63. ‘Working capital’ is also know as– (a) Operating capital (b) Revolving capital (c) Circulating capital (d) Both (b) and (c) 64. Permanent Working Capital is also known as– (a) Fixed Working Capital (b) Core Working Capital (c) Regular Working Capital (d) All the Above 65. The rate of return on investments–with the shortage of working capital. (a) Increases (b) Decreases (c) No impact (d) Adequate 66. Temporary working capital is also called– (a) Variable Working Capital (b) Fluctuating Working Capital (c) Revolving Working Capital (d) Both (b) and (c) (4) FF46 67. Ratio of current assets and current liabilities is called– (a) Current ratio (b) Stock ratio (c) Velocity ratio (d) Liquidity ratio 68. Liquid Ratio is also termed as– (a) Gross profit ratio (b) Turnover ratio (c) Proprietary ratio (d) Acid test ratio XIX 69. Current liabilities are payable in– (a) More than 5 years (b) Less than 5 years (c) Less than a year (d) Less than 2 years 70. Which of following is not included in current ratio? (a) Goodwill (b) Sundry creditors (c) Sundry Debtors (d) Bolls receivable (5)