EBA.201 - Touro College

advertisement

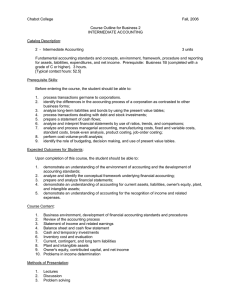

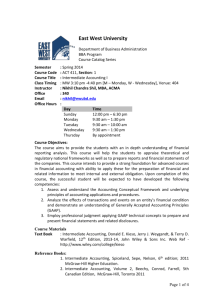

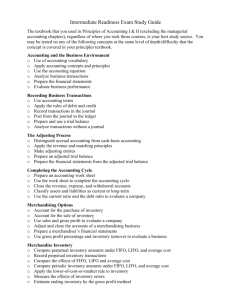

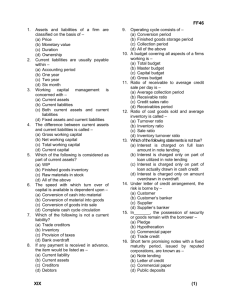

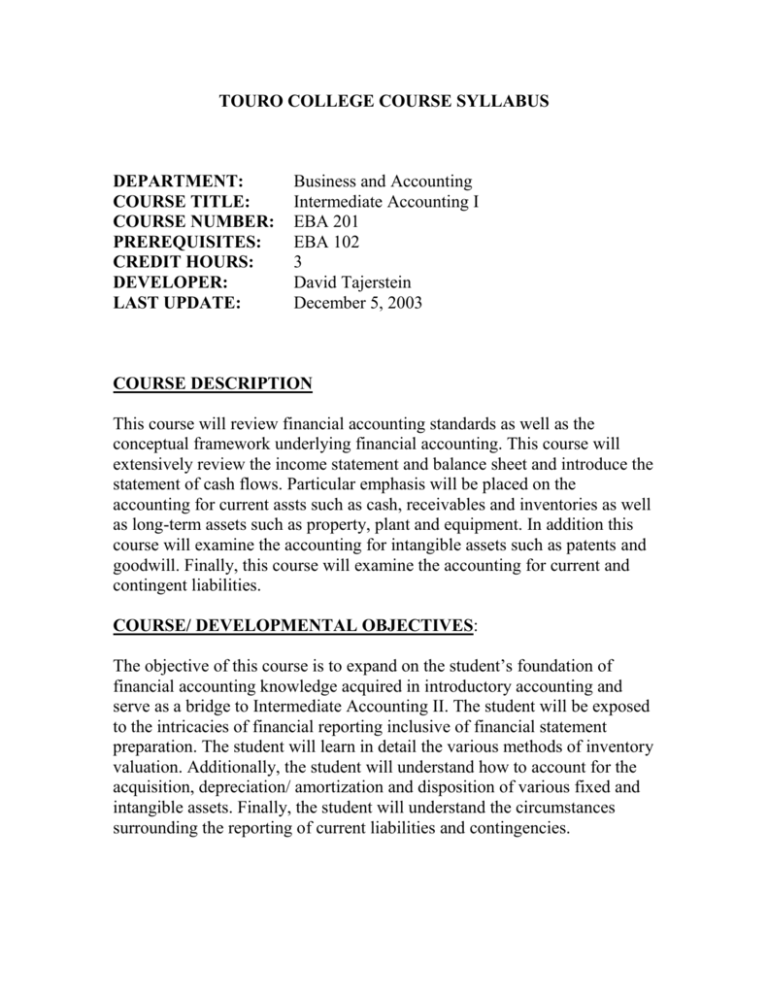

TOURO COLLEGE COURSE SYLLABUS DEPARTMENT: COURSE TITLE: COURSE NUMBER: PREREQUISITES: CREDIT HOURS: DEVELOPER: LAST UPDATE: Business and Accounting Intermediate Accounting I EBA 201 EBA 102 3 David Tajerstein December 5, 2003 COURSE DESCRIPTION This course will review financial accounting standards as well as the conceptual framework underlying financial accounting. This course will extensively review the income statement and balance sheet and introduce the statement of cash flows. Particular emphasis will be placed on the accounting for current assts such as cash, receivables and inventories as well as long-term assets such as property, plant and equipment. In addition this course will examine the accounting for intangible assets such as patents and goodwill. Finally, this course will examine the accounting for current and contingent liabilities. COURSE/ DEVELOPMENTAL OBJECTIVES: The objective of this course is to expand on the student’s foundation of financial accounting knowledge acquired in introductory accounting and serve as a bridge to Intermediate Accounting II. The student will be exposed to the intricacies of financial reporting inclusive of financial statement preparation. The student will learn in detail the various methods of inventory valuation. Additionally, the student will understand how to account for the acquisition, depreciation/ amortization and disposition of various fixed and intangible assets. Finally, the student will understand the circumstances surrounding the reporting of current liabilities and contingencies. COURSE/ INSTITUTIONAL OBJECTIVES This course is intended to augment the students’ knowledge of financial accounting while preparing them to deal with the types of accounting issues they will be exposed to while employed in the public or private accounting sector. In addition this course will aid in the students’ preparation to successfully complete the financial accounting part of the uniform CPA examination. The successful completion of all four parts of the uniform CPA examination is an institutional goal that this course is designed to assist in accomplishing. COURSE CONTENT Accounting Cycle The first part of this course focused on the framework of financial accounting and serves as an intensive review of Principles of Accounting I and II. The course reviews the analysis of transactions, recording transactions in the general journal and posting them to the general ledger. The course examines the accounting worksheet and the preparation of financial statements including the multi-step income statement (inclusive of irregular items), the statement of comprehensive income, the retained earnings statement, the balance sheet and the statement of cash flows. Time Value of Money The second part of this course introduces present and future value tables and calculations, which will be utilized throughout the remainder of the student’s accounting education. Examples include present and future value of single sums as well as “ordinary annuities” and “annuities due.” Receivables The third part of this course deals with the accounting for various receivables including Accounts Receivable and Notes Receivable. Particular attention for will be given to the calculation of the allowance for doubtful accounts (including the use of the percentage of receivables method I. E. “Aging” method) Inventory The fourth part of this course deals with the accounting for Inventory. The course will analyze both the Perpetual and Periodic Inventory systems. In addition the course will discuss the various Inventory costing methods (I. E., LIFO, FIFO and Average). Finally the course discusses the application of the Lower-of-Cost or market rule. Fixed / Intangible Assets The fifth part of the course deals with the accounting and recording of Fixed and Intangible Assets. Moreover, the course will examine the various methods of Depreciation and Amortization. Finally, the course will discuss the Accounting for Non monetary Transactions (I. E. Similar and Dissimilar Exchanges) Current and Contingent Liabilities The final part of this course deals with the accounting for various current liabilities. The course concludes with the decision of the rules of Contingent Liabilities inclusive of the appropriateness of accrual and disclosure of said liabilities. HARDWARE/SOFTWARE/MATERIALS REQUIREMENTS Not Applicable COURSE REQUIREMENTS Students must read assigned chapters in textbook Student must complete homework assignments Students must attend class and participate in classroom discussions Students must take and exams GRADING GUIDELINES Midterm Examination Final Examination Homework, Attendance Class Participation Total: 45% 50% 5% 100% METHODOLOGY The course should be carried out via lecture with in-class reference to pertinent illustration and case studies in the textbook. The lecture should be enhanced but introducing current developments in the accounting profession, including recently released accounting principles and practices published by authoritative bodies. COURSE TEXT Kieso, Weygandt, Warfield, Intermediate Accounting 11th ed., Wiley, 2003 ISBN# 047107208 BIBLIOGRAPHY Journal of Accountancy – monthly by AICPA www.aicpa.org www.fasb.org Dyckman, Dukes, and Davis, Intermediate Accounting 5th ed., Mcgraw Hill, 2001, ISBN# 0072508051. Spiceland, Sipe, & Tommassini: Inermediate Accounting 3rd Ed. Intermediate Accounting, Eighth edition, By Nikolai & Bazley Intermediate Accounting, by Skousen, and Stice, 15th edition, ITP. South Western Publishing Co.