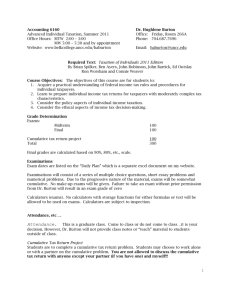

syllabus for accounting 406: advanced taxation

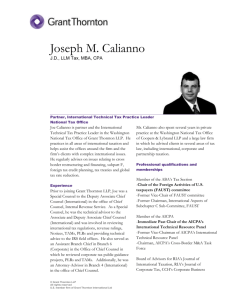

advertisement

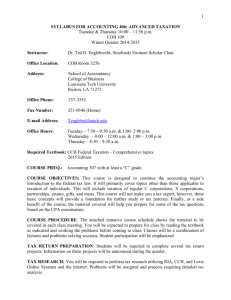

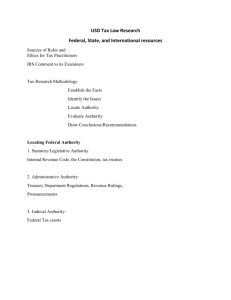

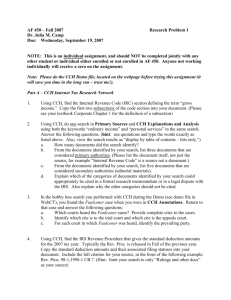

ACCOUNTING 521: TAX RESEARCH Tuesday & Thursday 10:00 – 11:50 a.m. COBB 105 Spring Quarter 2015 Instructor: Dr. Ted D. Englebrecht, Smolinski Eminent Scholar Chair Office Location: COBB Room 325B Address: School of Professional Accountancy College of Administration & Business Louisiana Tech University Ruston, LA 71272 Office Phone: 257-3552 Fax Number: 251-0546 (Home) E-mail Address: Tenglebr@latech.edu Office Hours: Tuesday – 7:50 – 9:50 a.m. & 1:00- 2:00 p.m. Wednesday – 8:00 – 12:00 a.m. & 1:00 – 3:00 p.m. Thursday – 8:30 – 9:30 a.m. Required Textbook: CCH Federal Taxation – Comprehensive topics 2015 Edition I. Course Objectives: To provide students with an understanding of (1) legal terms used in taxation, (2) elements of tax practice, (3) tax research methodology, (4) primary sources of federal tax law, (5) secondary research sources, (6) tax services, (7) tax research memorandums, (8) computerized tax research tools, (9) research of client’s tax problems including international tax issues, (10) state laws on principal and income, (11) selected tax topics on the CPA exam, and (12) detailed research paper in taxation. II. Attendance: Regular class attendance is expected. The class attendance policy as stated in the 2013-2014 Louisiana Tech University Bulletin will be followed. III. Method of Instruction: The course will be based on lecture, tax research, and the case method of inquiry. It is anticipated that students will spend time in the tax section of the library and utilize RIA, CCH, and Lexis Online tax research services to complete the class activities. Additionally, online websites like www.taxsites.com, www.irs.gov, and www.timbertax.org will be used in both problem solving and research applications. Also, practical international, estate, trust, timber, and farming 1 tax problems and scenarios will be emphasized. In addition, group interaction tax projects will be assigned throughout the quarter. IV. Make-up Exams: If you are unable to take an exam, you must notify me in person or in writing before the exam is given. If I am not notified before the scheduled exam, you will receive a grade of zero for the missed exam. Make-up exams will be allowed only for official university absences. Exam dates are tentatively scheduled in Sec. VII. Also the honor code of the University will be strictly adhered to in this course. V. Grades: My grading scale is – A:90-100, B:80-89, C:70-79, D:60-69, F:<60%. Grades are computed on the following basis: Two tests during the quarter Assigned Research Projects and Presentations Research Paper TOTAL VI. 70 points 15 points 15 points 100 points Websites for the course include but are not limited to the following: A. State Tax Statutes http://www.taxsites.com/state.html B. RIA – Check Point Login http://www2.checkpoint.riag.com/login C. IRS Web Site http://www.irs.gov D. Accounting Internet Links http://www.walshcol.edu/library/library36.html E. CCH – intelliconnect.cch.com F. Timbertax.org G. Lexis – www.lexisnexis.com VII. Primary Class Agenda for Spring 2015. The following is a list of the homework requirements for this course, as well as the dates for the exams. The instructor has the option of modifying these requirements at his discretion. 2 TENTATIVE SCHEDULE Chapter: Dates 1: 3/12 2: 3/17 – Research Problems 25: 3/19, 3/24, International Tax (pp. 37-80) 23: 3/26, 3/31, 4/2, 4/7 – Research Problems Exam: 4/9 Research Report due on 4/14 Research Report due on 4/16 Research Projects: 4/21, 4/23, 4/28, 4/30, 5/5, 5/7, 5/12, 5/14 Exam: 5/19 & Research Papers Turned in. Questions Problems 1-20 20-38 1-23 76, 79, & 80 59-62 & 78 26-56 Please note that we will be doing research not only on topics in the text but also, on international issues, timber tax issues, and estate & trusts tax & accounting issues. VIII. Students with Disabilities: If you have a disability and require special accommodations, you should identify yourself to me and provide me with a copy of the form from the Disability Office. IX. Tests Grades will be posted to Moodle during the quarter. However, the final grades are on the Boss System. 3