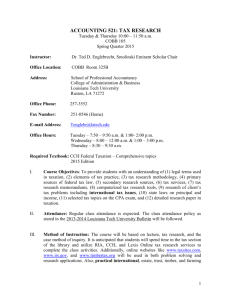

Tax Research Exercise 1

advertisement

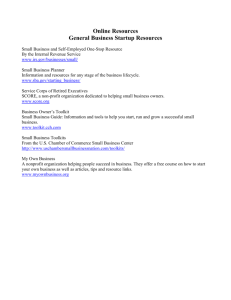

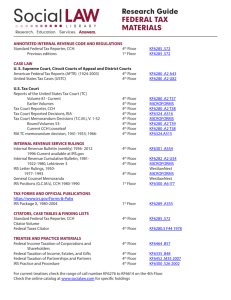

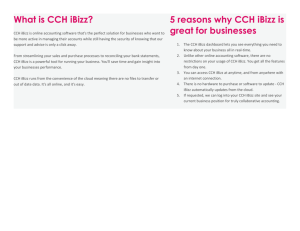

AF 450 – Fall 2007 Dr. Julia M. Camp Due: Wednesday, September 19, 2007 Research Problem 1 NOTE: This is an individual assignment, and should NOT be completed jointly with any other student or individual either enrolled or not enrolled in AF 450. Anyone not working individually will receive a zero on the assignment. Note: Please do the CCH Demo file, located on the webpage before trying this assignment (it will save you time in the long run – trust me!). Part A – CCH Internet Tax Research Network 1. Using CCH, find the Internal Revenue Code (IRC) section defining the term “gross income.” Copy the first two subsections of the code section into your document. (Please see your textbook Corporate Chapter 1 for the definition of a subsection) 2. Using CCH, do one search in Primary Sources and CCH Explanations and Analysis using both the keywords “ordinary income” and “personal services” in the same search. Answer the following questions. (hint: use quotations and type the words exactly as listed above. Also, view the search results as “display by table of contents – hits only.”) a. How many documents did the search identify? b. From the documents identified by your search, list three documents that are considered primary authorities. (Please list the document itself, not just the source, for example “Internal Revenue Code” is a source not a document.) c. From the documents identified by your search, list five documents that are considered secondary authorities (editorial materials). d. Explain which of the categories of documents identified by your search could appropriately be cited in a formal research memorandum or in a legal dispute with the IRS. Also explain why the other categories should not be cited. 3. In the hobby loss search you performed with CCH during the Demo (see demo file in WebCT), you found the Faulconer case when you were in CCH Annotations. Return to that case and answer the following questions: a. Which courts heard the Faulconer cases? Provide complete cites to the cases. b. Identify which cite is to the trial court and which cite is the appeals court. c. For each court in which Faulconer was heard, identify the prevailing party. 4. Using CCH, find the IRS Revenue Procedure that gives the standard deduction amounts for the 2007 tax year. Typically the Rev. Proc. is released in Fall of the previous year. Copy the standard deduction amounts and their associated filing statuses into your document. Include the full citation for your source, in the form of the following example: Rev. Proc. 98-1,1998-1 CB 7. (Hint: limit your search to only “Rulings and other docs” as your source) 5. Using CCH, find Rev. Rul. 2007-20 and answer the following questions. The purpose of these questions is to enhance your skills in reading and interpreting authorities that you locate while doing research. a. What is the complete citation to the ruling? b. In your own words, briefly explain the issue addressed by the ruling. c. Under the ruling, is paying taxes voluntary? d. In your own words, briefly explain the penalties according to the ruling. 6. Using CCH, find a Tax Court Memorandum decision involving Capital Video Corporation filed in 2002 dealing with business deductions and legal fees and answer the following questions. The purpose of these questions is to enhance your skills in reading and interpreting authorities that you locate while doing research. (hint: perform your search only using the “cases” primary source option) a. What is the complete citation to the case? (hint: Check your book to see how court cases are cited. Do NOT simply cut and paste the title of the document) b. For what taxable year is the tax liability in dispute? c. What code section(s) were at issue? d. In whose favor did the court rule (who won the case)? e. What is the general controversy being litigated in this case (in your own words)? f. Was the decision appealed? If so, provide a complete citation to the appeals decision. Did the appellate court agree or disagree with the Tax Court’s findings? Part B – World Wide Web Resources 1. Find the IRS website and answer the following questions: a. What types of tax-related resources are available on this site? b. For what years are tax forms available on this site? c. Find the most current version of the IRS publication entitled “Selling your home”. What is its publication number? List 4 important topics discussed in this publication. d. Find Form 706. What is the title of this form? Based on the instructions to the form, briefly explain the purpose of this form and which taxpayers would be required to file this form. 2. Find the Internal Revenue Code on any website other than CCH, and provide the URL. Do you consider the site reliable? Why or why not? 3. Find any tax glossary on the Web, and provide the URL. What is its definition of “gross income”? Compare this definition to the one you located in the Internal Revenue Code at the beginning of this research exercise. Which definition is more precise? Which definition is easier to understand? Which definition should you use in writing a formal research memorandum?