2011 Syllabus

advertisement

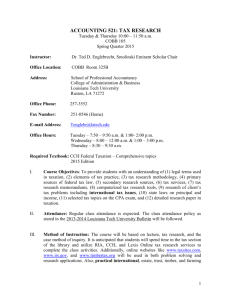

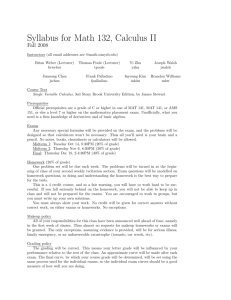

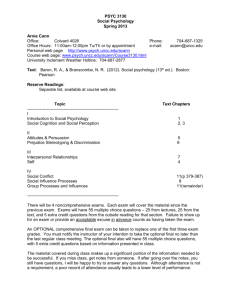

Accounting 6160 Advanced Individual Taxation, Summer 2011 Office Hours: MTW 2:00 – 3:00 MW 5:00 – 5:30 and by appointment Website: www.belkcollege.uncc.edu/haburton Dr. Hughlene Burton Office: Friday, Room 266A Phone: 704.687.7696 Email: haburton@uncc.edu Required Text: Taxation of Indviduals 2011 Edition By Brian Spilker, Ben Ayers, John Robinson, John Barrick, Ed Outslay Ron Worsham and Connie Weaver Course Objectives: The objectives of this course are for students to: 1. Acquire a practical understanding of federal income tax rules and procedures for individual taxpayers. 2. Learn to prepare individual income tax returns for taxpayers with moderately complex tax characteristics. 3. Consider the policy aspects of individual income taxation. 4. Consider the ethical aspects of income tax decision-making. Grade Determination Exams: Midterm Final 100 100 Cumulative tax return project Total 100 300 Final grades are calculated based on 90%, 80%, etc., scale. Examinations Exam dates are listed on the “Daily Plan” which is a separate excel document on my website. Examinations will consist of a series of multiple choice questions, short essay problems and numerical problems. Due to the progressive nature of the material, exams will be somewhat cumulative. No make-up exams will be given. Failure to take an exam without prior permission from Dr. Burton will result in an exam grade of zero Calculators (exams). No calculators with storage functions for either formulas or text will be allowed to be used on exams. Calculators are subject to inspection. Attendance, etc…. Attendance. This is a graduate class. Come to class or do not come to class…it is your decision. However, Dr. Burton will not provide class notes or “teach” material to students outside of class. Cumulative Tax Return Project Students are to complete a cumulative tax return problem. Students may choose to work alone or with a partner on the cumulative problem. You are not allowed to discuss the cumulative tax return with anyone except your partner (if you have one) and myself!!! 1 Websites and Additional Information Useful Websites IRS: http://www.irs.gov IRS website provides a plethora of resources, including access to federal & state tax forms. Commerce Clearing House (CCH): http://tax.cchgroup.com CCH website provides sources of tax research support (IRS Code, court cases, etc.) Academic Integrity. Students have a responsibility to know and observe the requirements of the UNCC Code of Student Academic Integrity. Copies of the code can be obtained from the Dean of Students’ Office. Standards of integrity will be enforced in this course. The Belk College of Business strives to create an inclusive academic climate in which the dignity of all individuals is respected and maintained. Therefore, we celebrate diversity that includes, but is not limited to ability/disability, age, culture, ethnicity, gender, language, race, religion, sexual orientation, and socio-economic status. 2