1 SYLLABUS FOR ACCOUNTING 406: ADVANCED TAXATION

advertisement

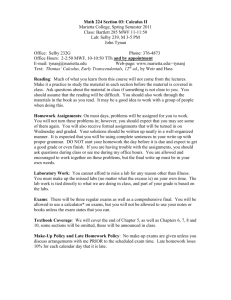

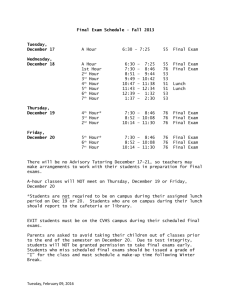

1 SYLLABUS FOR ACCOUNTING 406: ADVANCED TAXATION Tuesday & Thursday 10:00 – 11:50 p.m. COB 109 Winter Quarter 2014-2015 Instructor: Dr. Ted D. Englebrecht, Smolinski Eminent Scholar Chair Office Location: COB Room 325b Address: School of Accountancy College of Business Louisiana Tech University Ruston, LA 71272 Office Phone: 257-3552 Fax Number: 251-0546 (Home) E-mail Address: Tenglebr@latech.edu Office Hours: Tuesday – 7:50 – 9:50 a.m. & 1:00- 2:00 p.m. Wednesday – 8:00 – 12:00 a.m. & 1:00 – 3:00 p.m. Thursday – 8:30 – 9:30 a.m. Required Textbook: CCH Federal Taxation – Comprehensive topics 2015 Edition COURSE PREQ.: Accounting 307 with at least a “C” grade. COURSE OBJECTIVES: This course is designed to continue the accounting major’s introduction to the federal tax law. It will primarily cover topics other than those applicable to taxation of individuals. This will include taxation of regular C corporations, S corporations, partnerships, estates, gifts, and trusts. This course will not make you a tax expert; however, these basic concepts will provide a foundation for further study or tax practice. Finally, as a side benefit of the course, the material covered will help you prepare for some of the tax questions found on the CPA examination. COURSE PROCEDURE: The attached tentative course schedule shows the material to be covered in each class meeting. You will be expected to prepare for class by reading the textbook as indicated and working the problems before coming to class. Classes will be a combination of lectures and problems solving sessions. Student participation will be emphasized. TAX RETURN PREPARATION: Students will be required to complete several tax return projects. Information on these projects will be announced during the quarter. TAX RESEARCH: You will be required to perform tax research utilizing RIA, CCH, and Lexis Online Systems and the internet. Problems will be assigned and projects requiring detailed tax analysis. 2 EXAMS: Exams can consist of problems, true – false, essay questions, multiple choice questions, and matching. COURSE GRADING: Grades ACCT 406 are computed on the following basis: Three tests including the final exam Class participation (5 pts.) & Research Projects (5 pts.) TOTAL 90 points 10 points 100 points Grades are assigned according to the following ranges: A is 90 B is 80 C is 70 D is 60 F is below 100 points 89 points 79 points 69 points 60 points Grades for Graduate Credit are computed on the following basis: Three tests 75 points Research Paper (15 pages) 15 points Class Participation (5 pts.) & Research Projects (5 pts.) 10 points TOTAL 100 points POLICY ON MISSING EXAMS: A score of zero will be assigned to anyone absent from a scheduled exam unless prior approval has been granted by the instructor. In those rare instances where prior approval is granted, a makeup exam will be required and scheduled at the Professor’s discretion. Assignments will be made by the Professor for each class meeting. In addition, reading lists will be handed out periodically for required topics. See Tentative Schedule of Assignments for the primary class agenda. Also, the honor code of the University will be strictly adhered to in this course. CAMPUS EMERGENCY: All Louisiana Tech students are strongly encouraged to enroll and update their contact information in the Emergency Notification System (ENS) to ensure you are able to receive important text and voice alerts in the event of a campus emergency (http://www.latech.edu/administration/ens.shtml). In case of a campus emergency, you must login to http://www.latech.edu within 24 hours of the emergency for campus updates. In case of a campus closure, you must sign on to Moodle within 36 hours to contact the instructor regarding course materials and assignments. It is anticipated that in this situation, an additional research paper or an expanded paper assignment will be used to take the place of missed faculty presentations, depending on the number of presentations missed. 3 WRITTEN COMMUNICATIONS: At least 10% of your grade will be determined form written communication. This may be in the form of essay questions on exams, research projects, and/or homework assignments. TENTATIVE SCHEDULE Date Topics Assignment 12/4 Introduction to Tax Research Chapters 1 & 2 Problems to be assigned Chapter 22 Chapter 22 & Problems Chapter 22 – Research Problem Assigned and Comprehensive Problem Chapter 22 Chapter 22 12/9 Tax Research & Assignment 12/11 &16 Estate Tax 12/18 1/6 1/8 1/13 & 15 Research Assignment Research Problems 1st Test Fiduciary Taxation 1/20 & 22 Fiduciary Taxation 1/27 S. Corps 1/29 & 2/3 S. Corps. 2/5 2nd Test 2/10 Partnerships 2/12 Partnerships 2/19 & 24 C Corps. & Research Projects 2/26 Third test on C Corps. & Partnerships 3/3 Graduate Students Paper Chapter 23 Chapter 23 & assigned problems Chapter 23 Problems Chapter 21 & Problems Chapter 21 & Problems Chapter 19 & Problems Chapter 19 & Problems Chapter 14 & Problems Chapters 19 & 14 *Mardi holiday begins after classes on 3/13/15 and classes resume on 3/19/18 at 8:00 a.m. Attendance is required at all class meeting dates. Only medical or extraordinary circumstances will be accepted in lieu of a zero for the missed class meeting. Computerized tax research will be incorporated into the course. In this endeavor, each student will be required to complete several research projects using RIA Online System, CCH Network Research Site, and Lexis Research Site. CELL PHONES: Please turn your cell phone off or put in a silent mode during class. Cell phones may not be used as a calculator for quizzes or exams. ALL PHONES MUST REMAIN IN YOUR BOOK BAG, POCKET OR PURSE AT ALL TIMES. On Test days, everything except pencils, calculators and the test must be placed in front of the room on the day of the test., e.g., book bags, phones, caps, etc. 4 STUDENT ASSISTANCE: For students with disabilities, this course adheres to the Student Disability Act. Please advise your instructor on what accommodations that you will need, and the phone number for the center on campus that is assisting you with your disability. Test grades: Students’ test grades will be posted to Moodle during the quarter. However, the final grades are on the Boss System. MISSIONS Be aware of the “COLLEGE OF BUSINESS MISSION” and the “SCHOOL OF ACCOUNTING MISSION STATEMENT”. These statements will be reviewed periodically during the quarter via PowerPoints