Financial restructuring and recovery plan

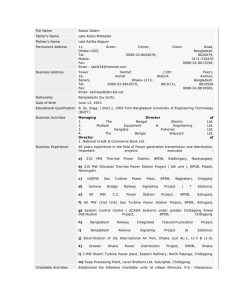

advertisement