Finance Exam Questions: Ratios & Profit Analysis

advertisement

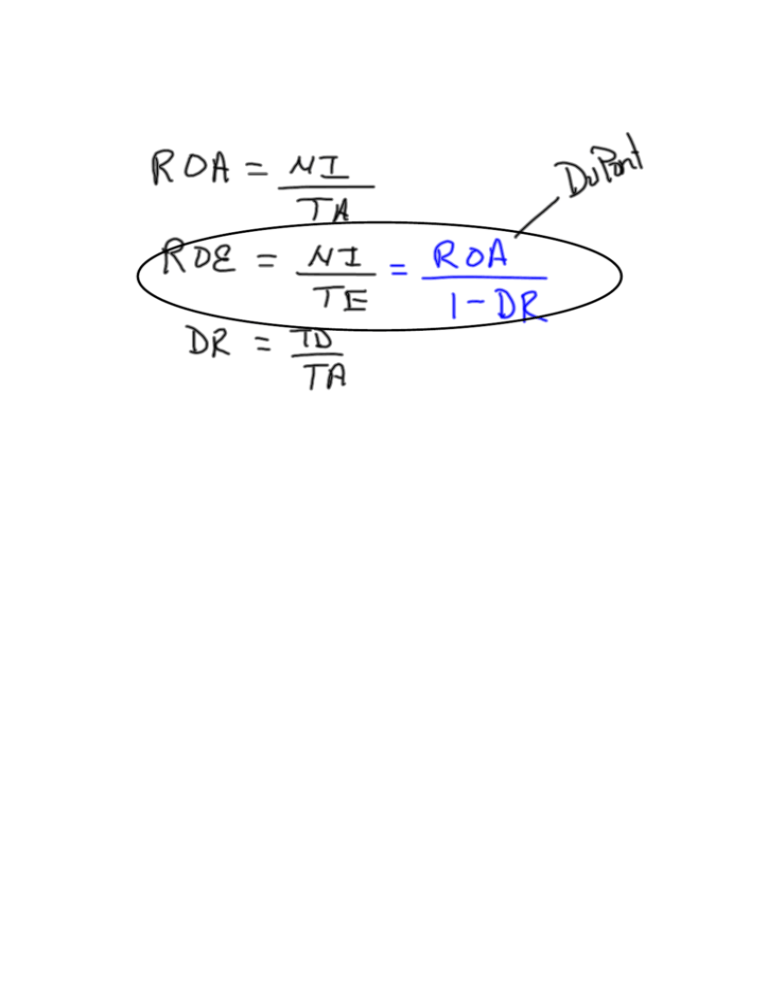

27) In an effort to analyze Clockwork Company finances, Jim realized that he was missing the company's net profits after taxes for the current year. Find the company's net profits after taxes using the following information. Return on total assets = 2% Total Asset Turnover = 0.5 Cost of Goods Sold = $105,000 Gross Profit Margin = 0.30 What is the debt/net worth ratio and the debt to total assets ratio for a firm with total debt of $600,000 and equity of $400,000? . Which business transaction will affect the quick ratio? a. Purchase of plant and equipment with long­term debt b. Temporary cash investments liquidated and proceeds placed in checking account c. Employee loans receivable paid off d. Payment made on accounts payable balance There are three essentially different, yet interrelated, relative measurements of debt: the debt ratio, the debt to equity ratio, and the equity multiplier. If the firm's total assets equal $1,200,000 and the equity multiplier is stated as 3:1, the debt ratio is: a. 66.67% b. 33.33% c. 2:1 d. 50.00% Many lending institutions rely on the "times interest earned" formula because it discloses the firm's ability to cover the interest charge on outstanding debt. With earnings before taxes of $30,000, interest expense of $3,000, and net income after taxes of $24,000, times interest earned is: a. 8 times b. 10 times c. 11 times d. none of the above 5. You have the following data for the Fosberg Winery. What is Fosberg's return on assets (ROA)? Return on equity = 15%; Earnings before taxes = $30,000; Total asset turnover = 0.80; Profit margin = 4.5%; Tax rate = 35%. If current assets = $95, net fixed assets = $250, long­term debt = $40, and owners' equity = $200, what is the value of current liabilities if it is the only other item on the balance sheet?