Egyptian Business and Commercial Laws

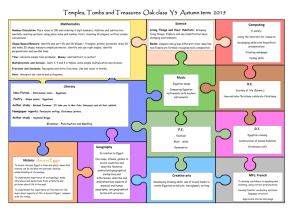

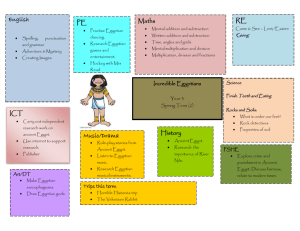

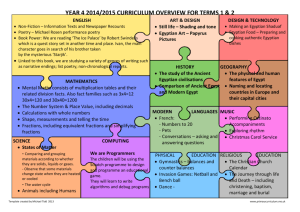

advertisement