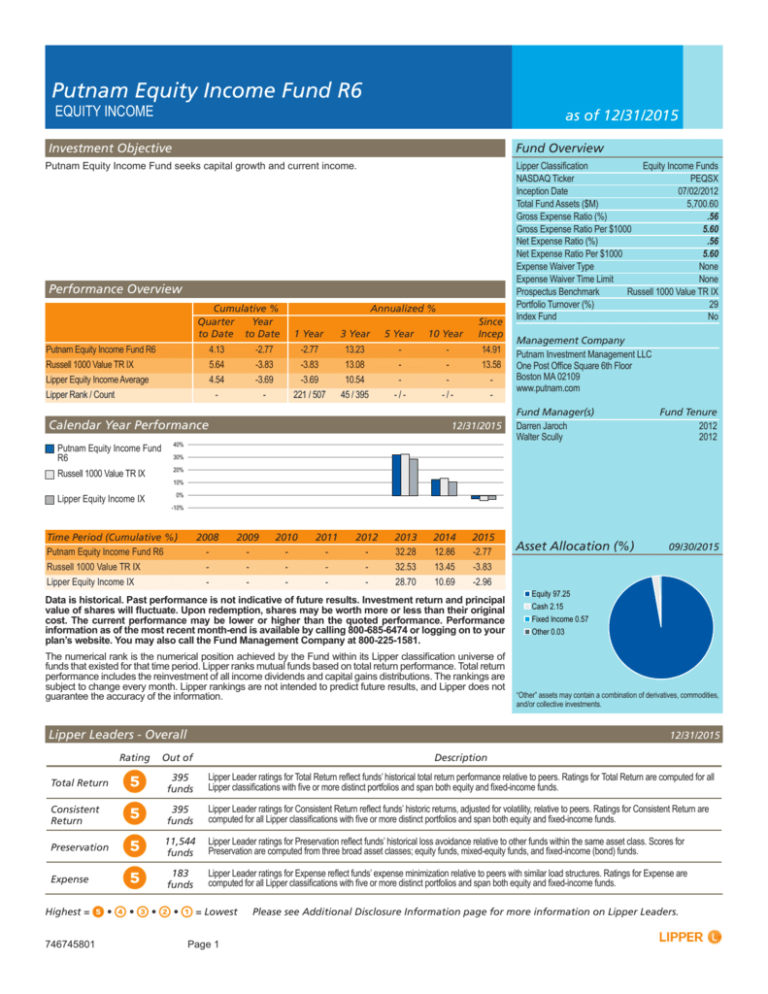

Putnam Equity Income Fund R6

EQUITY INCOME

as of 12/31/2015

Investment Objective

Fund Overview

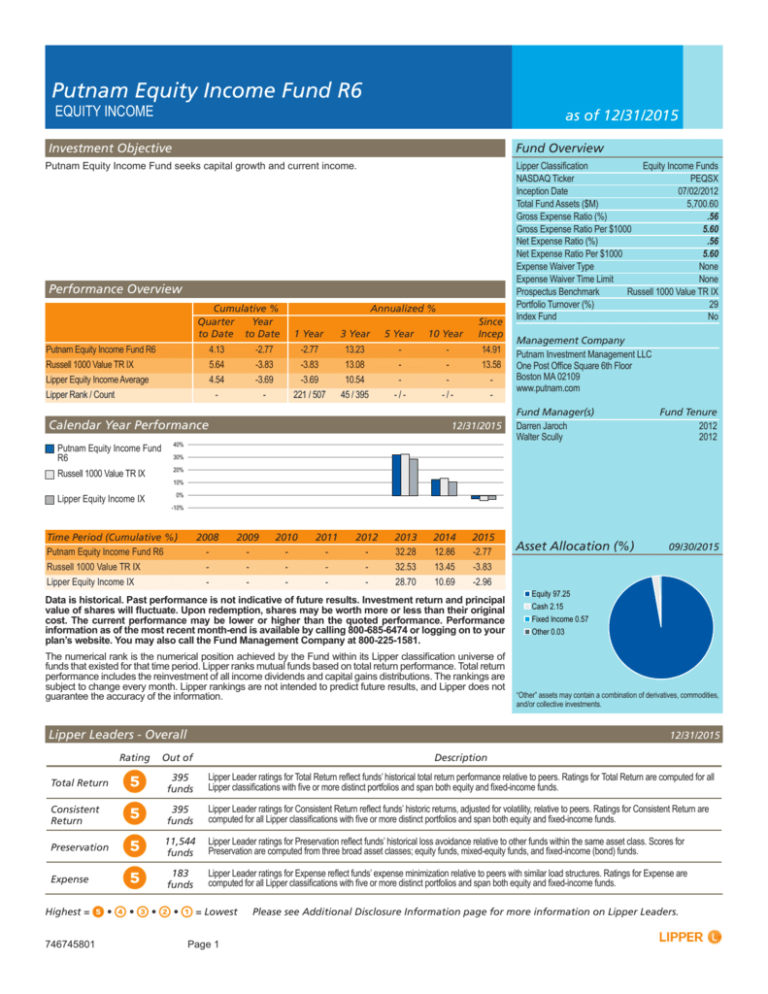

Putnam Equity Income Fund seeks capital growth and current income.

Performance Overview

Cumulative %

Annualized %

Quarter Year

to Date to Date 1 Year 3 Year 5 Year 10 Year

Putnam Equity Income Fund R6

Russell 1000 Value TR IX

Lipper Equity Income Average

Lipper Rank / Count

4.13

5.64

4.54

-

-2.77

-3.83

-3.69

-

-2.77

-3.83

-3.69

221 / 507

13.23

13.08

10.54

45 / 395

-

-

-

- / -

Calendar Year Performance

Putnam Equity Income Fund

R6

40%

Russell 1000 Value TR IX

20%

Lipper Equity Income IX

-

-

-

- / -

Since

Incep

14.91

13.58

-

12/31/2015

30%

10%

0%

-10%

Time Period (Cumulative %)

Putnam Equity Income Fund R6

Russell 1000 Value TR IX

Lipper Equity Income IX

2008

-

-

-

2009

-

-

-

2010

-

-

-

2011

-

-

-

2012

-

-

-

2013

32.28

32.53

28.70

2014

12.86

13.45

10.69

2015

-2.77

-3.83

-2.96

Data is historical. Past performance is not indicative of future results. Investment return and principal

value of shares will fluctuate. Upon redemption, shares may be worth more or less than their original

cost. The current performance may be lower or higher than the quoted performance. Performance

information as of the most recent month-end is available by calling 800-685-6474 or logging on to your

plan’s website. You may also call the Fund Management Company at 800-225-1581.

The numerical rank is the numerical position achieved by the Fund within its Lipper classification universe of

funds that existed for that time period. Lipper ranks mutual funds based on total return performance. Total return

performance includes the reinvestment of all income dividends and capital gains distributions. The rankings are

subject to change every month. Lipper rankings are not intended to predict future results, and Lipper does not

guarantee the accuracy of the information.

Lipper Leaders - Overall

Total Return

Consistent

Return

Preservation

Expense

Management Company

Putnam Investment Management LLC

One Post Office Square 6th Floor

Boston MA 02109

www.putnam.com

Fund Manager(s)

Darren Jaroch

Walter Scully

Asset Allocation (%)

Fund Tenure

2012

2012

09/30/2015

Equity 97.25

Cash 2.15

Fixed Income 0.57

Other 0.03

“Other” assets may contain a combination of derivatives, commodities,

and/or collective investments.

12/31/2015

Rating

Out of

Description

5

5

5

5

395

funds

Lipper Leader ratings for Total Return reflect funds’ historical total return performance relative to peers. Ratings for Total Return are computed for all

Lipper classifications with five or more distinct portfolios and span both equity and fixed-income funds.

395

funds

Lipper Leader ratings for Consistent Return reflect funds’ historic returns, adjusted for volatility, relative to peers. Ratings for Consistent Return are

computed for all Lipper classifications with five or more distinct portfolios and span both equity and fixed-income funds.

11,544

funds

Lipper Leader ratings for Preservation reflect funds’ historical loss avoidance relative to other funds within the same asset class. Scores for

Preservation are computed from three broad asset classes; equity funds, mixed-equity funds, and fixed-income (bond) funds.

183

funds

Lipper Leader ratings for Expense reflect funds’ expense minimization relative to peers with similar load structures. Ratings for Expense are

computed for all Lipper classifications with five or more distinct portfolios and span both equity and fixed-income funds.

Highest = 5 • 4 • 3 • 2 • 1 = Lowest

746745801

Lipper Classification

Equity Income Funds

NASDAQ Ticker

PEQSX

Inception Date

07/02/2012

Total Fund Assets ($M)

5,700.60

Gross Expense Ratio (%)

.56

Gross Expense Ratio Per $1000

5.60

Net Expense Ratio (%)

.56

Net Expense Ratio Per $1000

5.60

Expense Waiver Type

None

Expense Waiver Time Limit

None

Prospectus Benchmark

Russell 1000 Value TR IX

Portfolio Turnover (%)

29

Index Fund

No

Page 1

Please see Additional Disclosure Information page for more information on Lipper Leaders.

Putnam Equity Income Fund R6

Top Holdings

09/30/2015

Holding Name

% TNA

Top Sector Allocation1

Industry Name

09/30/2015

% TNA

Eli Lilly and Co ORD

2.87

Financials

21.78

Northrop Grumman Corp ORD

2.65

Industrials

11.78

Cigna Corp ORD

2.21

Health Care

11.13

JPMorgan Chase & Co ORD

2.20

Consumer Services

9.85

Citigroup Inc ORD

2.07

Consumer Goods

9.12

Exxon Mobil Corp ORD

2.04

Technology

9.00

Wells Fargo & Co ORD

1.98

Oil & Gas

8.91

Johnson & Johnson ORD

1.91

Utilities

5.03

Comcast Corp ORD

1.88

Non Classified Equity

4.76

Coty Inc ORD

1.67

Telecommunications

3.37

Total

21.48

1

Sector weightings are based on ICB Industries.

Top Country Allocation

09/30/2015

Country

United States

United Kingdom

Ireland

Netherlands

Bermuda

France

Other

Luxembourg

Fund Characteristics

% TNA

89.71

4.21

2.22

2.14

0.74

0.65

0.31

0.03

09/30/2015

Number of Holdings

Avg Weighted Market Cap ($M)

Price to Earnings Ratio

Price to Book Ratio

Return on Equity (%)

130

85822.7

21.73

3.65

18.18

Risk Statistics - 3 Year

Fund

Benchmark

Definition

Standard Deviation

10.35

10.68

Standard deviation is a measure of risk that gauges the variability of actual returns from the expected values and the

dispersion of these variations over time.

Sharpe Ratio

1.24

1.19

Sharpe ratio is a measure that uses standard deviation and excess return to determine reward per unit of risk. The greater a

portfolio’s Sharpe ratio, the better its risk-adjusted performance has been.

Alpha*

0.06

0.00

Alpha measures a manager’s contribution to performance due to security selection or market timing relative to the index. A

positive alpha of 1.0 means the fund has outperformed its benchmark index by 1%. Correspondingly, a similar negative alpha

would indicate an underperformance of 1%.

Beta*

0.96

1.00

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. A

beta of 1 indicates that the security’s price will move with the market. A beta of less than 1 means that the security will be less

volatile than the market. A beta of greater than 1 indicates that the security’s price will be more volatile than the market.

R-Squared*

0.98

1.00

R-squared values range from 0 to 1. An R-squared of 1 means that all movements of a security are completely explained by

movements in the index. A low R-squared means you should ignore the beta.

*Statistics are measured against the Fund’s prospectus benchmark.

Before investing, consider the investment options’ or funds’ investment objectives, risks, charges, and expenses. Call 1-800685-6474 or log on to your plan’s website for an offering statement or prospectus and, if available, a summary prospectus

containing this and other information. Read it carefully.

746745801

Page 2

Putnam Equity Income Fund R6

Additional Disclosure Information

Lipper Leaders Overall

This fund (in Lipper’s Equity Income Funds classification) received the following ratings for the 3-, 5-, and 10-year periods, respectively (number of funds rated follows

the rating in parentheses). Total Return: 5 (395 funds), - (- funds), and - (- funds). Consistent Return: 5 (395 funds), - (- funds), and - (- funds). Preservation (in Equity

Funds asset class): 5 (11,544 funds), - (- funds), and - (- funds). Expense: 5 (183 funds), - (- funds), and - (- funds). Lipper ratings are not intended to predict future

results, and Lipper does not guarantee the accuracy of this information. See Disclaimer Page for additional information. Lipper Leaders ratings DO NOT take into

account the effects of sales charges. The Lipper ratings are subject to change every month and are based on an equal-weighted average of percentile ranks for the

Total Return, Consistent Return, Preservation, and Expense metrics over three-, five-, and ten-year periods (if applicable). The highest 20% of funds in each peer group

are named Lipper Leaders or a 5, the next 20% receive a rating of 4, the middle 20% receive a rating of 3, the next 20% receive a rating of 2, and the lowest 20% receive

a rating of 1. For more information on Lipper Leaders, go to www.lipperweb.com.

Expense Information

The Gross Expense Ratio is the fund’s total operating expenses taken from the most recent prospectus. This ratio excludes waivers and/or expense reimbursements

the Fund Manager might apply. The Net Expense Ratio, also taken from the most recent prospectus, represents the expenses paid with inclusion of waivers and/or

expense reimbursements. When waivers and/or expense reimbursements are included, the Fund’s expenses will be lowered and performance will be higher for the

disclosed expense waiver period. Waiver and/or expense reimbursements can be voluntary or mandated by contract, and can expire either at a specific date, at will, or

indefinitely. Funds Closed to New Investors are not required to file a prospectus, thus the prospectus gross and net expense ratios may not be available. In the event

that the prospectus expense information is not available the expense ratio reported on the latest audited annual report will be provided.

Fees and expenses are only one of many factors to consider when you decide to invest in an option. You may also want to think about whether an investment in a

particular option, along with your other investments, will help you achieve your financial goals.

Fees and expenses for each investment option include the total annual operating expense (annual gross expense ratio), which reduces the investment’s rate of return,

along with any associated shareholder-type fees. The cumulative effect of fees and expenses can substantially reduce the growth of your retirement savings. Visit the

Department of Labor’s website at www.dol.gov/ebsa/publications/401k_employee .html for an example showing the long-term effect of fees and expenses.

Average Weighted Market Cap:

Measures the average market capitalization of all holdings in a fund with each company weighted according to its percent held in the fund.

Price to Earnings Ratio (P/E):

A measure of a company’s valuation that is calculated by dividing the current market price of a stock by the earnings per share.

Price to Book Ratio (P/B):

A measure of a company’s valuation that is calculated by dividing the current market price of a stock by the latest quarter’s book value per share.

Return on Equity (ROE):

A measure of a company’s profitability. ROE represents the average return on equity of the securities in the portfolio.

Portfolio Turnover

A fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These transaction costs, which are not reflected in annual Fund

operating expenses or in the example, affect the fund’s performance.

Top Holdings, Asset Allocation, and Sector Weightings

Data is based on information collected from the investment company, is updated as of the date shown in the section’s title, and will vary over time. Asset Allocation may

equal less than or greater than 100% due to hedged funds or leveraged cash positions by the fund.

Lipper Index

Measures the unweighted average total return performance of either the ten or thirty largest share classes (as available) of funds for a Lipper Classification. The full list

of Lipper Index components is available directly from Lipper. Lipper Indices are unmanaged. It is not possible to invest in a Lipper Index.

Lipper Average

Measures the simple arithmetic average across all funds within the fund’s Lipper classificatoin. Lipper averages are unmanaged. It is not possible to invest in a Lipper

Average.

Prospectus Benchmark

An index assigned to the Fund by the portfolio’s manager to show how the Fund’s total return compares with those of an index measure of market performance. It is

not possible to invest in an index.

The Russell 1000 Value Index is created to measure the performance of the large-cap value segment of the U.S. equity universe. Companies included in this index

generally have low price-to-book ratios and low expected growth values. To ensure that new and growing equities are captured and that the represented companies

continue to reflect value characteristics, the Index is comprehensively reconstituted annually. An investor cannot invest directly in an index.

Lipper, a Thomson Reuters Company. Copyright 2016 Thomson Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly

prohibited without the prior written consent of Lipper. Lipper Fund Fact Sheets Service.

746745801

Page 3

Putnam Equity Income Fund R6

Supplemental Information

Principal Investment Strategies

We invest mainly in common stocks of midsize and large U.S. companies, with a focus on value stocks that offer the potential for capital growth, current income,

or both. Value stocks are issued by companies that we believe are currently undervalued by the market. If we are correct and other investors ultimately recognize

the value of the company, the price of its stock may rise. We may consider, among other factors, a company’s valuation, financial strength, growth potential,

competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments.

Principal Investment Risk

It is important to understand that you can lose money by investing in the fund.

The value of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market

conditions and factors related to a specific company or industry. Value stocks may fail to rebound, and the market may not favor value-style investing. Income

provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests.

The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the

Federal Deposit Insurance Corporation or any other government agency.

746745801

Page 4