SUCCESS IN

MULTI-ASSET CLASS INVESTING

AGENDA

• CI’s multi-manager excellence

• Investment Consulting Team and philosophy

• Performance highlights

• Investment process

• Outlook

MULTI-MANAGER EXCELLENCE

CI INVESTMENT CONSULTING TEAM

Alfred Lam, CFA

VP & Portfolio Manager

Investment strategy / Asset allocations

Fund selection/ Currency strategy

Communications

Lewis Harkes, CFA

Senior Analyst

Yoonjai Shin, CFA

Director

Andrew Ashworth

Analyst

Fund/manager analysis

Performance reporting

Fund/manager analysis

Asset allocations

Currency strategy

Fund selection

Project management

Fund/manager analysis

Cash flow management

Performance reporting

Marchello Holditch, CFA

Senior Analyst

Fund/manager analysis

PORTFOLIO MANAGEMENT

$20 billion in assets under management

INDUSTRY RECOGNITION

Best Fund of Funds Award - 2011

Best Fund of Funds Award - 2012

Best Global Fixed Income Balanced Award - 2013

Morningstar Awards © Morningstar Inc. All Rights Reserved.

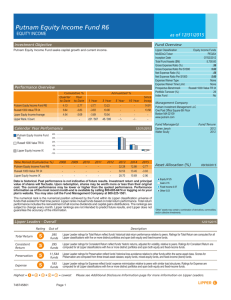

Lipper Fund Awards are given by Lipper, Inc. to recognize funds that have provided superior consistency and risk-adjusted returns when compared to a group of

similar funds. Awards are given to the fund with the highest value within its category for the time periods of three, five and 10 years according to the Lipper

Leader ratings for Consistent Return, which reflect funds’ historic returns, adjusted for volatility, relative to peers. Lipper Leader ratings change monthly. For

more information, see lipperweb.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the

accuracy is not guaranteed by Lipper. Users acknowledge that they have not relied upon any warranty, condition, guarantee, or representation made by Lipper.

Any use of the data for analyzing, managing, or trading financial instruments is at the user’s own risk. This is not an offer to buy or sell securities. Portfolio Series

Income Fund (Class A) was named Best Global Fixed Income Balanced Fund in February 2013 for the three and five-year periods ending Oct. 31, 2012, out of a

category total of 26 and 19 funds, respectively.

WHAT ARE YOU INVESTING FOR?

For fun?

To get exposure to the markets?

For stability and to grow wealth?

TOTAL RETURN EQUATION

Manage/Reduce

Optimize

Minimize

Total return = Asset mix + Alpha + Market Beta + Currency – Tax – Fees

Maximize

Manage

Reduce

FORWARD-LOOKING ASSET MIXES

26

Price-Earnings Multiples

Based on 12 Month Forward Operating Earnings

26

TSX

S&P 500

24

24

22

22

Overweight US

20

20

18

18

16

16

14

14

12

12

10

10

Cumulative returns from

April 2011 to August 2013:

S&P/TSX -2.8%

S&P 500 C$ +40.4%

8

8

86

88

90

92

94

96

98

00

02

04

06

08

10

Bottom Up Earnings Based on CPMS (TSE) and IBES (S&P) Consensus

Source: TD Securities

12

14

DYNAMIC INCOME ASSET MIX TO ACHIEVE

SUPERIOR RISK-ADJUSTED RETURNS

2011

Q4

2012

Q1

2012

Q2

2012

Q3

2012

Q4

2013

Q1

2013Q

2

Target

Cash

12

15

21

21

27

34

24

0%

Government & Investment grade

debt

49

44

41

41

36

31

44

60%

High yield Corporate Bonds

21

22

19

18

15

13

12

20%

High-dividend Stocks

18

19

19

20

22

22

20

20%

Duration (years)

5.1

4.5

4.2

4.1

4.1

3.3

3.1

Weighting (%)

Represented by Portfolio Select Series: Select Income Managed Corporate Class [CIG 2265]

Source: CI Investments

ACTIVE SECTOR AND STOCK SELECTION

Sector Exposure Comparison

Financials

Energy

Materials

Industrials

Telecom Services

Consumer Discretionary

Consumer Staples

S&P/TSX Index

Portfolio Select Series

Health Care

Utilities

Information Technology

Cash

0%

5%

Source: CI Investments, Wilshire Associates. Data as of July 31, 2013

10%

15%

20%

25%

30%

35%

CURRENCY MANAGEMENT

ALSO SETS US APART

Canadian dollar (US$)

11.7% cumulative added value

1.10

10% hedged

1.00

30% hedged

30% hedged

0.90

50% hedged

0.80

70% hedged

0.70

Jan-08

Jan-09

Jan-10

Dynamic hedging introduced

Source: Bloomberg, CI Investments

Jan-11

Jan-12

Jan-13

INVESTMENT PROCESS

1. Income markets

Long-term Government of Canada bond yield

18

Implications:

• Low expected return:

~2% with 100% fixed income

16

14

12

10

•

8

6

4

2

0

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

Average yield of Gov’t of Canada bonds with at least 10 years to maturity

Source: TD Securities

Increased volatility

and downside

INVESTMENT PROCESS

2. Power of multi-asset class optimization

Base case

25% equity

• higher expected return

75% cash

• lower volatility

INVESTMENT PROCESS

3. Add-on’s to cash

25% equity

currencies

high yield bonds

75%

investment grade

REITs

• further enhance returns &

diversification

• reduce volatility

• add-on’s to outperform cash

Select Income Managed - CIG 2265

INVESTMENT PROCESS

4. Add equity for longer-term horizons

Select Income Managed

+

Canadian

equity

U.S.

equity

EAFE

equity

EM

equity

SOLUTION FOR AN INVESTOR

Expected Return %

.

..

.

PE expansion

.

Gov’t

Bonds

GIC

For illustration purposes only; there is no guarantee on results

100e

40i60e

100i

Volatility

OUTLOOK: CANADA VS. U.S.

26

Price-Earnings Multiples

Based on 12 Month Forward Operating Earnings

26

TSX

S&P 500

24

24

22

22

20

20

18

18

16

16

14

14

12

12

10

10

8

8

86

88

90

92

94

96

98

00

02

04

06

08

10

Bottom Up Earnings Based on CPMS (TSE) and IBES (S&P) Consensus

Source: TD Securities

12

14

OUTLOOK: CANADA VS. U.S.

Real GDP Growth, Y/Y % Chg

GDP growth forecast

6%

4%

2014

2.0%

3.2%

Canada 1.6%

2.4%

US

2%

0%

-2%

Forecast

-4%

US

14:3

13:4

13:1

12:2

11:3

10:1

09:2

08:3

07:4

10:4

Canada

-6%

Source: CIBC

2013

OUTLOOK: BOND MARKET

Even though overnight rates have not changed,

bonds have been volatile

Government of Canada benchmark bond yields - 5 year

GRAPH PERIOD: 1 year ending Sep 10, 2013

Buying

Selling

Source: Bank of Canada

Thank You

FOR ADVISOR USE ONLY

®CI Investments and the CI Investments design are registered trademarks of CI Investments Inc. This communication

is published by CI. Any commentaries and information contained in this communication are provided as a general

source of information and should not be considered personal investment advice. Every effort has been made to

ensure that the material contained herein is accurate at the time of publication. However, CI cannot guarantee its

accuracy or completeness and accepts no responsibility for any loss arising from any use of or reliance on the

information contained herein.

Thank you

Facts and data provided by CI and other sources are believed to be reliable when posted. CI cannot guarantee that

they are accurate or complete or that they will be current at all times. Information in this presentation is not

intended to provide legal, accounting, investment or tax advice, and should not be relied upon in that regard. CI and

its affiliates will not be responsible in any manner for direct, indirect, special or consequential damages howsoever

caused, arising out of the use of this presentation. You may not modify, copy, reproduce, publish, upload, post,

transmit, distribute, or commercially exploit in any way any content included in this presentation. You may

download this presentation for your activities as a financial advisor provided you keep intact all copyright and other

proprietary notices. Unauthorized downloading, re-transmission, storage in any medium, copying, redistribution, or

republication for any purpose is strictly prohibited without the written permission of CI.