Putnam VT Equity Income Fund

Fact Sheet as of 12/31/2015

Classification: Equity Income Funds

Share Class

Class IB

Investment Objective

The Fund seeks current income and capital growth is secondary. The Fund invests

mainly in common stocks of U.S. companies, focusing on value stocks that offer the

potential for current income. At least 80% of the net assets are in common stocks

and other equity investments that offer current income. There can be no guarantee

that the investment objective will be achieved.

Performance Overview

Cumulative

Fund

Russell 1000 Value Index1

Fund Overview Based on Share Class

Annualized

QTD

YTD

1 Yr

3 Yr

5 Yr

10 Yr

Since

Incep

4.01

-3.04

-3.04

13.09

11.95

7.86

9.23

5.64

-3.83

-3.83

13.08

11.27

6.16

-

CUSIP

746896349

Benchmark 1

Russell 1000 Value Index

Inception Date

Total Net Assets ($M)

Total Expense Ratio (%)

05/01/2003

290.70

0.86

Fund Manager Benchmark

1

Past performance does not guarantee future returns. The investment

return and principal value of an investment will fluctuate so that the

units, when redeemed, may be worth more or less than their original

cost. Current performance may be lower or higher than the past

performance data quoted. Performance information as of the most

recent month-end is available upon request.

Risk Statistics 3-year

Alpha*

0.04

Beta*

0.96

R-Squared*

0.98

Tracking Error*

Annualized Standard Deviation

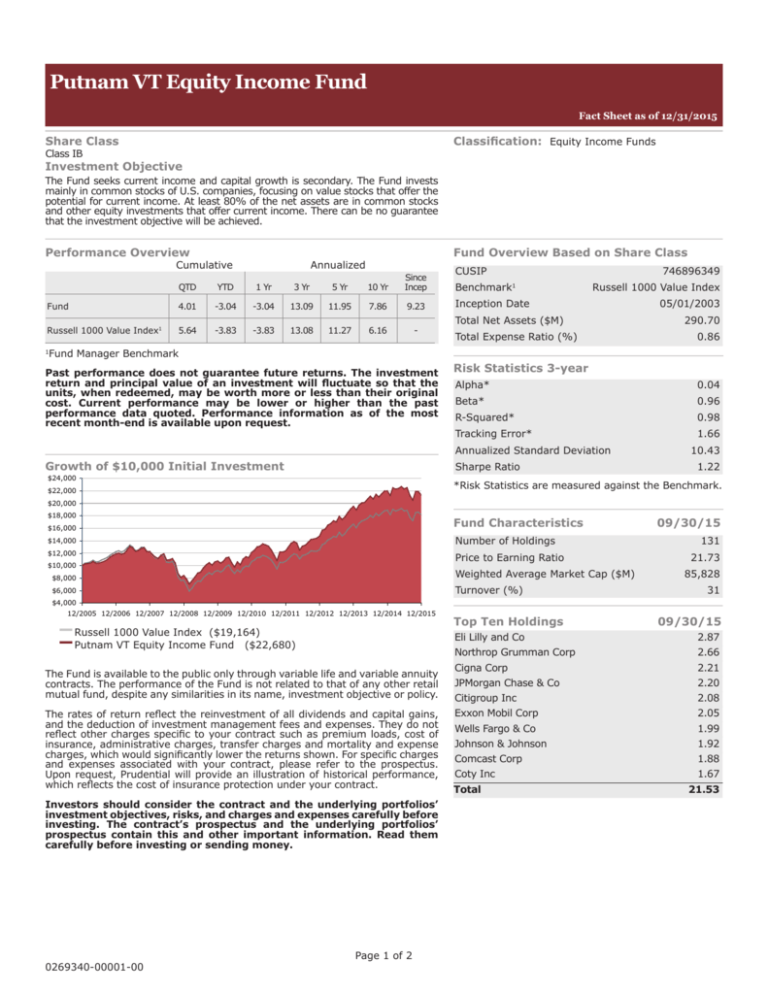

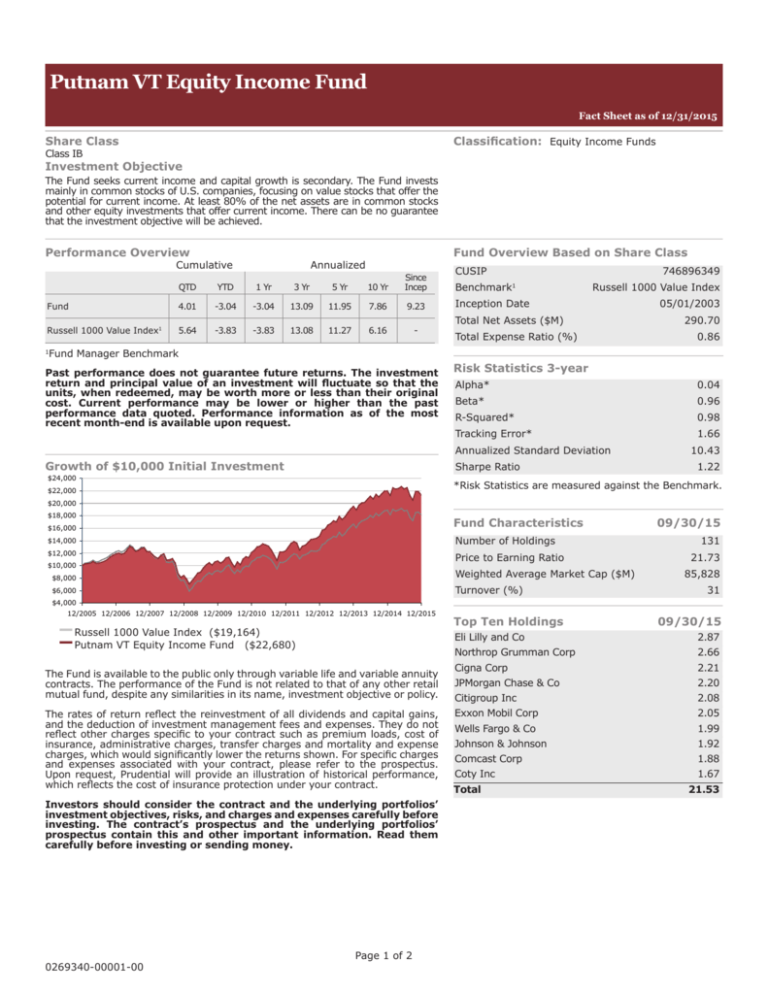

Growth of $10,000 Initial Investment

Sharpe Ratio

$24,000

1.66

10.43

1.22

*Risk Statistics are measured against the Benchmark.

$22,000

$20,000

$18,000

$16,000

Fund Characteristics

$14,000

Number of Holdings

$12,000

Price to Earning Ratio

$10,000

$8,000

Weighted Average Market Cap ($M)

$6,000

Turnover (%)

09/30/15

131

21.73

85,828

31

$4,000

12/2005 12/2006 12/2007 12/2008 12/2009 12/2010 12/2011 12/2012 12/2013 12/2014 12/2015

Russell 1000 Value Index ($19,164)

Putnam VT Equity Income Fund ($22,680)

The Fund is available to the public only through variable life and variable annuity

contracts. The performance of the Fund is not related to that of any other retail

mutual fund, despite any similarities in its name, investment objective or policy.

The rates of return reflect the reinvestment of all dividends and capital gains,

and the deduction of investment management fees and expenses. They do not

reflect other charges specific to your contract such as premium loads, cost of

insurance, administrative charges, transfer charges and mortality and expense

charges, which would significantly lower the returns shown. For specific charges

and expenses associated with your contract, please refer to the prospectus.

Upon request, Prudential will provide an illustration of historical performance,

which reflects the cost of insurance protection under your contract.

Investors should consider the contract and the underlying portfolios’

investment objectives, risks, and charges and expenses carefully before

investing. The contract’s prospectus and the underlying portfolios’

prospectus contain this and other important information. Read them

carefully before investing or sending money.

0269340-00001-00

Page 1 of 2

Top Ten Holdings

09/30/15

Eli Lilly and Co

2.87

Northrop Grumman Corp

2.66

Cigna Corp

2.21

JPMorgan Chase & Co

2.20

Citigroup Inc

2.08

Exxon Mobil Corp

2.05

Wells Fargo & Co

1.99

Johnson & Johnson

1.92

Comcast Corp

1.88

Coty Inc

Total

1.67

21.53

Putnam VT Equity Income Fund

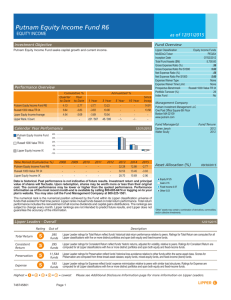

Sector Allocation

9

09/30/15

10

8

1

7

6

2

5

4

3

1 Financials

21.83

2 Industrials

11.81

3 Health Care

11.16

4 Consumer Services

9.87

5 Consumer Goods

9.13

6 Technology

9.02

7 Oil & Gas

8.92

8 Utilities

5.04

9 Non Classified Equity

4.77

10 Telecommunications

3.38

Asset Allocation

Managed By

ADVISOR

Putnam Investment Management LLC

09/30/15

97.48

Equity

1.81

Cash

Fixed Income

0.68

Other

0.03

0

25

50

75

% of Investments

100

Top Holdings, Asset Allocation, Quality Analysis &

Sector Weightings

Data is based on information collected from the investment

company, is updated as of the date shown in the section’s title,

and will vary over time. Asset Allocation may equal less than

or greater than 100% due to hedged funds or leveraged cash

positions by the Fund. Holdings and allocations are subject to

change. Asset allocation does not guarantee a profit or protect

against a loss in declining Markets.

Risk Measures

Alpha - Measures a manager’s contribution to performance due

to security selection or market timing relative to the index.

Beta – Measures a portfolio’s sensitivity to market movements

in the index.

R-Squared - A measure that indicates the extent to which

fluctuations in portfolio returns are correlated with those of the

index.

Standard Deviation – A measure of risk that gauges the

variability of actual returns from the expected values and the

dispersion of these variations over time.

Sharpe Ratio – A measure that uses standard deviation and

excess return to determine reward per unit of risk.

Tracking Error – A divergence between the price behavior of a

position or portfolio and the price behavior of a benchmark.

125

Indices

The Russell 1000 Value Index is an unmanaged index which

measures the performance of those Russell 1000 companies with

lower price-to-book ratios and lower forecasted growth values. The

Russell indexes and Russell are trademarks of the Frank Russell

Company. Investors cannot invest directly in a market index.

Risk Disclosures

The Fund may invest in foreign securities, which are subject to

currency fluctuation and political uncertainty. The Fund may invest

in derivative securities, which may carry market, credit, and

liquidity risks. These risks may result in greater share price

volatility.

Variable life insurance is issued by the Hartford Life Insurance Company (HLI) (New York) and Hartford Life and Annuity Insurance

Company (HLA) (outside New York), Simsbury, CT. The mailing address for both issuers is P.O. Box 2999, Hartford, CT 06104-2999.

Variable life insurance is distributed by Pruco Securities LLC, Newark, New Jersey, Member SIPC and a Prudential Financial Company.

Fund data provided by Lipper. © 2016 Thomson Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content

is expressly prohibited without the prior written consent of Lipper. The information contained herein is not represented or warranted to be

accurate, complete, or timely. Past performance is no guarantee of future performance.

0269340-00001-00

Page 2 of 2