PERFORMANCE UPDATES

ivari Guaranteed Investment Funds

ivari Canadian Short Term Bond GIF

As of January 31, 2016

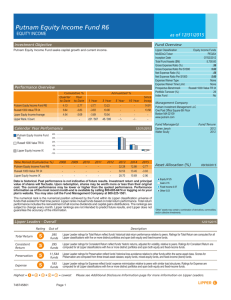

Asset Mix as of December 31, 2015

QUICK FACTS

Inception Date: November 2012

Assets Under Management: $480,000

Minimum Initial Deposit: $500/Policy ($100/Fund)

PAC Minimum: $50 ($25/Fund)

Fund Code DSC: TLC1100

Fund Code ISC: TLC1101

Management Fee (1): 1.25%

Insurance Fee (2)†: 0.10%

Net Aset Value: $10.38

Portfolio Manager: Aegon Capital Management Inc

98.31%

1.69%

HOW HAS THIS FUND PERFORMED?

Compound Returns as of January 31, 2016

Where the Fund invests in an Underlying Fund, there is no duplication of management

fees. Excludes applicable taxes.

(2)

Excludes applicable taxes

(1)

ivari Canadian Short Term

Bond GIF

WHAT DOES THIS FUND INVEST IN?

The Fund invests mainly in Canadian fixed-income and other shortterm securities.

Top Holdings as of December 31, 2015

CANADA 0.750% 01-SEP-2020

SCHOONER TRUST 4.849% 12-OCT-2038

CANADA 1.500% 01-SEP-2017

CANADA 1.500% 01-MAR-2020

METRO LIFE GLOBL 2.682% 16-APR-2019

HOME TRUST 3.400% 10-DEC-2018

ENERCARE SOL 4.600% 03-FEB-2020

WTH CAR RENT ULC 2.542% 20-AUG-2019

AIMIA INC 6.950% 26-JAN-2017

NATIONAL BANK OF CANADA 3.261% 11-APR-2022

BANK OF NOVA SCOTIA 3.036% 18-OCT-2024

CIBC CAP TRUST 9.976% 30-JUN-2108

GLACIER CREDIT CARD TRUST 20-SEP-2025 151

MASTER CR CARD TR II 2.447% 21-OCT-2018

OMERS REALTY 3.203% 24-JUL-2020

BANK OF MONTREAL 3.120% 19-SEP-2024

GENESIS TRUST II 17-SEP-2018 152

CARDS II TRUST 16-OCT-2023 153

CHIP MORTGAGE TR 3.663% 25-SEP-2018

MASTER CR CARD TR II 2.200% 21-OCT-2018

Total

Bond

Cash & Equivalents

YTD

1 Mo

3 Mo

1 Yr

3 Yr

5 Yr

10 Yr

Since

Inception

0.03%

0.03%

0.42%

-0.95%

1.21%

-

-

1.15%

Note: Past performance does not guarantee future returns.

RISK PROFILE

Very low

8.70%

4.96%

4.81%

4.76%

3.74%

3.32%

3.27%

3.12%

2.91%

2.85%

2.77%

2.52%

2.26%

2.25%

2.20%

2.14%

2.14%

2.09%

1.93%

1.87%

64.61%

Low

Low to moderate

Moderate

Moderate to high

High

▲

Note: Risk Profile review is done an annual basis by ivari for the annual Fund Fact Pages.

Historical Performance as of January 31, 2016*

This graph shows how a $1,000 investment in this fund would have changed in value over time.

ivari Canadian Short Term Bond GIF

$1,050

$1,040

$1,038

$1,030

$1,020

$1,010

$1,000

$990

Jan14

Jan16

*For illustration purposes only. Includes segregated fund performance as indicated. Actual fund performance could be

expected to vary.

Calendar Year Return

This chart shows the fund’s annual performance and how an investment made on January 1st

would have changed by December 31st.

ivari Canadian Short Term Bond GIF

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2013

2014

Any amount that is allocated to a segregated fund is invested at the risk of the contract holder(s) and may increase or decrease in value.

2015

Each segregated fund pays ivari an insurance fee for the cost of providing the insurance benefits under the contract. ivari may change the current insurance fee up to the maximum insurance fee, without prior notice.

Please note that a more detailed description of the fund, including investment objectives, investment policies, Fund assets and investment risks may be found in the Information Folder which now includes the Fund Facts. The

breakdown of fund investments is presented to illustrate how the fund may invest and may not be indicative of the fund’s current or future investments. The fund’s investments may change at any time in accordance with its

objective and strategy.

™ ivari and the ivari logos are trademarks of ivari Canada ULC. ivari is licensed to use such marks.

™Trademarks of ivari Canada ULC and/or its affiliated companies.

Lipper, a Thomson Reuters Company. Copyright 2016 Thomson Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper.

†