Cash Available for Distribution

advertisement

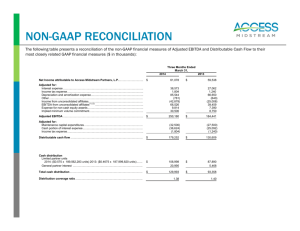

Gulfstream Reconciliation of Non-GAAP “Adjusted EBITDA” and “Cash Available for Distribution” 2011 2010 (in millions) 2009 Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $132.0 $131.6 $124.0 Add: Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69.9 69.8 61.3 Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.4 35.0 34.5 Less: Other income and expenses, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.9 1.4 Adjusted EBITDA — 100% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add: Preliminary project costs, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Cash paid for interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Maintenance capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 237.3 235.5 218.4 1.1 0.6 (1.3) 70.3 2.8 70.3 1.3 60.1 0.9 Cash Available for Distribution — 100% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $165.3 $164.5 $156.1 Adjusted EBITDA — Spectra Energy Partners’ Share(a) . . . . . . . . . . . . . . . . . . . . $116.2 $ 63.0 $ 53.5 Cash Available for Distribution — Spectra Energy Partners’ Share(a) . . . . . . . . $ 81.0 $ 43.0 $ 38.2 (a) During the fourth quarter of 2010, we purchased an additional 24.5% interest in Gulfstream which is accounted for as an equity method investment. The equity earnings related to the additional interest was recorded as of the date of the acquisition. Market Hub Reconciliation of Non-GAAP “Adjusted EBITDA” and “Cash Available for Distribution” 2011 2010 2009 (in millions) Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $85.4 $79.3 $80.8 Add: Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1 0.1 0.1 Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.2 0.2 0.2 Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.8 14.5 12.1 Less: Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1 0.2 0.3 Other income and expenses, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.6 — Adjusted EBITDA — 100% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: Cash paid (received) for interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cash paid for income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Maintenance capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96.4 93.3 92.9 (0.1) 0.2 4.4 (0.1) 0.3 2.0 7.1 0.5 3.8 Cash Available for Distribution — 100% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $91.9 $91.1 $81.5 Adjusted EBITDA — 50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $48.2 $46.7 $46.5 Cash Available for Distribution — 50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $46.0 $45.6 $40.8 Effective January 1, 2012, we have refined the calculation of Cash Available for Distribution. Interest expense will now be deducted from Adjusted EBITDA instead of Cash paid for interest expense, net. This change will remove the quarterly timing effects of cash interest payments during the year and include the impact of amortized debt costs. In addition, other non-cash amounts that affect net income will be an adjustment to Adjusted EBITDA, as appropriate. 48