to tables

advertisement

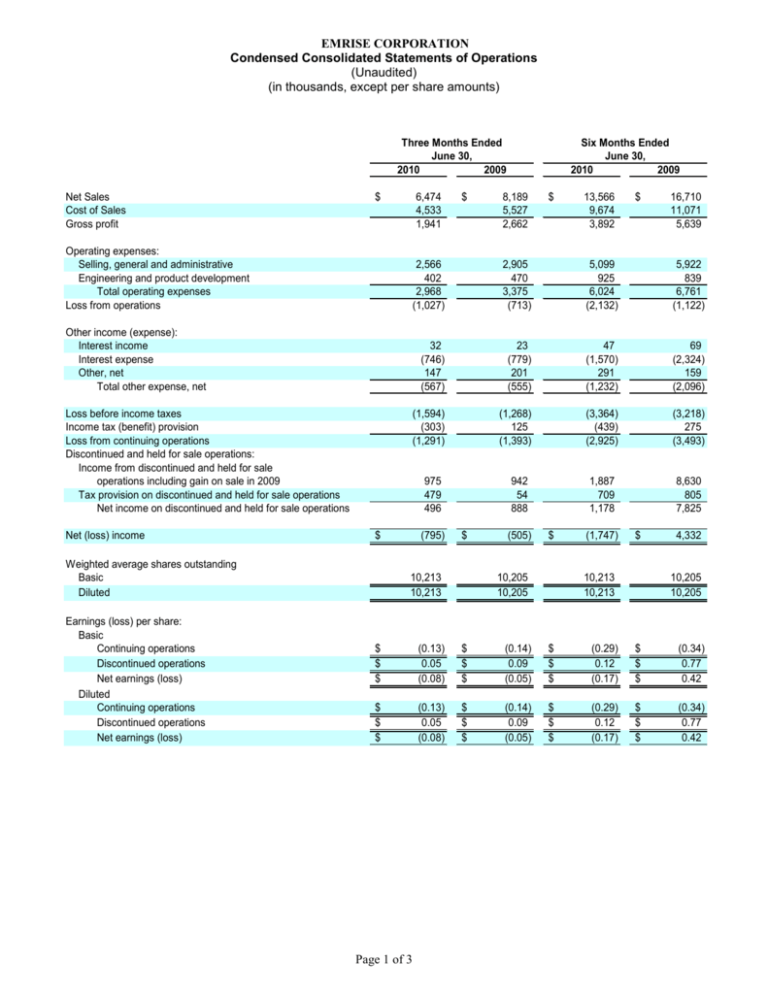

EMRISE CORPORATION Condensed Consolidated Statements of Operations (Unaudited) (in thousands, except per share amounts) Three Months Ended June 30, 2010 2009 Net Sales Cost of Sales Gross profit $ 6,474 4,533 1,941 Operating expenses: Selling, general and administrative Engineering and product development Total operating expenses Loss from operations Other income (expense): Interest income Interest expense Other, net Total other expense, net Loss before income taxes Income tax (benefit) provision Loss from continuing operations Discontinued and held for sale operations: Income from discontinued and held for sale operations including gain on sale in 2009 Tax provision on discontinued and held for sale operations Net income on discontinued and held for sale operations Net (loss) income $ 8,189 5,527 2,662 $ 13,566 9,674 3,892 $ 16,710 11,071 5,639 2,566 402 2,968 (1,027) 2,905 470 3,375 (713) 5,099 925 6,024 (2,132) 5,922 839 6,761 (1,122) 32 (746) 147 (567) 23 (779) 201 (555) 47 (1,570) 291 (1,232) 69 (2,324) 159 (2,096) (1,594) (303) (1,291) (1,268) 125 (1,393) (3,364) (439) (2,925) (3,218) 275 (3,493) 1,887 709 1,178 8,630 805 7,825 975 479 496 Weighted average shares outstanding Basic Diluted Earnings (loss) per share: Basic Continuing operations Discontinued operations Net earnings (loss) Diluted Continuing operations Discontinued operations Net earnings (loss) $ Six Months Ended June 30, 2010 2009 (795) 942 54 888 $ 10,213 10,213 (505) $ 10,205 10,205 (1,747) $ 10,213 10,213 4,332 10,205 10,205 $ $ $ (0.13) 0.05 (0.08) $ $ $ (0.14) 0.09 (0.05) $ $ $ (0.29) 0.12 (0.17) $ $ $ (0.34) 0.77 0.42 $ $ $ (0.13) 0.05 (0.08) $ $ $ (0.14) 0.09 (0.05) $ $ $ (0.29) 0.12 (0.17) $ $ $ (0.34) 0.77 0.42 Page 1 of 3 EMRISE CORPORATION Condensed Consolidated Balance Sheets (in thousands, except per share amounts) ASSETS Current assets: Cash and cash equivalents Accounts receivable, net of allowances for doubtful accounts of $125 at June 30, 2010 and $160 at December 31, 2009 Inventories Current deferred tax assets Prepaid and other current assets Current assets of discontinued and held for sale operations Total current assets Property, plant and equipment, net Goodwill Intangible assets other than goodwill, net Deferred tax assets Other assets Noncurrent assets of discontinued and held for sale operations Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses Line of credit Current portion of long-term debt, net of discount of $0 and $290 Notes payable to stockholders, current portion Income taxes payable Other current liabilities Current liabilities of discontinued and held for sale operations Total current liabilities June 30, 2010 (unaudited) $ $ 1,987 December 31, 2009 $ 3,994 4,228 7,203 117 771 5,935 20,241 6,059 8,031 158 841 6,368 25,451 784 3,484 1,040 500 88 18,040 44,177 987 2,878 1,107 308 121 19,425 50,277 $ $ 3,064 4,102 3,556 7,569 179 289 356 6,619 25,734 Long-term debt Deferred income taxes Other liabilities Noncurrent liabilities of discontinued and held for sale operations Total liabilities Commitments and contingencies Stockholders' equity: Preferred stock,$0.01 par value. Authorized 10,000,000 shares, no shares issued and outstanding Common stock,$0.0033 par value. Authorized 150,000,000 shares; 10,213,214 issued and outstanding at June 30, 2010 and December 31, 2009 Additional paid-in capital Accumulated deficit Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity $ 2,883 315 1,386 1,175 31,493 2,938 144 688 1,572 34,889 - - 126 43,554 (28,333) (2,663) 12,684 44,177 126 43,480 (26,586) (1,632) 15,388 50,277 Page 2 of 3 $ $ 2,734 5,232 5,156 8,109 348 604 370 6,994 29,547 Reconciliation of Adjusted EBITDA to Net (Loss) Income (Unaudited, in thousands) Three Months Ended June 30, 2010 2009 Net (loss) income as reported $ Additions: Depreciation and amortization Stock based expense Interest expense (income), net Other, net Income tax (benefit) provision Subtractions: Income from discontinued and held for sale operations Adjusted EBITDA $ (795) (505) $ (1,747) 108 38 714 (147) (303) 133 41 756 (201) 125 227 74 1,523 (291) (439) 266 77 2,255 (159) 275 496 888 1,178 7,825 (881) $ Six Months Ended June 30, 2010 2009 $ (539) $ (1,831) $ 4,332 $ (779) Use of Non-GAAP Financial Measures In evaluating its business, EMRISE considers and uses Adjusted EBITDA as a supplemental measure of its operating performance. EMRISE defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, non-cash stock compensation, and net other income, less net gain or loss on discontinued operations. Management believes that Adjusted EBITDA is a meaningful measure of liquidity and the Company’s ability to service debt because it provides a measure of cash available for such purposes. Management provides an Adjusted EBITDA measure so that investors will have the same financial information that management uses with the belief that it will assist investors in properly assessing the Company’s performance on a period-over-period basis. The term Adjusted EBITDA is not defined under U.S. generally accepted accounting principles, or U.S. GAAP, and is not a measure of operating income, operating performance or liquidity presented in accordance with U.S. GAAP. Adjusted EBITDA has limitations as an analytical tool, and when assessing the Company’s operating performance, investors should not consider Adjusted EBITDA in isolation, or as a substitute for net income (loss) or other consolidated income statement data prepared in accordance with U.S. GAAP. Other companies may calculate similar measures differently than EMRISE, limiting their usefulness as comparative tools. EMRISE compensates for these limitations by relying primarily on its GAAP results and using Adjusted EBITDA only supplementally. Page 3 of 3