Chapter 4

advertisement

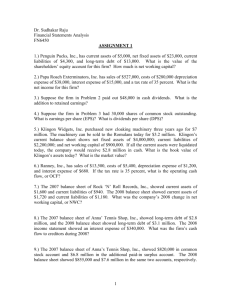

Chapter 4 Understanding the Statement of Cash Flows P4-4. Choice D is correct. An increase in inventory indicates that more cash was spent on inventory than will be recognized as cost of goods sold on the income statement. Since an increase in inventory represents a use of cash for working capital (that is, a current asset), the reduction to cash flow appears in the operating activities section of the cash flow statement. P4-5. Choice C is correct. Dividends are a financing cash outflow. A is false despite the fact that preferred securities often have some of the attributes of both equity and debt. B is incorrect because payment of dividends represents an outflow of cash. D is incorrect because payment of dividends, for either common or preferred stock, by a U.S. firm is treated as a financing activity. P4-6. Choice A is correct. A portion of Boche’s R&D has been capitalized (that is, accounted for as though it creates a long-term asset) whereas all of Perck’s R&D has been expensed as a period cost. Therefore, the impact of this difference in accounting rules must be adjusted before comparing the operating cash flows of these firms. B is incorrect because IAS does not require that R&D be financed in a particular way in order for the related expenditure to be capitalized. Since A is correct and B is incorrect, C and D are both false. P4-7. Use of accelerated depreciation for tax purposes has enabled SSI to reduce its income before tax. This results in lower tax expense and increased cash flow in the current year. The amount of the tax saving equals the product of the difference in depreciation and SSI’s tax rate. Thus, Tax Saving = $5 million X 25% = $1.25 million The tax saving increases SSI’s cash flow by $1.25 million. P4-8. CPLI’s operating cash flow is obtained by adjusting the net income for depreciation and the given changes in its working capital accounts as follows: Net Income Add: Depreciation Add: Decrease in Acct.Rec. $(20) 30 40 Add: Decrease in Inventory Add: Increase in Acct. Payable 60 Cash Flow from Operating Activities: 30 $140 In addition to reviewing the directional effect of specific changes in working capital on operating cash flow, this problem illustrates how cash flow from operations can depart dramatically from net income. P4-9 a. EBITDA is given as: Less Depreciation & amortization: EBIT Interest Expense EBT TAX NET INCOME Plus: Deprec. & Amort OPERATING CASH FLOW: +100 million (80) million +20 million (10) million +10 million (3) million +7 million +80 million +87 million Since the purchase of its own stock does not affect operating cash flow, the additional information is not sufficient to explain the forecast of either negative net income or negative cash flow from operating activities for HLHN. b. One type of item that could help reconcile the apparent discrepancy between EBITDA and Operating Cash flow is an increase in working capital (such as inventory). This would reduce operating cash flow without affecting EBITDA or net income. While increases in fixed assets (such as property, plant, and equipment) or debt repayment would affect total cash flow without affecting net income, they would not reduce operating cash flow. P4-10. The effect of a $50 million investment in its customer on each of the following components of Firm A’s cash flow statement is as follows: Effect on Cash From Operating Activities Effect on Cash From Investing Activities Effect on Cash From Financing Activities 0 ($50 million) 0 Investments such as this one are classified as investing activities. There are no tax implications at the time such investments are made, so Firm A’s tax rate is irrelevant. The amount of the cash outflow from investing is $50 million. P4-11. The effect of these bonds on CFI’s net income is: Interest Payment Less Amortization of premium Interest Expense $8,000,000 ($500,000) $7,500,000 In contrast, the effect on cash is an outflow of $8 million. The reduction of the interest expense for the amortization of bond premium is a noncash item, which reflects the fact that part of the annual outflow of interest is merely a return of capital to the investor. As a result, the calculation of the CFI’s cash flow by the indirect method must include a reduction of $500,000 for the difference between the actual cash outflow and the amount of interest expense that is incorporated in the firm’s reported income. P4-12. To arrive at cash flow from operating activities, given net income, the following adjustments are necessary: Net Income $10,000,000 Add back Depreciation + 500,000 Add increase in A/P + 1,500,000 Add increase in Int/P + 50,000 Add Loss on Stock + 1,000,000 Cash flow from Op. $13,050,000 P4-13. The two adjustments to operating cash low needed to arrive at free cash flow to the firm can be explained as follows. First, for the purpose of measuring free cash flow to the firm, cash used to pay interest expense remains available. Note that this would not be the case for free cash flow to equity. Since interest expense is deductible, however, its effect on Net Income was equal to Interest Expense X (1-tax rate). Therefore, this same quantity is added back to cash flow available to the firm. Under IAS, if interest expense had not been deducted from operating cash flow this adjustment would not be necessary. Next, an adjustment to operating cash flow is required for the firm’s ongoing investment in fixed capital assets. While this amount has been deducted from total cash flow, in the cash flow from investing section of the cash flow statement, it has not been included as an outflow in operating cash flow. These ongoing, necessary expenditures must not be included in any measure of “free cash flow”. P4-14. Since depreciation does not impact either EBITDA or operating cash flow, it can not explain any discrepancy between the two measures. In contrast, a significant change in working capital impacts operating cash flow but not EBITDA. Thus, a large increase in working capital assets during a given year would consume cash and could account for a discrepancy between the two measures. In such a case, operating cash flow might be less than EBITDA. P4-15. Choice B is correct. Net cash flow from operations = Cash collected from customers – Cash paid for salaries – Cash paid to suppliers – Cash paid for interest to bondholders = $150,000 - $60,000 - $40,000 - $20,000 = $30,000 P4-16. Choice A is correct. Operating interest received and Interest paid are both classified as operating cash flows under U.S. GAAP. Under IAS alternative classifications are available. P4-17. Choice B is correct. Increase NP – Retired long-term debt + Stock sold – Dividends Paid = $800 - $796 + $300 - $864 = -$560